A company’s financial statements include a summary of its books of accounts. These statements allow the stakeholders to make decisions regarding their relationship. Sometimes, however, stakeholders may not trust the figures presented in the financial statements. For that reason, companies must get their financial statements audited by an independent audit.

Auditing is a function in which independent auditors assess a company’s financial statements. Usually, these evaluate whether those financial statements are free from material misstatements. Similarly, they also determine whether these statements provide a true and fair view in accordance with the applicable framework. Based on this assessment, auditors give their opinion in an audit report.

What is an Auditor’s Report?

An auditor’s report is a document that contains their audit opinion of whether a company’s financial statements are free from material misstatements. This report includes several sections, including the opinion, basis for opinion, responsibilities of the management and auditors, etc. The audit report plays a crucial role in establishing the trust of stakeholders in a company’s financial statements.

The essence of the audit report includes the audit opinion provided by the auditors. There are several types of audit reports and opinions that may exist. Firstly, there is an unmodified report. This report usually contains no changes to the primary opinion provided by auditors. Unmodified reports do not include any amendments and give an unqualified audit opinion.

The other type of audit report is the modified report. This report usually contains amendments to the audit opinion provided by the auditors. The audit opinions provided in unmodified reports include qualified opinion, adverse opinion, and disclaimer of opinion. Sometimes, modified reports also consist of an unqualified opinion. However, it will contain additional paragraphs, such as the key audit matters or the emphasis of matter paragraphs.

The provision of an audit opinion in the audit report depends on several factors. These include whether the financial statements are free from material misstatements, whether they provide a true and fair view, and if auditors can obtain sufficient appropriate audit evidence. Usually, both clients and their stakeholders prefer an unqualified audit report. This type of audit report is prevalent as well.

What is an Unqualified Audit Report?

An unqualified audit report is a type of audit report that presents an unqualified audit opinion. This report states that a company’s financial statements are free from material misstatements. Similarly, it expresses that the financial statements present a true and fair view. In this report, auditors conclude that the financial statements present a company’s affairs fairly in all material aspects.

Another name used for the unqualified audit report is a clean report. This report implies that the financial statements present a fair picture of its operations. For stakeholders, it means that they can rely on the amounts reported in those statements.

An unqualified audit report may also present the auditor’s opinion on changes in accounting policies. If a company goes through any significant changes, this report will state that any changes are adequately determined and divulged. However, this audit report is not a guarantee of a company’s financial health. It only expresses that its financial statements are transparent and thorough in essential regards.

The unqualified audit report also does not require an amendment to the basis of the opinion paragraph. Similarly, it only indicates the auditor’s opinion of the financial statements. In actuality, these statements may include misstatements. However, the auditors may not have come across them during their performance of the audit engagement.

What are the differences between an Unqualified and Qualified Audit Report?

The unqualified audit report differs from the qualified audit report in various fundamental aspects. Some of the primary differences between those include the following.

Meaning

The unqualified audit report expresses that the financial statements do not contain any issues that may affect users. Therefore, it provides a company with a positive rating from the auditors. However, a qualified report states that there might be issues in a company’s financial statements. Similarly, it may indicate a problem with audit evidence not being sufficient and appropriate.

Opinion

The unqualified audit report provides a clean audit opinion. In this report, the auditor concludes that the financial statements are free from material misstatements. Similarly, it expresses that those statements show a true and fair presentation. A qualified report, however, states issues with these matters. Furthermore, the qualified audit report may also question the presentation of those statements.

Applicable framework

Another primary area on which the audit report provides an opinion is the applicable frameworks. Usually, these include adherence to accounting standards. The unqualified audit opinion states that the financial statements adhere to the applicable accounting standards. The qualified opinion, in contrast, may express that the financial statements not following those standards.

Impact on stakeholders

The unqualified audit report provides stakeholders with confidence toward a company’s financial statements. This report allows stakeholders to trust those statements and go ahead with their decisions. However, the qualified audit report sends a negative signal to the stakeholders. It may impact their trust in the financial statements and result in altering their decisions.

Explanation

The unqualified audit report does not require any explanation from the auditors. However, the qualified audit report must explain the areas that the auditors consider problematic. Therefore, the unqualified audit report may be shorter as a result. On the other hand, the qualified audit report requires a lengthier explanation of the auditors’ findings.

Example of Unqualified Audit Opinion

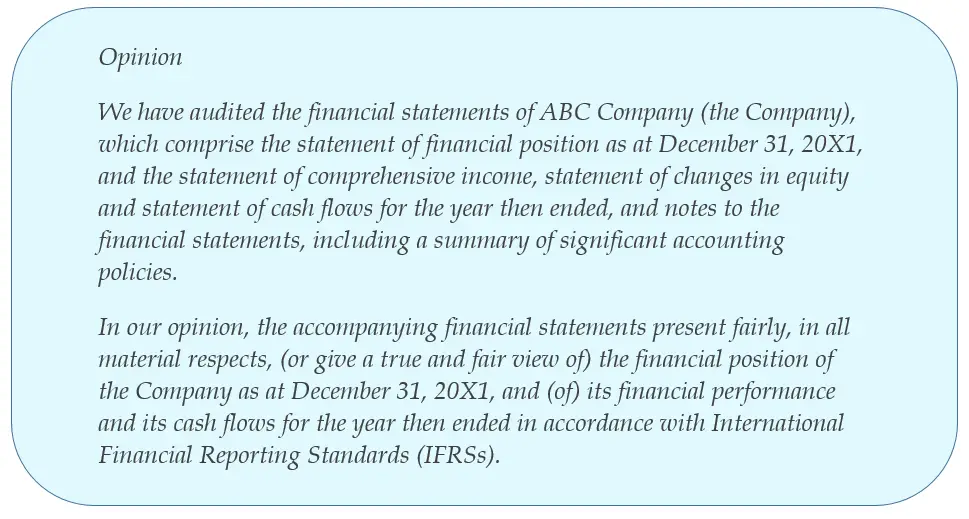

The unqualified audit report is straightforward. It includes an explanation of the audit scope. This report primarily states that the financial statements are free from material misstatements. Similarly, it expresses that financial statements present a true and fair view in accordance with the applicable framework. Given below is an example of an unqualified audit report.

The basis of the opinion paragraph for the unqualified audit report is also straightforward. Since there is no explanation to provide in this report, the basis of the opinion paragraph would not include significant statements. The auditors will mention the applicable framework against which the auditors examine the financial statements. It will also consist of a statement regarding the audit evidence collected.

Conclusion

An audit report is a statement that mentions the auditors’ opinion regarding a client’s financial statements. When there are no issues to report with those statements, auditors will provide an unqualified audit report.

An unqualified audit report is a type of audit report that does not include any modifications to the auditor’s opinion. It differs from a qualified audit report in various areas, including the meaning, opinion, applicable framework, etc.