Introduction

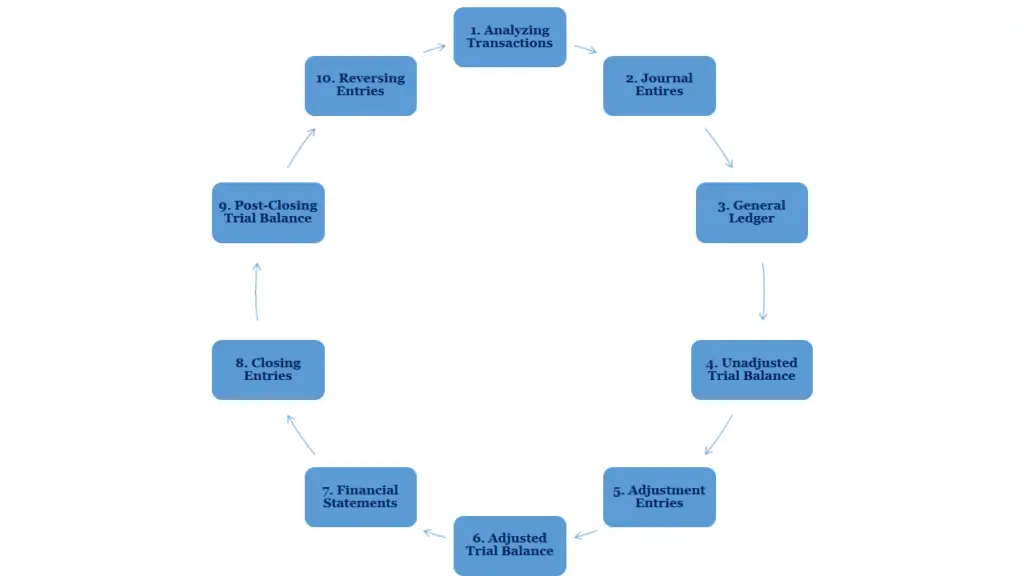

When we talk about the accounting cycle, we normally refer to the 10 steps process in accounting from the analysis, then record those transactions until the preparation of Financial Statements and reversing entry where necessary. In this article, we will detail each of the 10 steps plus examples. So what are those steps in the accounting cycle?

So let’s start.

The Accounting Cycle, 10 Steps Process

The accounting cycle consists of 10 steps. We will list the accounting cycle steps in the proper order as below:

- Analyzing transactions and source documents

- Journalizing transactions (Journal Entries)

- Summary or post into General Ledger (GL)

- Prepare Unadjusted Trial Balance

- Journalizing adjustment entries

- Prepare Adjusted Trial Balance

- Prepare Financial Statements

- Closing entries

- Post-Closing Trial Balance

- Reversing entry

The above is the full accounting cycle that each accountant should be aware of.

This can be summarized in the accounting flow chart below:

In practice, steps 3, 4, 6, 7, and 9 are often automatically generated by a computerized accounting system.

Now you know the 10 steps of the accounting cycle. Below is a detailed explanation as well as examples of each step.

So let’s dive in.

Step 1: Analyzing Transactions and Source Documents

The first step of the accounting cycle is to analyze business transactions and the relevant source documents. This is the starting point of accounting. Before we record any transactions, an accountant or bookkeeper needs to analyze those transactions first. This analysis is done by looking at the source documents. They must look at the nature of each transaction and how to record it.

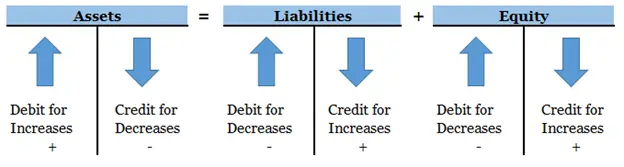

Each accountant or bookkeeper shall understand the key principle of Debits (left-hand side) and Credits (right-hand side) when they analyze transactions. If they don’t understand the rule of Debits and Credits and incorporate them into the analyzing process, they won’t be able to record transactions correctly. This rule differs for assets, liabilities, equity, revenues, and expenses.

