An audit is a process in which independent auditors assess a subject matter. During this process, auditors gather evidence and reach a conclusion on whether the subject matter meets specific requirements. This conclusion is a part of the auditor’s opinion, which they present in a statement known as the audit report.

There are two types of audit opinions that auditors may provide. These include modified and unqualified audit opinions. Modified audit opinions have further types, including qualified opinion, adverse opinion, and disclaimer of opinion. Among these, the disclaimer of opinion relates to the availability of audit evidence. This opinion can be an issue for companies.

What is the Disclaimer of Opinion?

Auditing standards require auditors to obtain sufficient appropriate audit evidence related to an audit engagement. This audit evidence can help auditors draw a conclusion and support their opinion. Sometimes, however, the evidence may not be available. In those cases, auditors may issue a disclaimer of opinion to cover the audit risks for an engagement.

A disclaimer of opinion is a type of qualified audit opinion that auditors present due to the absence of audit evidence. There are various reasons why auditors may not be able to gather audit evidence. On top of that, auditors may also present this opinion even though audit evidence exists. However, the audit evidence may not constitute sufficient appropriate audit evidence.

For auditors to present a disclaimer of opinion, the impact of the issue must be pervasive. It is a term in audit that refers to the overall effect of a material misstatement. A misstatement is pervasive if it affects various financial statement items or affects users’ decisions. Therefore, auditors use the disclaimer of opinion when they can’t obtain sufficient appropriate audit evidence with pervasive effect.

How does the Disclaimer of Opinion affect the audit report?

ISA 705 (Revised) Modifications to the Opinion in the Independent Auditor’s Report deals with disclaimers of opinion. The standard requires auditors to perform several modifications to the audit report if they cannot obtain sufficient appropriate audit evidence. These include the following:

a. State that the auditor does not express an opinion on the accompanying financial statements.

b. State that the auditor has not cannot obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on the financial statements. Auditors must also state a reference to the Basis of Disclaimer of Opinion.

c. Amend the statement required by ISA 700 (Revised), which indicates that the financial statements have been audited. Instead, auditors must state that they were engaged to audit the financial statements.

Source: ISA 705 (Revised) Modifications to the opinion in the Independent Auditor’s Report

These amendments to the audit report are crucial when auditors present a disclaimer of opinion. The disclaimer of opinion also modifies the audit report as with other qualified opinions. Auditors must also mention that the effects of the audit evidence are pervasive. Similarly, the disclaimer of opinion will also impact the basis for the disclaimer of the opinion paragraph.

Why is the Disclaimer of Opinion an issue?

Technically, the disclaimer of opinion isn’t an audit opinion. Instead, it implies that auditors cannot provide an opinion due to the reasons explained in the audit report. The disclaimer of opinion is the most serious audit opinion and can cause significant repercussions for the client. Some stakeholders may also view it as more problematic than the adverse opinion.

For the client, the disclaimer of opinion means that stakeholders won’t trust their financial statements. Usually, when auditors issue this opinion, stakeholders see it as a negative signal towards the client’s operations. The wording for this opinion also mentions the auditors were “unable to form an opinion”. For stakeholders, this may imply the management trying to conceal information or commit fraud.

For auditors, the disclaimer of opinion is also serious. Usually, auditors refrain from using this opinion. In some cases, however, they may not have any other options. Nonetheless, auditors have to cover their risks and liabilities for audit engagements. Therefore, they will use the disclaimer of opinion to avoid taking an unnecessary responsibility.

What are the reasons auditors will provide a Disclaimer of Opinion?

As mentioned, there are several reasons why auditors may provide a disclaimer of opinion. However, all these reasons fall under two primary categories. The first is that audit evidence is unavailable. In this case, the auditors may not get any audit evidence at all. The second case relates to audit evidence not being sufficient and appropriate. Here, audit evidence will exist but will not be of expected quality or quantity.

Unavailability of audit evidence

The unavailability of audit evidence may come from missing supporting documents. In some cases, a client’s management will stop auditors from accessing audit evidence. This treatment may also fall under the limitation of the auditor’s scope. However, the management may also have a legit reason for not providing audit evidence or preventing access to it.

Not sufficient appropriate audit evidence

Similarly, sometimes the management may be cooperative in providing audit evidence or access to it. However, the audit evidence may not be enough to support accounting transactions or events. It may occur due to the absence of proper controls at the client. Regardless of the reason, it is a factor behind auditors providing a disclaimer of opinion.

Lack of communication

In some cases, both auditors and the management may lack communication and coordination. Therefore, auditors may believe that the management is not providing the required audit evidence. In contrast, the management may think of their audit evidence as sufficient and appropriate. The lack of communication can also be a reason behind a disclaimer of opinion in the audit report.

High judgement areas

Auditors may also sometimes come across areas that require high judgment. In case auditors believe the management cannot justify their treatment of major transactions or events, they will issue a disclaimer of opinion. These areas usually include high risks for auditors. Therefore, if the management cannot explain their treatment or satisfy auditors, the disclaimer of opinion will be necessary.

Example

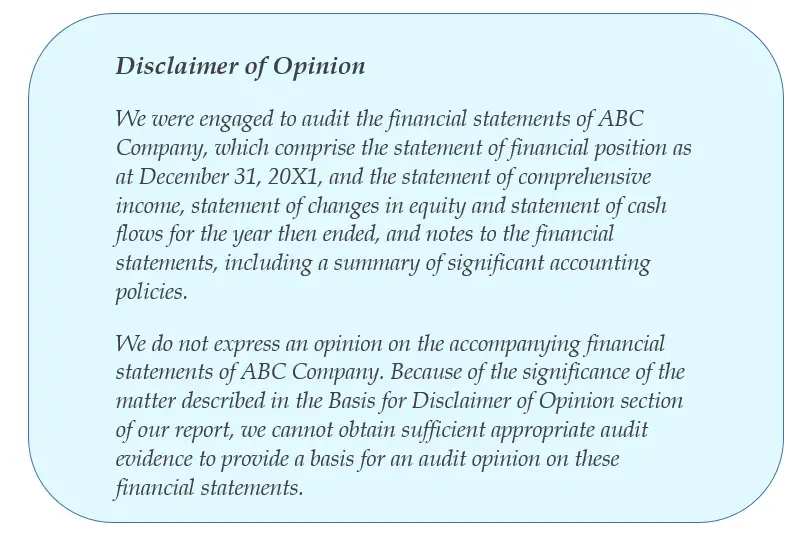

The following is a sample disclaimer of opinion. This opinion relates to auditors not obtaining sufficient appropriate audit evidence relating to an element of the financial statements.

In the basis for the disclaimer of opinion paragraph, auditors must describe the areas which lead to this opinion. Auditors must also include the reason why they couldn’t obtain sufficient appropriate audit evidence.

Conclusion

The disclaimer of opinion is an audit opinion provided by auditors in the auditor’s report. Technically, it doesn’t constitute an audit opinion. Auditors must also modify the audit report when providing this audit opinion. The disclaimer of opinion is the most serious audit opinion provided by auditors. There are various reasons why auditors may use this opinion.

Reference

- ISA 705 (Revised) Modifications to the Opinion in the Independent Auditor’s Report [Source]

Pingback: What is an Unqualified Audit Report? - Accounting Hub