Employee stock option (ESO) is a compensation plan for employees and executives. The plan comes in the form of a regular call option that allows employees to buy shares at a specific price and date.

Employees can evaluate the stock options just like investors do. They hold the right to exercise the option but not the obligation.

The company can use different evaluation models to calculate the probability of the likely outcome. The ASC 718 defines the rules for employee stock option plans and accounting treatment for the employer.

Let us discuss the employee stock option plan and its accounting treatment with an example.

Employee Stock Options

ASC 718-10-15 states that ASC 710 should apply to all equity-based compensation plans where the company:

- Issues stocks, stock options, and other equity instruments.

- Incurs liability to pay cash whose value depends on the company’s share.

- Incurs liability that can be settled through the company’s shares or other equity instruments.

The management must determine the nature of the transaction for stock options to decide whether it falls within the scope of ASC 718 or not.

The ASC 718 includes all types of equity-based compensations.

- Stock Options

- Restricted Stock and Restricted Stock Units

- Stock Appreciation Rights (SARs)

- Employee Stock Purchase Plans (ESPPs)

- Employee Stock Ownership Plans (ESOPs)

The ASC 718 covers both public and non-public companies.

“Public entity: An entity (a) with equity securities that trade in a public market, which may be either a stock exchange (domestic or foreign) or an over-the-counter market, including securities quoted only locally or regionally, (b) that makes a filing with a regulatory agency in preparation for the sale of any class of equity securities in a public market, or (c) that is controlled by an entity covered by (a) or (b)”.

Employee – Definition under ASC 718

Although ASC 718 largely covers both employees and non-employees, there are a few differences in accounting for costs and remunerations. Thus, the employer must determine the employees under ASC 718.

ASC 718-20 defines an employee as someone over whom the issuer of compensation has significant control or has the option to exercise significant control under the local laws.

A director’s compensation will fall under ASC 718 scope if the director has been:

- Elected by the company’s shareholders. Or

- Appointed temporarily as a director in the board where the position will be filled by a chosen representative of shareholders for the next term.

If the employer has control over part-time and leased employees as defined above for the definition of an employee, they will also be considered employees under ASC 718.

Accounting for Employee Stock Options

The compensation expense must be measured using fair value accounting. However, in many cases, the fair value market analysis based on market observations will not be available easily.

The employer can use a valuation model instead that meets the definition under ASC 718.

The ASC 718 should take the following points into consideration.

- The Exercise price of the option.

- Current share price.

- The Expected term of the option that should not be less than the vesting period.

- Expected volatility of the price of the share.

- Risk-free interest rate

- Expected future dividends

The compensation plan costs must be recognized in the period in which the employee rendered services. If the compensation is for the services rendered for the past services and there is no continuation of services, then it must be recognized in the period when the payment is made.

If the compensation is made in advance, then the cost must be recognized over the period when the services are rendered and the scheduled performance occurs.

Working Example

Suppose a company ABC Inc. announces an employee stock option. The stock option comes with a two-year maturity.

Following data regarding the current share price and the stock option is available.

Options = 10,000

Exercise Price = $ 33

Current Price = $ 30

Probabilities = $ 25, $ 30, $ 35; hence, p = ⅓

Dividend = $ 0.50

Discount Rate = 5%

PV Factor Y1 = 0.952, Y2 = 0.907

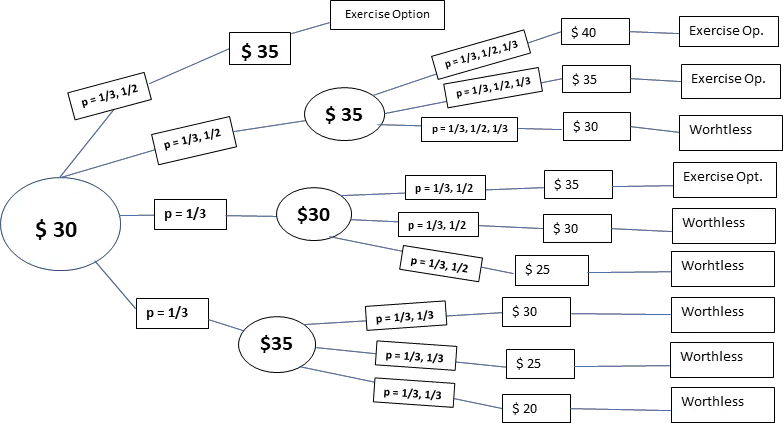

The company calculates the possible outcome of the employee stock option using the Binomial method. It uses the sum of probabilities to calculate the stock option value that expires in two years.

The company uses trend analysis and historical performance to estimate that the stock prices can move with a deviation of $ 5 from its current market price. It means the stock price can be $ 30, $ 35, or $ 25. It means there is a probability of each stock price of ⅓.

Scenario 1

Option gain = $ 35 – 33 = $ 2 less dividend = $ 1.50, PV = $ 1.428

Probability = ⅓ ✕ ½ ✕ 1.428= $ 0.238

The stock price appreciates to $ 35. The company estimates half of the employees exercise the option and the other half waits until the next year.

Employees exercising the option will forfeit the dividend for one year. The net gain of $ 1.50 will be discounted to the present value today.

The PV is then adjusted for the probability of the likely outcome.

We’ll apply the same procedure to first calculate the PV of the exercise option net of dividend loss. Then, the PV will be adjusted for the probability in certain situations as depicted in the graph image.

Scenario 2

Option gain = $ 40 – 33 = $ 7 less dividend = $ 6, PV = $ 5.442

Probability = ⅓ ✕ ½ ✕ ⅓ ✕ (5.442) = $ 0.30233

Scenario 3

Option gain = $ 35 – 33 = $ 2 less dividend = $ 1, PV = $ 0.907

Probability = ⅓ ✕ ½ ✕ ⅓ ✕ (0.907) = $ 0. 050388

Scenario 4

Option gain = $ 35 – 33 = $ 2 less dividend = $ 1, PV = $ 0.907

Probability = ⅓ ✕ ⅓ ✕ (0.907) = $ 0.10077

Total Probability = 0.10077 + 0.050038 + 0.30233 + 0.238 = 0.6980

Value of Options = 10,000 ✕ 0.6980 = $ 6,980.

The Journal entries for the stock options will be for each year:

| Account | Debit | Credit |

| Compensation Cost | $ 3,490 | |

| Additional Paid-In Capital | $ 3,490 |

If all options are subsequently exercised at their given points, then the total proceeds will be $ 3,06,970. Thus,

| Account | Debit | Credit |

| Cash | $ 300,000 | |

| Additional Paid-in Capital | $ 6,970 | |

| Common Stock (at par) | $ 10,000 | |

| Additional Paid-In Capital | $ 296,970 |

Reference

- ASC 718 – Compensation-Stock Compensation [Source]