Below is the rule of Debits and Credits that accountants or bookkeepers should know and apply in the process of analyzing transactions.

Assets

For an asset, its balance should be on the Debit side. Thus, any increase shall be recorded on the Debit side, and if it decreases, we shall record it on the Credit side.

Liabilities

For liability, its balance should be on the Credit side. Therefore, any increase shall be recorded on the Credit side and vice versa.

Owner Equity or Shareholder Equity

Equity has its balance on the Credit side. Normally, the increase comes from additional investment or injection of capital. We shall record such an increase in Credit. The decrease normally comes from the withdrawal from the owner; thus, such a decrease shall be recorded on the Debit.

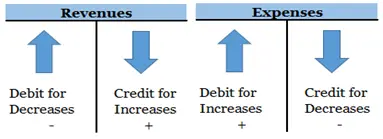

Revenues/Gains or Incomes

Revenues or incomes/gains have a balance on Credit. Thus, any increase in revenue shall be recorded on the credit side and vice versa.

Expenses/Losses

Expenses/losses have a balance on debit. Therefore, any increase in expense shall be recorded on the debit side and vice versa.

To be easy to memorize, let’s see the acronyms below:

“D.E.A.L and G.I.R.L.S for the increase and decrease of each accounts.” according to AccountingCoach.

An increase in Debit is called (D.E.A.L). This comes from the word below:

D. Drawing or withdrawal and Dividend

E. Expenses

A. Assets

L. Losses

In contrast, the increase in Credit is called (G.I.R.L.S). This comes from the word below:

G. Gain

I. Income

R. Revenues

L. Liabilities

S. Stockholder’s Equity or owner Equity

Below is the summary in T-Account for such increases and decreases:

In short, Assets and Expenses/Losses increase on Debit while Liabilities, Equity, and Revenues/Gains/Incomes increase on Credit.

Step 2: Journalizing Transactions (Journal Entries)

Journalizing transactions is the second step among the 10 steps of the accounting cycle. After analyzing transactions, considering the source of documents and the rule of Debits and Credits. The accountant or Bookkeeper shall need to record those transactions in Journal. In the old fashion of accounting, while paperwork is used, the accountant or bookkeeper shall maintain a journal book where all transactions have been recorded.

The template might differ from one entity to another; however, the concept remains the same. The Journal should contain the Journal number, account number, account name, the double entries of each transaction, as well as the narrative or description of each transaction. Below is the simple sample Journal:

| GENERAL JOURNAL | ||||

| Page 1 | ||||

| Date | Account Titles and Explanation | PR | Debit | Credit |

| 1-Jan-19 | Cash | 30,000 | ||

| Capital | 30,000 | |||

| (To record investment by owner) | ||||

| 3-Jan-19 | Supplies | 3,000 | ||

| Cash | 3,000 | |||

| (To purchase supplies for cash) | ||||

| 5-Jan-19 | Office Equipment | 5,500 | ||

| Cash | 5,500 | |||

| (To record purchase of office equipment) | ||||

In a computerized accounting or a modern accounting world, we do not need to maintain such Journal Book. In each off-the-shelf software or advanced tailored application, the Journal has been built, and the format is different from one system to another.

