Due to the agency problem, shareholders appoint auditors to verify whether the financial statements prepared by the management of a company are free from material misstatements and present a true and fair view. Auditors may also test the internal controls of a company to identify any weaknesses and provide recommendations about them to the management. However, the main purpose of an audit is for auditors to provide an audit report.

The audit report is a statement or document stating the opinion of auditors, known as audit opinion. There are various types of audit opinions that auditors may present in the report. However, before understanding these types, it is necessary to know what audit opinion is and what it means.

What is Audit Opinion?

The audit opinion is a statement given by auditors in the audit report that accompanies financial statements. The audit opinion presents the auditor’s view of whether the financial statements prepared by the management of a company prepare a true and fair view and whether it is free from material misstatements. Auditors base their opinion on the audit evidence obtained during the course of an audit.

In fact, ISA 700 (Revised) states that the objectives of the auditor during an audit engagement are:

(a) To form an opinion on the financial statements based on an evaluation of the conclusions drawn from the audit evidence obtained; and

(b) To express clearly the opinion through a written report.

What does the Audit Opinion Include?

Practically, the ISA requires auditors to conclude as to whether they have obtained reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, in order to form an opinion. In the opinion, the ISA requires auditors to take the following considerations into account.

(a) The auditor’s conclusion, in accordance with ISA 330, whether they have obtained sufficient appropriate audit evidence.

(b) The auditor’s conclusion, in accordance with ISA 450, whether uncorrected misstatements are material, individually or in aggregate.

(c) Whether the management has prepared the financial statements, in all material respects, in accordance with the requirements of the applicable financial reporting framework.

(d) The auditor should evaluate whether the financial statements disclose significant account policies and if they are consistent with the applicable financial reporting framework and appropriate. Furthermore, they should determine whether the information presented in financial statements are relevant, reliable, comparable, and understandable. Similarly, they should consider whether the accounting estimates made by management are reasonable.

Similarly, the auditors should evaluate the disclosures presented in the financial statements and whether they provide intended users with the effect of material transactions and events on the information provided in financial statements. Lastly, they should also evaluate whether the terminology used in the financial statements is appropriate.

(e) When the financial statements follow the fair presentation framework, the auditor should also include, in addition to the point (d), whether the financial statements achieve fair presentation. For this, auditors may need to consider the overall presentation, structure, and content of the financial statements. Similarly, they also need to consider whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

(f) Lastly, they need to evaluate whether the financial statements adequately refer to or describe the applicable financial reporting framework.

What are the 4 Types of Audit Opinion?

As mentioned above, there are four types of audit opinions. As a whole, auditors can provide two types of audit opinion, unmodified and modified. However, there are a further three types of modified opinion as well. These are the qualified and adverse opinion and the disclaimer of opinion.

The four types of audit opinion are as follows.

Unmodified Audit Opinion

Auditors express an unmodified or unqualified audit opinion in the audit report when the financial statements present, in all material respect, a true and fair view and are free from material misstatements. In simpler words, auditors provide an unmodified audit opinion when all the points mentioned above are satisfied in the financial statements when auditors are forming an audit opinion. Similarly, unmodified audit opinion also comes as a result of auditors obtaining sufficient appropriate audit evidence to the financial statements during their audit procedures.

An unmodified audit report in an audit report does not modify the audit report. Similarly, it does not provide absolute assurance but rather reasonable assurance. That is why auditors use the wording ‘in all material respect’. The financial statements may still have immaterial misstatements that the auditor might have neglected to form an opinion.

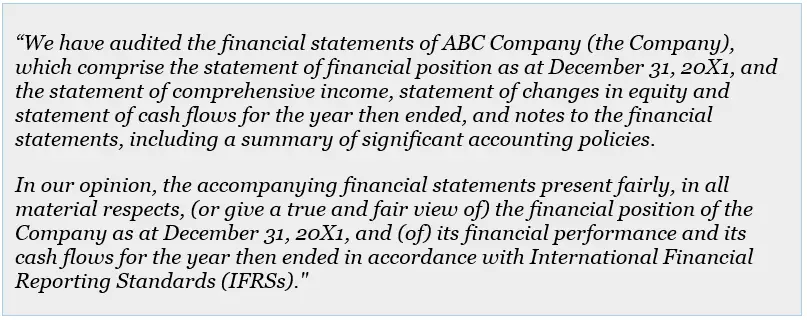

An excerpt of unmodified opinion provided by auditors is as follows.

Qualified Audit Opinion

The qualified opinion is the first type of modified opinion. Auditors use a qualified opinion when they find material misstatements in the financial statements after their testing. However, in this opinion, the material misstatement should not be pervasive and may relate to a specific area in the financial statements. Auditors can use their judgment to determine if a material misstatement may qualify as pervasive.

Pervasive is a term which, according to ISA 705 (Revised), describes material misstatements that may have an effect on the decision-making of users of the financial statements. Usually, auditors use the term ‘except for’ to present a qualified opinion. With this opinion, the auditor gives a modified report and mentions the areas in which the auditor found misstatements.

