There are commonly two types of costs associated with products, fixed and variable costs. In many cases, there are semi-variable costs that can either be termed as variable or fixed costs. It is important to differentiate between the portion of each cost type to analyze the profit margins of each product and improve the total company profitability. The High-Low method is used to separate the variable and fixed costs using a simple mathematical equation.

What is High Low Method?

The cost accounting technique of the high-low method is used to split the variable and fixed costs. The mathematical expression for the high-low method takes the highest and lowest activity levels from an accounting period. The activity levels are then apportioned against the highest and lowest number of units produced. The one element of the total cost then provides the second element by deducting it from the total costs.

The fixed costs in any particular set up remain the same. Variable costs also increase in the proportion of production. However, in many cases, the increased production levels need additional fixed costs such as the additional purchase of machinery or other assets. The higher production volumes also reduce the variable proportion of costs too. The high-low method can be used to identify these patterns and can split the portions of variable and fixed costs.

How to Use the High Low Method to Estimate Fixed and Variable Costs?

The process of calculating the estimated fixed costs and variable costs takes a step by step approach with the High-Low method.

Step 01: Determine the highest and lowest level of activities and units produced

The first step is to determine the highest and lowest levels of activities and the units produced against each of these levels.

Step 02: Calculate the variable cost element

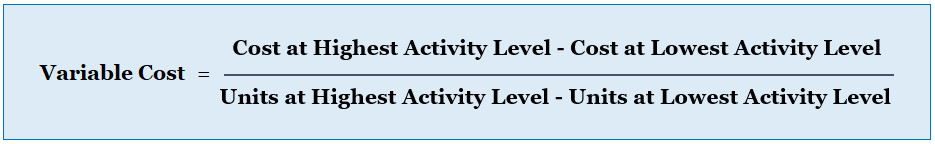

The next step is to calculate the variable cost element using the following formula.

Step 03: Find the fixed cost element

The third step is to find the fixed cost using the following formula.

Fixed cost = Total cost at activity level – Total variable cost

Important:

The variable cost calculated in step 02 will be the cost per unit. The fixed cost can then be calculated at the specific activity level i.e. either high level or low level of activity.

Once the variable cost per unit and the fixed costs are calculated, the future expected activity level costs can be determined using the same equation.

Working Example

Suppose a company Green Star provides the following production scenario for the 06 months of the production period.

| Month | Units Produced | Total Cost of Production |

|---|---|---|

| January | 3000 | $ 65,000 |

| February | 2700 | $ 57,000 |

| March | 2500 | $ 55,000 |

| April | 2100 | $ 45,500 |

| May | 1800 | $ 48,000 |

| June | 1300 | $ 39,000 |

We can calculate the variable cost and fixed cost components by using the High-Low method.

Step 01: Determine the highest and lowest level of activities and unit produced

The Highest activity level = 3000 units, the lowest Activity Level = 1300

The Cost at the Highest Activity level = $ 65,000 Cost at the Lowest Activity Level = $ 39,000

Step 02: Calculate the variable cost element

By using the variable cost formula above, we can calculate the variable cost as follows:

Variable Cost = (65,000 – 39,000) ÷ (3,000 – 1,300)

Variable Cost = $ 15.29 per unit

Step 03: Find the fixed cost element

Fixed Cost = Total cost at activity level – Total variable cost

Fixed Cost = 65,000 – (15.29 × 3,000) = $ 19,117

Note: Even using the fixed cost for the lowest activity level will provide the same figures.

In our example, the Fixed Costs= 39,000 – (15.29 ×1,300) = $ 19,123

Advantages of Using the High-Low Method

The biggest advantage of the High-Low method is that uses a simple mathematical equation to find out the variable cost per unit. Once a company calculates the variable cost, it can then assign the fixed cost for any activity level during that period. The same variable cost per unit can also provide a forecast analysis. As the company can use it to predict the portion of fixed costs with fluctuating activity levels.

The High-low method provides some useful benefits to company management:

- It is simple to calculate within a few mathematical steps

- It splits the variable and fixed cost portions

- The semi-variable costs can be allocated proportionally with the High-Low method

- It can be used to forecast the future activity level costs

- It is easier to understand and use, and does not require complex calculations

Disadvantages of Using the High-Low Method

The High-Low method takes a linear equation approach. It correlates the activity levels with the production levels. Thus, it calculates the variable costs where the linear correlation holds true. Like any other theoretical method, the High-Low method of cost allocation also offers some limitations.

- Although it is simple to calculate, it is a complex process as compared with other costing methods such as activity-based costing.

- It considers the extreme activity levels, where the total costs may not provide the optimum total costs. As at the higher level of productions, the companies often incur additional expenses.

- It does not provide useful information over a long period of production, as the costs, in the beginning, maybe higher and gradually lower after some time.

- It does not provide any significant reasons for changes in the fixed or variable costs

In many cases, the variable costs identified under the high-low method can be different from other cost methods. The direct costing methods of calculating the variable cost per unit provide accurate figures that consider costs related to the production. Also, the mean or the average variable cost per unit for longer periods can provide more realistic figures than taking extreme activity levels.

Conclusion

The High-Low method of costing provides a useful cost splitting method. The method is a simple mathematical equation that splits the semi-variable costs into variable and fixed costs. The analysis can also provide useful forecasts for future activity level cost analysis. However, the reliability of the variable costs with two extreme activity levels poses questions over the effectiveness of the method.