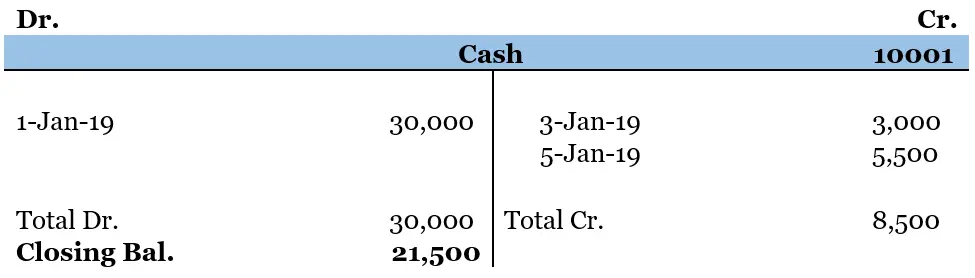

Step 3: Posting to General Ledger

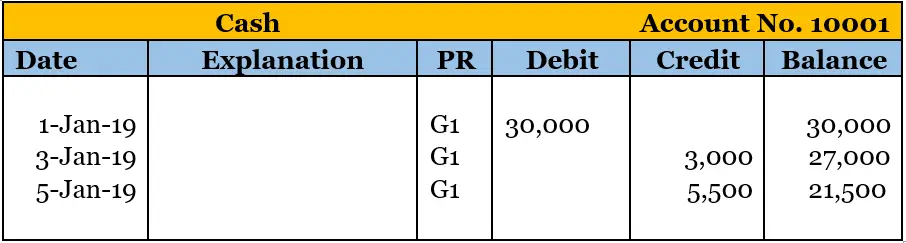

After each accountant or bookkeeper records transactions in the Journal, the next step of the accounting cycle is summarizing them in General Ledger. Each account in the chart of accounts has its own separate ledger. General Ledger commonly has two forms, Balance Column Account and T-Account.

Below are the two for of General Ledger:

- Balance Column Account:

In this form, General Ledger is tabular. At the top, there is information on the account name and account number and followed by the next heading, the date, explanation or narrative, PR, Debit, Credit, and Balance. You can see the sample Balance Column Account as follow:

- Ledger in the form of T-Account

The word T-Account is because the ledger derives from the letter “T”. At the top left corner is Debit (Dr.), and the top right corner is Credit (Dr.). Then the title of the account is in the middle, followed by the account number.

The T-Account form is very common for academic or illustration purposes as it is easy and convenient.

Balance Column Account is very common in the computerized system. There might be some additional features or a little bit different in formatting in each computerized system; however, some basic information is the same as per the tabular above.

