The operating assets of a company are directly responsible for producing income from operations. These assets include both fixed and current assets. The net operating assets figure deducts the operating liabilities from the operating assets. The return on net operating assets would then indicate the relation between the net income and operational efficiency of the business.

Before jumping into RNOA and its calculation, let first understand the net operating assets.

What is Net Operating Asset (NOA)?

Net operating assets refer to the assets of the business that involve only in the business operation. Thus, the term NOA results from the operating assets minus operating liabilities. That means the net operating assets are the difference between a business’s operating assets and operating liabilities.

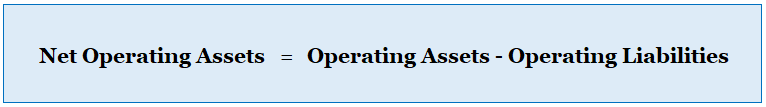

From the above definition, we can derive the formula to calculate the NOA as below:

Net Operating Assets = Operating Assets – Operating Liabilities

So now let understand the term Operating Assets and Operating Liabilities.

Operating assets

Operating assets are assets of a business that are used in the business operation to generate revenue for the company. The operating assets include the company’s cash and cash equivalents, inventory, trade receivable, prepaid expenses, property plant and equipment, and some other intangible assets required for the operation. However, it does not include any financial assets, such as financial instruments, long-term investments, loans, etc.

The excess cash and cash equivalent that the company does not need for day-to-day operation does not count as operating assets for an entity.

We can calculate the operating assets by using the below formula:

Operating assets = Total Assets – Excessive Cash and Cash Equivalents – Financial Assets and Investments

Operating Liabilities

Operating liabilities refer to the short-term liabilities of a business that need for day-to-day operation. It typically includes trade payable, accrued liabilities, accrued income tax liability, and any other short-term liabilities that a business needs for its operation. The operating liabilities do not include long-term liabilities such as bonds, long-term loans, and other long-term debt.

By now, you understand the NOA, which is the difference between the operating assets and operating liabilities. You also know the definition of operating assets and operating liabilities. Now, it is time to jump into the return on net operating assets and how to calculate it.

What is Return on Net Operating Assets?

A company can generate profits from mainly two types of activities. The prime source of income comes from operating activities through sales. The secondary source of income for any business comes from financial activities. Financial activities may include investing in marketable securities and bank interests etc.

The purpose of return on net operating assets is to distinguish the profits generated from the operating activities from those of financial activities. Shareholders are more concerned about returns from the assets employed in a business, as financial and investing incomes do not rely on company operations.

How to Calculate Return on Net Operating Asset?

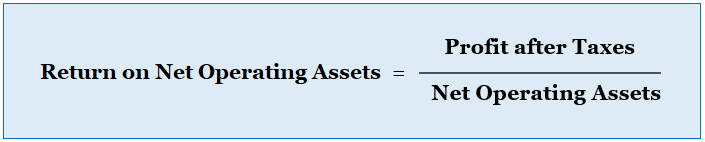

The Return on Net Operating Assets (RNOA) is calculated by dividing profits after taxes by the net operating assets (NOA) figure.

Formula:

The profits after taxes are simply the operating profits after deducting the administration and other expenses from gross income. The NOA is distinguished from the non-operating (financial net assets).

As mentioned in the above section, we can calculate the NOA by using the formula below:

Both operating assets and liabilities may include current and long-term figures. The only exclusion from these figures is any financing activities or significant cash balances that generate interest in bank investments.

Working Example

Suppose a company ABC Co. produced a net income of $ 130,000 for the last financial year. Its total assets are $ 1.5 million with marketable securities of $ 0.25 million. It has total liabilities of $ 1.0 million with financial liabilities of $0.3 million.

We will first calculate the net operating assets of the company as below:

Net Operating Assets = Operating Assets – Operating Liabilities

Operating Assets = $ 1.5 – $ 0.25 = $ 1.25 million

Operating Liabilities = $ 1.0 – $ 0.3 = $ 0.7 million

Net Operating Assets = $ 1.25 – $ 0.7 = $ 0.55 million

The RNOA can now be calculated as:

Return on Net Operating Assets = NI / Net Operating Assets

Return on Net Operating Assets = 130,000 ÷ 550,000

Hence, Return on Net Operating Assets = 0.2363 or 23.63 %

Interpretation and Analysis

The RNOA figure provides useful insights into a company’s ability to generate profits from equity resources. It distinguishes the financial and investment income from the operating income. In a sense, this ratio provides useful information on a company’s liquidity without leveraging the financing activities.

The operating income of a company remains the main source of profits through sales. Hence the net operating assets provide the efficient use of assets employed in the business. The company management can improve only operating efficiency by providing useful resources to the operational staff. Investing returns usually correlate with external macroeconomic factors such as the interbank interest rates and inflation rates.

Both items used in calculating the RNOA figure directly relate to the operational activities of the company. The net income figure also provides a clearer approach in relating the returns for the equity investors in the business. The RNOA then compares the company’s ability to generate profits from the operating assets without adding financial earnings.

A common practice for analyzing the shareholders’ return has been the comparisons of metrics like ROE and ROCE. When we analyze these figures in detail, investing decisions such as marketable securities and interest rate changes can alter these returns. Hence, these figures somewhat cover the inefficiencies from the operating activities of the business. The RNOA ratio separates these financial and operating decisions for business management. It offers useful insights to the shareholders on the company management decisions and performance on operating activities.

What is a good Return on Net Operating Assets Ratio?

Like most accounting ratios, the best possible way with the RNOA ratio is to make the correct comparisons. Without a comparative analysis, the RNOA figures alone cannot provide any useful information.

However, for standalone analyses, the RNOA figure provides the returns from operations of the company. Any changes in the leverage or debt ratio will not affect the RNOA ratio. Hence the analyst can make a useful interpretation of the company’s operational efficiency.

The most effective use of any ratio analysis is to compare different sizes of companies in the same industry. In a percentage figure, the analyst can compare the performance of the companies of different sizes. Such analyses are particularly useful for growing companies that benchmark the industry standards.

Advantages of Using RNOA Ratio

The Return on Net Operating Asset ratio offers some advantages as compared with traditional metrics like ROE and ROA.

- RNOA separates the income generated from financial activities and operational activities

- RNOA does not change with any changes in the company leverage or debt ratio

- It cannot be easily manipulated as it uses NET INCOME and NET Operating Assets figures

- It provides accurate income potential of a business from its core activities rather than relying on financial income such as marketable securities or interest

- Shareholders can use it as a benchmark with industry and company historical performance measurement

Limitations of Using RNOA Ratio

The return on net operating assets ratio comes with limitations as well:

- The interpretation needs a comparative analysis as with any other ratio analysis

- The operational management may not accept the interpretation as a measure of efficiency

- The calculation of net income and net assets figures in a complex financial structure may not be easy

- Both operating assets and liabilities consider the book values, which may significantly be different from those of the fair market values

Conclusion

The RNOA Ratio provides an important indication of a company’s efficiency without relying on financial investments. The shareholders can analyze the company’s utilization of operational assets against the net income. However, it may take specialized skills to differentiate the net financial assets and net operating assets.