Introduction

In management accounting, budgeting is a vital part of planning, performance management, and control measures.

“A budget is a quantitative plan prepared for a specific time period. It is normally prepared in financial terms and for a time period of one year”.

In different types of budgeting techniques, Activity Based Budgeting is defined as:

“A method of budgeting based on activity framework, using cost driver data in the budget setting and variance feedback processes” CIMA Official

As this method derives budgeting from cost drivers, the ABB method is closely linked to Activity Based Costing (ABC). The ABC method which stresses on cost drivers that cause the overheads to change, the ABB is measuring about those cost drivers variances.

Budgets provide management with a benchmarking approach towards performance management; different budgeting approaches will focus on the respective focus point. The ABB method will focus on benchmarking targets for overhead cost budget, and measuring the variance in the targets.

Three Approaches of Activity Based Budgeting (ABB)

The approach of ABB can be defined as:

- Identification of Key activities of the company, and cost drivers associated with these activities

- Forecasting the total number of cost driver units

- Calculating the cost drivers rate

In contrast to the traditional budgeting approach which simply is calculation of the variance over the past data, the ABB focuses on process efficiencies. As ABC focuses on reducing overhead costs, the ABB also used to effectively reduce these costs, and budgets are then allocated. The ABB approach argues that the activity costs are controllable, and these activities are the cost drivers so the focus is more on the output.

Example 1

A simple example will be in comparison to the traditional budgeting method. A manufacturing facility handles 5,000 orders costing $ 50,000 ($ 10 per order). The traditional budgeting will adjust for the next year using the inflation method say 10% with cost budget of $ 55,000. In the ABB method, the order cost is first calculated (using the ABC technique). The cost per order can be above the previous cost ($12) or lower ($ 9) which in turn will give a budget allocation of $ 60,000 or $ 45,000. The

ABB will first focus on the cost per order, minimizing the cost and removing wastes and then allocate the forecast budget for the specific production period.

Example 2

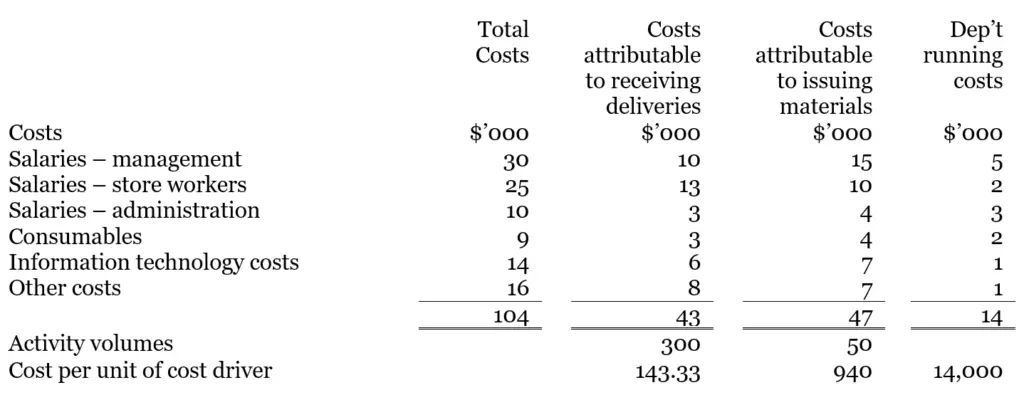

Below is a more advance example of ABB Budgeting approach of a Stores Department of ABC Co.

In ABC Co, a stores department has two main activities. These activities are receiving deliveries and issuing raw materials. The first activities is normally to receive any deliveries of raw materials from suppliers and then they report to the stores department. The second one is to issue raw materials to production departments. ABC Co has identified two major cost drivers in this stores department. The first cost driver that ABC Co has identified in the stores department is the number of deliveries of raw materials. The second driver is the number of production runs needed.

In addition, there is a small amount of cost of department running costs which includes the general administration costs such as salary of department manager and other related costs.

ABC Co has budgeted the following cost driver volumes:

300 deliveries of raw materials

50 production runs

Below are the budget and costs analysis for stores department for the next control period:

Please note as follow:

- It is very subjective to a certain extend for the apportionment of cost. The primary objective of this budgeting approach is that each entity shall need to be able to justify its resources that attributes to one or more activities. All hidden should be avoided.

- The cost driver rates of $143.33 and $940 can be used to calculate product costs using Activities Based Costing (ABC) approach.

- The identification of activities and their costs helps to focus attention on those activities which add value and those that do not.

- The budget has to be highlighted the cost of the two activities.

There are certain advantages and disadvantages to the ABB approach.

Advantages of Activity Based Budgeting (ABB)

- As it closely follows the ABC method, this approach focuses on overhead cost controlling.

- Unlike traditional budgeting, this method provides calculated and precise costs for forecasting.

- It focuses on cost drivers and the activities that can increase the costs which provided stricter controls to the management.

- In ABB method efficiency and cost control measure involve both financial and non-financial activities

The disadvantages associated with the ABB approach are also very similar to the ABC.

Disadvantages of Activity Based Budgeting (ABB)

- The control measures associated to reduce overheads costs are very expensive.

- The implementation of ABB method requires specific skills

- The variable costs often do not change significantly, so the ABB approach cannot be applied in short term precisely without a change in overhead costs.

- This method can achieve good results only if the company is already following practices under the Activity Based Costing method.

Conclusion

The activity based budgeting can be a useful tool in performance forecasting and measuring for the companies where the overheads costs of production are significant. Like ABC this method also helps implement an environment of total quality management at levels of a company.

For some companies where the change in variable expenses is consistent or small, this approach is not helpful. Further, the ABB method requires participation from all management for successful implementation. As the budgeting process involves monitoring of past date, forecasting for the future data, and control implementations, the ABB method may not be suitable for the startups.