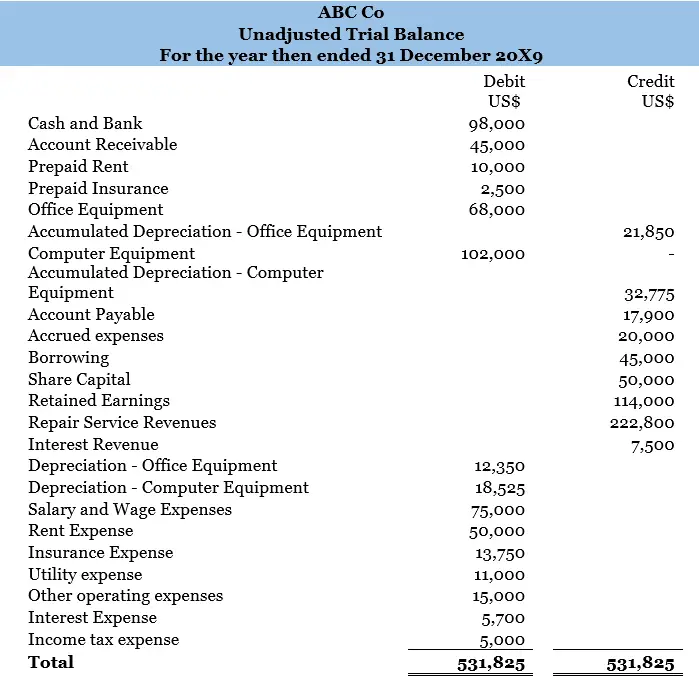

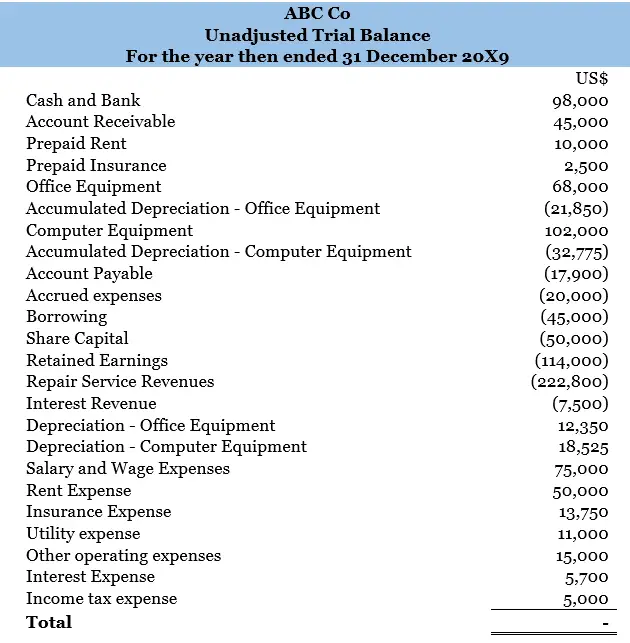

Step 4: Prepare Unadjusted Trial Balance

The fourth step of the accounting cycle is preparing the Unadjusted Trial Balance. The Unadjusted Trial Balance consists of the summary of each account balance. Commonly, Trial Balance is presented on both sides, Debit and Credit. In the end, the total Debit shall equal the total Credit. If it does not balance, there should be some errors or problems. Thus, each accountant or bookkeeper shall investigate and correct it.

However, in some accounting software, the trial balance is shown only one column. The Debit and Credit sides are presented in one column together. Assets and Expenses are presented as positive balances, while liabilities, equity, and revenues are presented as negative balances. Thus, the sum of all accounts together shall be zero.

Below is the basic illustration of Unadjusted Trial Balance for both one column and two columns Unadjusted Trial Balance:

Two-column Unadjusted Trial Balance:

One column Trial Balance:

Step 5: Journalizing Adjustment Entries

The next step after preparing the Unadjusted Trial Balance is to journalize the adjustments. There are some prepaid expenses and accruals that we shall need to make adjustments to at the end of the accounting period.

Therefore, the adjusting journal entries are prepared in order to recognize expenses and revenues that were incurred or earned but have not been recognized in the accounting book.

For the detail of the adjustments, you can refer to previous articles on how to account for amortization of prepaid expenses and accounting for accrued expenses. These two articles cover all aspects of adjustments that we shall make for this step of the accounting cycle.

For illustration purposes, let’s assume that the below expenses have not been adjusted yet by an accountant of ABC Co.

- ABC Co has not recorded depreciation of office equipment of US$950 for December 20×9.

- ABC Co has not recorded depreciation of computer equipment of US$1,425 for December 20×9.

- The rent expense for December 20×9 has not been amortized. The amount for December 20×9 is US$5,000

- Insurance expense for December 20×9 has also not been amortized. The amount for December 20×9 is US$1,250

- ABC Co has not received the utility bill as of 31 December 20×9. From past experience, the utility expense is approximately US$1,000 per month.

Thus, based on the above information, ABC Co shall need to make the adjustment entries as follow:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Depreciation – Office Equipment | 950 | |

