Suppose you put 10,000 in a saving account with the interest of 8% and keep it there for 5 years. What would the future value at the end of year 5?

With a single investment like this, its expected value at the end of year 5 is called the future value (FV) of a single amount.

In this article, we cover the future value of a single amount. This includes the definition, formula, and example calculation.

So let’s get started!

What is the Future Value of a Single Amount?

The future value (FV) of a single amount is the value of a present single amount at a given interest rate over a specified future period of time. This is done by applying the compound interest which is the interest that is earned on a given initial principal and such interest has become part of the principal at the end of a specified period.

The compounding here can be annually, semi-annually, quarterly, monthly, weekly, daily, or even continuously.

Formula

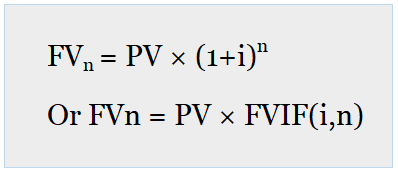

We can calculate the future value of a single amount by using the below formula:

Where:

PV = Present Value or initial principal

i = Interest rate

n = number of periods

FVIF(i,n) = Future value interest factors

Example

Now let’s continue from the example as mentioned in the top section above. Mr. A put a 10,000 in a saving account with a bank with an interest of 8%. How much is the future value at the end of year 5?

Before applying the formula above, let’s go through the concept of compounding interest at the end of each year separately. So the future value at the end of each year comes from the principal plus interest at that given year. The principal and interest will become a new principal for next year and so on.

Thus, we can calculate the future value at the end of each year as follows:

Future value at the end of year 1 = 10,000 × (1+0.08) = US$10,800

The principal and interest of US$10,800 become a new principal for year two.

FV at the end of year 2 = 10,800 × (1+0.08) = US$11,664

FV at the end of year 3 = 11,664 × (1+0.08) = US$12,597.12

FV at the end of year 4 = 12,597.12 × (1+0.08) = US$13,604.89

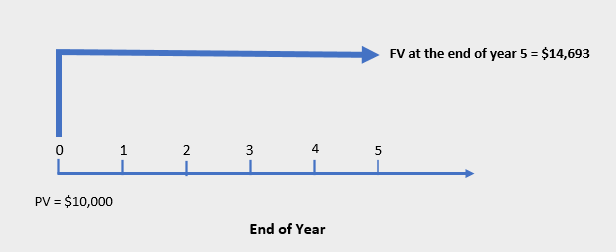

Finally, the FV of year 5 = 13,604.89 × (1+0.08) = US$14,693.28

So the future value at the end of year 5 is US$14,693.28.

Now let’s use the formula above to calculate the future value of a single amount.

FVn = PV × (1+i)n

FV = 10,000 × (1+0.8)5 = US14,693.28

Alternatively, we can look at the future value interest factors and then multiply it with the initial principal.

The future value interest factors at an interest of 8% over 5 year-time are 1.4693. You can obtain the future value interest factors table and how to generate the future value interest factors table by click here.

Therefore, the FV = 10,000 × 1.4693 = US$14,693

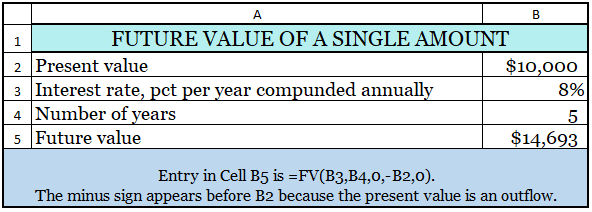

We can also calculate the future value of a single amount by using Excel Spreadsheets as follows:

We can depict the future value of a single amount of the above example as follows:

Future Value Relationship Graph

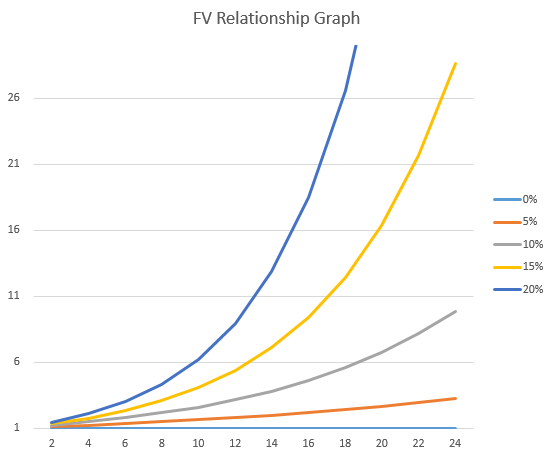

Below is the graph illustrating the relationship between interest rate over time for future value of one dollar.

From the graph above, the higher the interest rate, the higher the future value. In addition, the longer the period is, the higher the future value.

On the other hand, when the interest rate is 0, the future value always equal to 1. In contrast, if the interest rate is greater than 0, the future value is always greater than 1.

Conclusion

Understanding the future value of a single amount is the foundation for the more complex future value. It is very straight forward to calculate either by using the formula, future value interest factors table, or in Excel Spreadsheet.