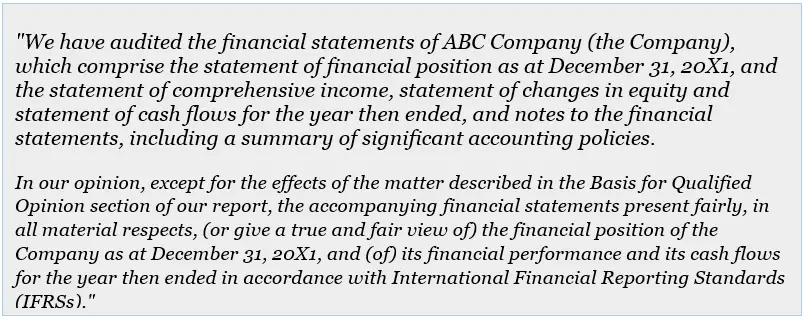

An excerpt of qualified opinion provided by auditors is as follows.

As mentioned in the opinion, the auditor must provide details of why they provided a qualified opinion in the ‘Basis for Qualified Opinion’ paragraph.

Adverse Audit Opinion

Auditors provide an adverse opinion when they find material misstatements in the financial statements of the client, which are pervasive. As compared to the qualified opinion, the adverse opinion is more severe. This is because this opinion does not use the word ‘except for’ but instead qualifies the financial statements as a whole.

The adverse audit opinion, which is a type of modified opinion, sends a negative signal to the stakeholders. It suggests for them not to trust the financial statements prepared by the management. Auditors use an adverse opinion when the management is unwilling to alter their financial statements. Although misstatements may occur due to errors, adverse opinions usually indicate fraud.

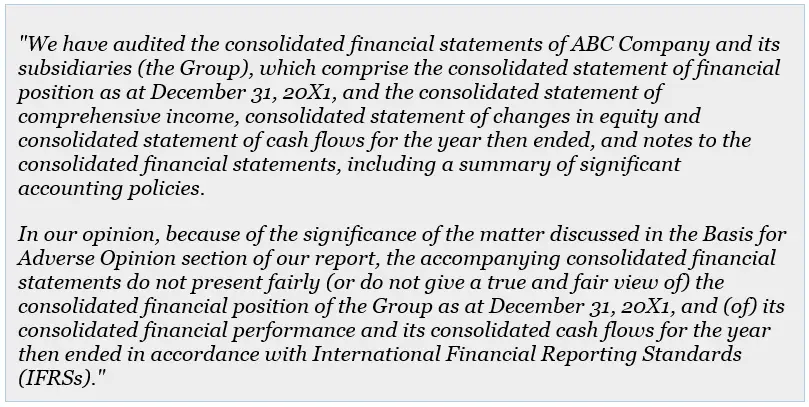

An excerpt of adverse opinion provided by auditors is as follows.

As the opinion suggests, the auditors also provide the reason for the adverse opinion in the ‘Basis for Adverse Opinion’ paragraph.

Disclaimer of Opinion

Auditors use the disclaimer of opinion in circumstances in which they cannot obtain sufficient appropriate audit evidence regarding whether the financial statements are free from material misstatements. While it is a type of modified opinion, it does not necessarily qualify the financial statements. Instead, it happens when auditors don’t have access to evidence to material items in the financial statement.

Similar to adverse opinion, for auditors to present a disclaimer of opinion, the effect of the unavailable information should be pervasive. Usually, it occurs when the management of the client is unwilling to provide auditors with the relevant supporting documents or evidence used for the preparation of financial statements. In this circumstance, auditors may sense a limitation of scope, which can force them to issue a disclaimer of opinion. Technically, a disclaimer of opinion isn’t an opinion at all.

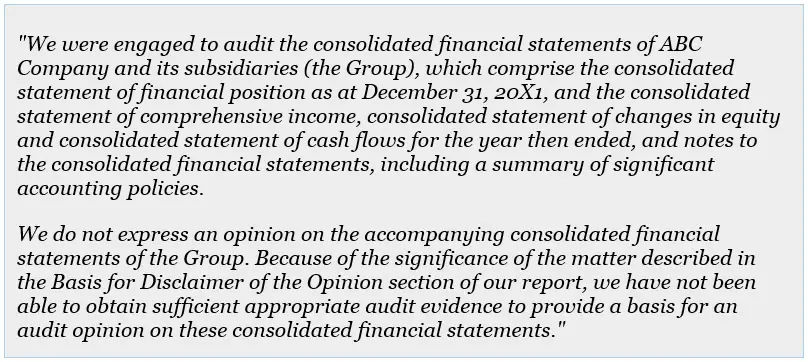

An excerpt of disclaimer of opinion audit opinion provided by auditors is as below.

As with all other types of opinion, auditors provide the reason for the disclaimer opinion as well, in the paragraph titled ‘Basis for Disclaimer of Opinion’.

Conclusion

Auditors are independent parties that examine the financial statements of a company to determine whether they are free from material misstatement and present a true and fair view. They provide their conclusion in the audit report in the form of an audit opinion. There are four types of audit opinion. Firstly, there is the unmodified audit opinion, which suggests the financial statements are free from material misstatements.

However, auditors may also provide a modified opinion, which has three types. These are the qualified and adverse opinion and the disclaimer of opinion. For all of these, the auditor must provide the reason in the ‘Basis’ paragraph.