| Accumulated Depreciation – Office Equipment | 950 | |

| Depreciation – Computer Equipment | 1,425 | |

| Accumulated Depreciation – Computer Equipment | 1,425 | |

| Rent Expense | 5,000 | |

| Prepaid Rent | 5,000 | |

| Insurance Expense | 1,250 | 5,700 |

| Utility Expense | 1,000 | |

| Accrued Expenses | 1,000 | |

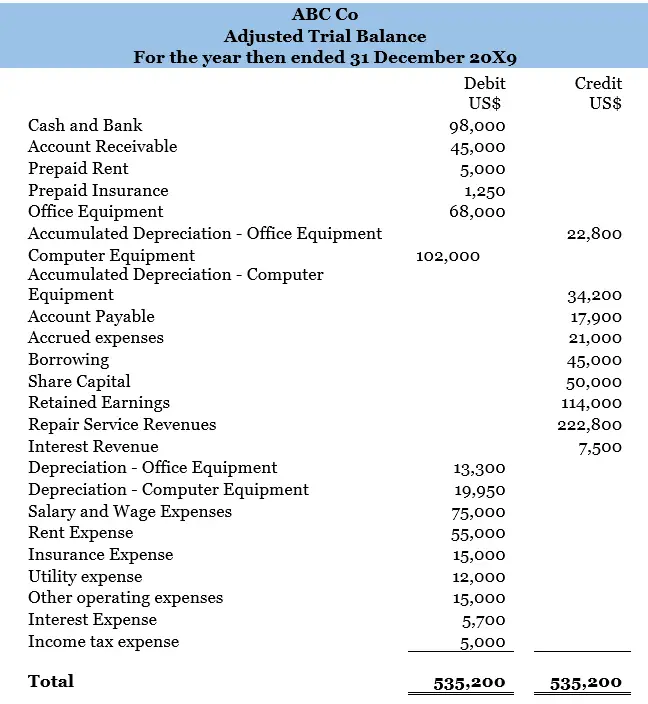

Step 6: Prepare Adjusted Trial Balance

After making or journalizing relevant adjustments, the next step is to prepare the Adjusted Trial Balance. In the Adjusted Trail Balance, all revenues and expenses have been accounted for fully. Thus it is time for an entity to prepare the Financial Statements. Below is the illustration of Adjusted Trial Balance continuing from step 4 above. Going further, we will use only two columns, Trial Balance, for illustration purposes.

