Introduction

In this article, we cover the variable overhead spending variance. This is also called variable production overhead expenditure variance or variable production overhead spending variance.

Overhead costs are indirect in nature for product or service and divided into fixed and variables overheads. Variable overheads are linked with products indirectly but change in proportion to the level of production.

Fixed overheads do not fluctuate with the level of production. Overheads make up for an important part of operating costs, hence affect per-unit costs of the production. With large volumes, a slight change in overheads can change the profit margins or contribution affecting the sales for the company. Variable overhead variance consists of two parts:

- Variable overhead Spending variance or Variable production overhead expenditure variance; and

- Variable overhead efficiency variance

Similarly, the fixed overhead variance can be divided into two parts, and total overhead variance would comprise of these four components.

Table of contents

Definition

Variable overhead spending variance can be defined simply as:

“The difference between the amounts of variable production overhead that should have been incurred in the actual hours actively worked and the actual amount of variable production overhead incurred.”

The variable overhead spending variance collectively measures the standard variable overhead rate and the actual variable overhead rate. As variable overheads can incur in several forms such as energy supplies, indirect material, and labor, etc, the variable overhead spending variance can occur with any price changes from these overheads. The standard way of calculating the variable overheads is to assign costs on labor hours worked, so variable overhead spending also is calculated in the same way.

Variable Overhead Spending Variance Formula

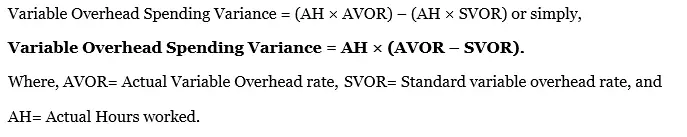

We can calculate the variable overhead spending variance as per the formula below:

Example and Calculation

Example 01:

Suppose Blue waters co. produces a product of bottled water P1. It provides following data:

Variable hours worked 15 hours @ $ 1 = $ 15

Actual Variable overhead for the period = 15,500 hours

Actual units produced= 1,000 units

Total Costs = $ 14,900.

Required: Calculate the variable overhead spending variance.

Solution 01:

The variable overhead spending variance is calculated by using the below formula:

Variable Overhead Spending Variance = AH × (AVOR – SVOR)

= Actual Cost – SVOR × AH

Where: Variable overhead costs at standard rate = 15,500 * 1 = $ 15,500.

Actual Cost = AVOR × AH = $14,900

Hence, Variable Overhead Spending Variance = 14,900 – (1 × 15,500) = $ 600 FAVORABLE

Alternatively, we can calculate this variance by using the table format below:

| US$ | |

| 15,500 hours incurred variable overhead expenditure should cost (×US$1) | 15,500 |

| But did cost | 14,900 |

| Variable Overhead Spending Variance | 600 FAVORABLE |

Example 02:

Suppose Techno blue produces two products P1 and P2, with variable overhead expenses given as below:

| Product P1 | Product P2 | |

| Hours of Work required | 2 labor hours | 1 machine hour |

| Material Costs : | $ | $ |

| Indirect Labor | 8 | 3 |

| Paint color per unit | 6 | 2 |

| Printing and Designing supplies | 3 | 1 |

| Electricity costs | 3 | 2 |

| Standard Total Costs: | $ 18 or $ 9 per unit per labor hour | $ 8 or $ 8 per unit per machine hour |

Actual Variable production costs = $ 140,000, Labor Hours = 10,000, Machine hours = 4,000

Required: Calculate the variable overhead expenditure variance.

Solution 02:

We can calculate the variable production overhead expenditure variance by using the formula below:

Variable Overhead Expenditure Variance = (AH × AVOR) – (AH × SVOR)

Or simply: Actual Variable Spending – Standard Variable Spending

From the table above, we can calculate the variable overhead expenditure for both product P1 and P2 as below:

Variable Overhead Spending for P1 = 10,000 × 9 = $ 90,000

Variable Overhead Spending for P2 = 4,000 × 8 = $ 32,000

Standard Total overhead spending = $ 122,000, hence

Variable Overhead Expenditure Variance = 122,000 – 140,000 = $ 18,000 ADVERSE.

Alternatively, we can calculate the variable overhead expenditure variance by using the table as below:

| US$ | |

| Variable overhead should cost at standard overhead rate: | |

| P1 (10,000 labor hours × $9 per labor hour) | 90,000 |

| P2 (4,000 machine hours × $8 per machine hour) | 32,000 |

| Total variable overhead should cost for both P1 and P2 | 122,000 |

| But did cost | 140,000 |

| Variable Overhead Expenditure Variance | 18,000 ADVERSE |

Interpretation and Analysis

Spending overhead variance can change due to a change in price, usage, and also efficiency in operation. Price and volume changes are similar to direct material and labor variance analysis. However, waste in processes or idle labor hours can also cause the spending overhead variance to increase.

Similarly, increased efficiency can decrease the overhead spending variance and hence the total overhead variance rate. Variable overhead prices are often uncontrollable factors for operational managers; however, changes in prices do also cause a change in the variance. Therefore, variable overhead spending variance can occur due to a change in the price and efficiency (or spending) of the overhead components. It can be argued that one part of the spending overhead variance is controllable for operational managers i.e. the efficiency.

Several factors contribute towards a FAVORABLE variable overhead spending variance:

- Increased efficiency in operations through eliminating waste and idle labor hours

- Bulk purchase of direct materials or decrease in indirect material prices

- An unexpected decrease in prices of energy e.g. electricity rates decrease

- Inaccurate standard budgets preparation can also cause favorable but inaccurate variance

Similarly, ADVERSE overhead spending variance can occur due:

- Decreased efficiency in operations e.g. non-skilled labor

- Increased labor or energy supply rates

- A seasonal or sudden increase in the indirect material prices

- Poor planning may also lead to unrealistic standard budget estimates causing adverse variances

Responsibility of Variable Overhead Spending Variance

Variable overhead spending variance can change with the price and spending changes. Often the indirect material, indirect labor, or energy costs are not in control of operational managers. So the only factor controllable for operational managers is efficiency in operations. If the prices do not change, then the price allocation process can be used to divide the total indirect material costs to different departments. For example, Electricity bill costs can be divided into manufacturing and admin departments in a proportion of the usage. In general, the responsibility for variable overhead spending variance is allotted to the production department.

Advantages of Using Overhead Spending Variance

- It forms an integral part of the total variable overhead variance analysis, providing important information on variable expenditures

- Enables Management to identify controllable and non-controllable factors to appraise staff performance

- Production cannot simply ignore the variable overhead variance effects that can increase operations’ efficiency

Disadvantages of Using Overhead Spending Variance

- Variable overhead costs are often indirect in nature, hence are uncontrollable for operational managers

- Operational and production managers may not agree on the labor hours rate for the variable overhead spending variance analysis

- Production department may also lose morale due to uncontrollable factors contributing to adverse overhead spending variances

Conclusion

Variable overheads form an integral part of the total product cost per unit. A careful study of cost drivers and variance can help management analyze the true causes of variance. A slight change in variable overhead costs can create an adverse impact on the contribution margin for the company. Variable overheads though are often indirect costs but variable overhead spending can provide an important study into process efficiencies.