Introduction

Accounting for goodwill is normally applicable for Group Company where the parent company has bought or acquired its subsidiaries’ shares. There is specific formula for goodwill calculation. Before understanding how to account for goodwill and the subsequent impairment recognition, let’s understand the key definition of goodwill first. So what is Goodwill?

Definition

We commonly call goodwill as value or reputation of a business or entity. The value of such kind of goodwill might be considerable. However, each entity does not usually value and record this goodwill in the accounts of a business at all and they normally shall not present such kind of goodwill in the Balance Sheet or Statement of Financial Position of a business.

Only the goodwill arising from the business combination or acquisition shall be accounted for in the Financial Statements.

In accordance with IFRS 3, Goodwill is defined as follow:

“Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized”.

So from above definition, it is clear that the goodwill arises from the business combination. So what is business combination? And when we consider business combination incurred?

An entity considers an event or transaction as business combination when the assets acquired and liabilities assumed constitute a business. This means that such asset acquisition is for business purpose. For instance to gain market shares or to enter into a new market through such acquisition.

Calculation and Accounting for Goodwill

In order to account for goodwill, an entity shall first identify the business combination by applying the acquisition method. The identification of business combination through the acquisition method requires such entity to know the following information:

First, we need to identify the acquirer. Who acquires or purchase shares of a business and gain the control over such entity. Secondly, we need to identify the acquisition date. The date at which the parent company gain control as result of such acquisition.

Then, we shall need to recognize and measure the identifiable assets that they acquired and any liabilities that they assumed as well as any non-controlling interest where such acquisition or gaining control is not 100% of shares of targeted entity that they acquired.

Finally, we shall recognize and measure the goodwill or gain from such bargain purchase or acquisition.

So at this stage, if the consideration transferred exceed the fair value of the identified assets, we commonly call such difference as Goodwill. However, if it is less than the fair value of the identified assets, we consider such difference as Negative goodwill instead.

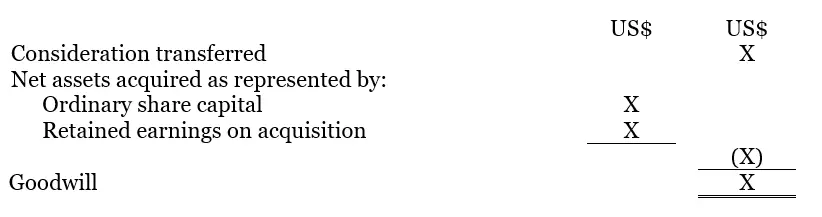

Below is the basic formula for Goodwill calculation as result of business combination:

The above formula is is for basic calculation of goodwill. In a complex group company where there are deferred consideration or contingent liability, such formula for goodwill calculation will change a little bit to include the deferred consideration or contingent liability.

Recognition of Goodwill

An entity recognizes as Goodwill as a result of business combination when the fair value of the assets acquired exceed the consideration transfer as mentioned above.

After a parent or a group of company have calculated Goodwill, the group shall initially measure and recognize such Goodwill at its cost. The cost at which the excessing of the cost or consideration transferred of the combination over the acquirer’s interest in the net fair value of the acquiree’s identifiable assets, liabilities and any contingent liabilities.

After the initial recognition, the Goodwill shall need to be subsequently recognized at its costs less any accumulated impairment losses. An entity shall not recognize any amortization of goodwill arising from the business combination. Instead, the group company shall perform test of impairment on annual basis on such goodwill and recognize the impairment accordingly in the income statement or profit and loss account as result of such impairment testing.