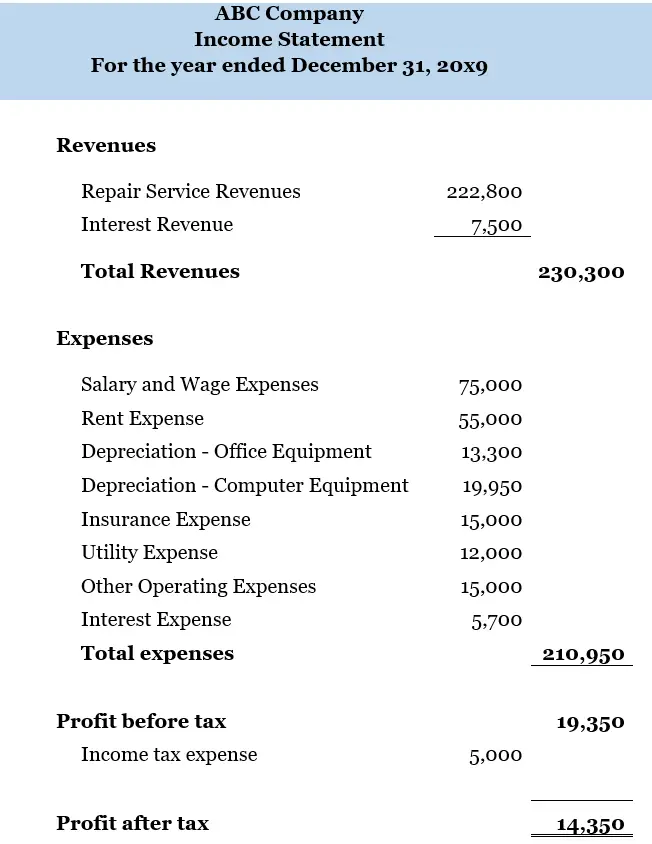

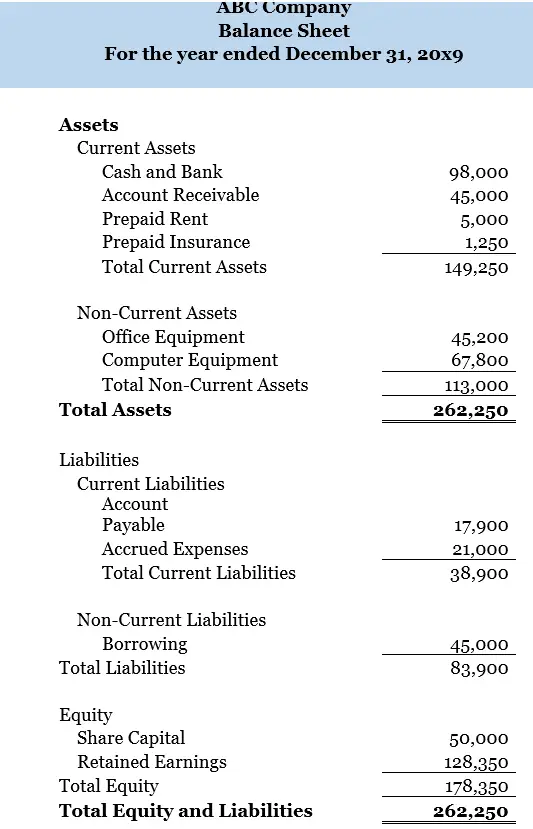

Step 7: Prepare Financial Statements

Once a trial balance has been prepared, the next step of the accounting cycle involves the preparation of financial statements. In this step, we are able to prepare all four main types of financial statements. These are the Income Statement or Profit and Loss Statement, Balance Sheet or Statement of Financial Position, Statement of Changes in Equity, and Statement of Cash Flow. In practice, there are also disclosure notes to support the figures in the Financial Statements as well as the significant accounting policies and procedures which play a vital role in preparing the Financial Statements.

For illustration purposes, we will show only the Income Statement and Balance Sheet. For other statements such as Statement of Changes in Equity and Statement of Cash Flow, please refer to another article on Type of Financial Statements. In that article, there is more detail about the preparation of Financial Statements.

After ABC Co has prepared its Adjusted Trial Balance, it is time to prepare the Financial Statements. Below are the preparation of both the Income Statement and Balance Sheet.

Here is the profit or loss statement for the income statement for ABC Co after all adjustments have been made.

Below is the Balance Sheet or Statement of Financial Position after all adjusting entries have been made.

Step 8: Closing Entries

In practice, we can perform the closing process on the monthly basis or on annual basis, depending on the preference of each entity. Some companies prefer to perform the closing on an annual basis which is at the end of the accounting period.

This step involves the transfer of all temporary accounts to retained earnings. In accounting, there are two types of accounts; Permanent Accounts and Temporary Accounts. Permanent accounts refer to all of the assets, liabilities as well as share capital or share premium. All these accounts usually are shown on the Balance Sheet.

In contrast, temporary accounts are those accounts mostly found in the Income Statements except the dividend or withdrawal account.

In the closing process, we shall need to close or transfer all temporary accounts to retained earnings. Before transferring to retained earnings, we commonly use an income summary account as a temporary account for the closing process for all revenues and expenses accounts. In order to illustrate this closing process, let’s take the extract of all Profit and Loss accounts plus retained earnings and withdrawal of ABC Co as follow:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Retained Earnings | 114,000 | |

| Repair Service Revenues | 222,800 | |

| Interest Revenue | 7,500 | |

| Depreciation – Office Equipment | 13,300 | |

| Depreciation – Computer Equipment | 19,950 | |

| Salary and Wage Expenses | 75,000 | |

| Rent Expense | 55,000 | |

| Insurance Expense | 15,000 | |

| Utility expense | 12,000 | |

| Other operating expenses | 15,000 | |

| Interest Expense | 5,700 | |

| Income tax expense | 5,000 |

The closing process involves four steps as follows:

- Step 1: Closing all revenue accounts:

This involves transferring all revenue accounts to an income summary account. Commonly all revenue accounts have balances at Credit. Thus to close all revenue accounts, we need to record them on Debit as follows:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Repair Service Revenues | 222,800 | |

| Interest Revenue | 7,500 | |

| Income Summary | 230,300 |

- Step 2: Closing all expense accounts:

This step involves transferring all expense accounts to an income summary account. As all expense accounts have a balance on Debit; thus to close all these accounts, we need to record them on Credit as follows:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Income Summary | 215,950 | |

| Depreciation – Office Equipment | 13,300 | |

| Depreciation – Computer Equipment | 19,950 | |

| Salary and Wage Expenses | 75,000 | |

| Rent Expense | 55,000 | |

| Insurance Expense | 15,000 | |

| Utility expense | 12,000 | |

| Other operating expenses | 15,000 | |

| Interest Expense | 5,700 | |

| Income tax expense | 5,000 |

- Step 3: Closing income summary account:

In this step, we need to transfer the Income Summary account to retained earnings. The Debit or Credit of Income Summary account depends on the difference between step 1 and step 2 above. If the balance of such an account in step 1 is higher than that in step 2, that means the net balance would be on Credit. Thus to close this, we shall need to record on Debit and vice versa.