Example of Goodwill Calculation

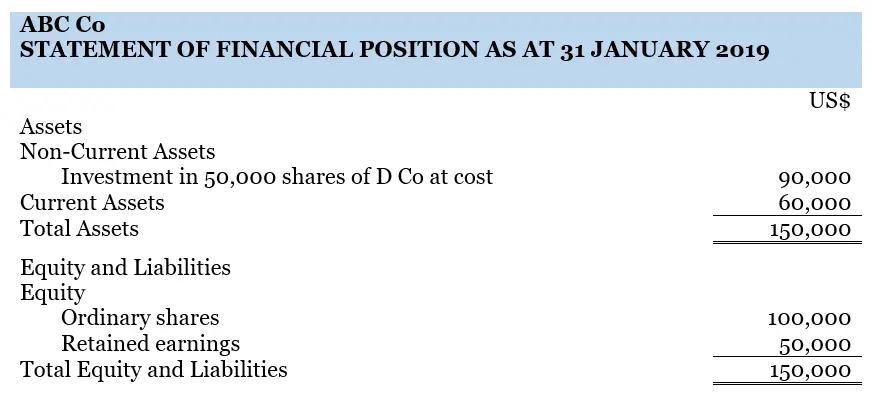

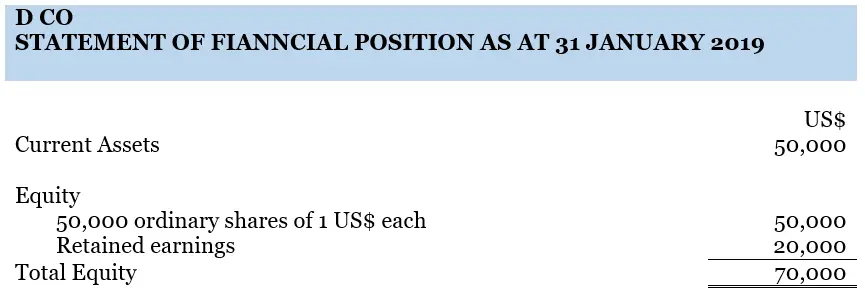

ABC Co acquired the ordinary shares of D Co on 31 January 2019 for a consideration transferred of US$80,000. The financial statements at the date of the acquisition of each company are as follow:

Calculate the Goodwill as result of the acquisition

Solution:

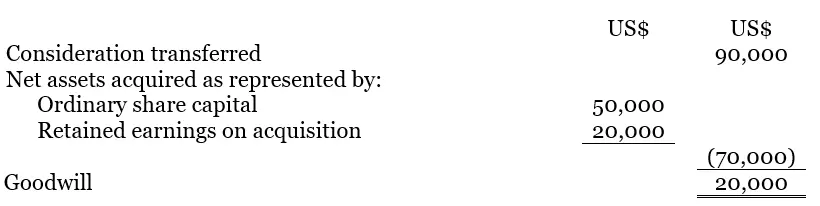

From the example above, we can summary as follow:

Consideration transferred = US$90,000

Net asset represented by:

Ordinary shares = US$50,000

Retained earnings = US$20,000

Thus, the goodwill will be as follow:

Therefore, the goodwill arising from the acquisition is US$20,000.

Suppose further that at the end of 31 December 2019, the goodwill has been tested for impairment. As result, the carrying value of goodwill as of 31 December 2019 is only US$18,000.

Therefore, ABC Co shall recognize the impairment of goodwill in the financial statement by reducing from US$20,000 at the date of acquisition to only US$18,000 subsequently as at 31 December 2019.

The journal entries of the impairment are as follow:

Dr. Group Retained earnings US$2,000

Cr. Goodwill US$2,000

Thus, the group shall record or show the impairment of US$2,000 as a reduction in group retained earning and the group shall record and present the reduction in goodwill as a reduction of carrying amount of goodwill. Therefore, the carrying amount of US$18,000 will be shown in the Consolidated Balance Sheet or Consolidated Statement of Financial Position.

Conclusion

Only goodwill arising from the business combination or acquisition shall be accounted for in the Financial Statements. At initial recognition, the goodwill shall be recognized at its cost and subsequently shall be recognized at the costs less accumulated impairment as per the annual impairment valuation or testing.