In the case of ABC Co above, the sum of step 1 is greater than step 2; thus, the closing entries in the step would be as follow:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Income Summary (230,300 – 215,950) | 14,350 | |

| Retained Earnings | 14,350 |

- Step 4: Closing dividend or withdrawal (If an entity is a sole proprietorship or partnership):

In the final step of the closing process, we shall need to transfer all balances of the dividend or withdrawal account to retained earnings. The dividend or withdrawal has its balance on Debit; thus, to close this account, we need to record on Credit and other correspondent entries to retained earnings.

In the case of ABC Co above, there is no dividend nor withdrawal. Therefore, the amount will be zero. However, for illustration purpose, please see the entry with nil balance as follow:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Retained Earnings | Nil | |

| Dividend/Withdrawal | Nil |

After we perform all these four steps process of closing, all balances of revenues, expenses as well as dividends or withdrawals would be zero, and those balances are transferred to retained earnings account.

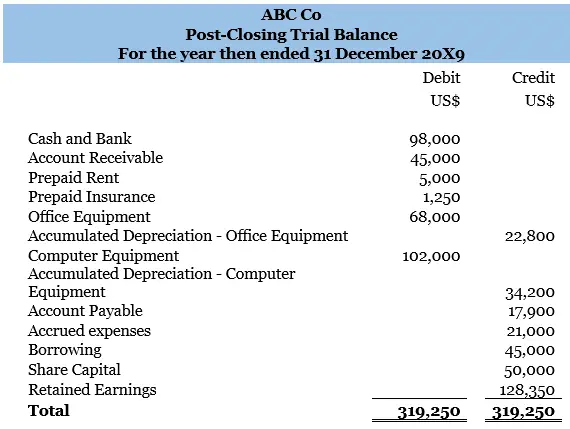

Step 9: Post-Closing Trial Balance

This step involves preparing a trial balance that contains only permanent accounts. This is because all temporary accounts have been closed to zero in step 8 above.

Thus, after the closing process, the Post-Closing Trial Balance of ABC Co would be as follow:

As you can see, the Post-Closing Trial Balance consists of only permanent accounts on the Balance Sheet. All temporary accounts have been transferred to retained earnings after the closing process.

Step 10: Reversing Entries

This is an exceptional and last step of the accounting cycle. In some cases, it requires to have a reversal entry. For example, when an entity record any accruals but such an entity has not received nor issued invoices. Thus, such an entity shall need to reverse that entry at the beginning of the following period and then record actual invoices instead.

In some computerized accounting systems, there is an option where each accountant or bookkeeper is able to choose or tick so that such entries will be automatically reversed in the following period. This would help a lot in practice to avoid so much manual work. This would ensure that there is no chance of missing such a reversal.

For example, ABC Co has recorded accrued utility expense at the end of 31 December 20×9. ABC Co has not received the utility bill yet as of 31 December 20×9. From past experience, ABC Co normally incurs utility expense of US$1,000 per month. However, on 5 January 202x, ABC Co received the utility bill with the actual amount of US$1,200.

Thus, in the adjustment process in step 5 above, ABC Co shall need to record the accruals at the end of 31 March 20×9 as follow:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Utility expense | 1,000 | |

| Accrued expense | 1,000 |

If there is an option to choose auto reverse in the accounting system of ABC Co, these entries would be reversed automatically in early January 202x. However, if not, each accountant shall need to reverse manually and then record the actual utility bill. The entries would be as follow:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Accrued expense | 1,000 | |

| Utility expense | 1,000 |

Then the new entries would be as follow in recording the actual bill:

| Account Name | Debit | Credit |

| US$ | US$ | |

| Utility expense | 1,200 | |

| Cash or Account Payable | 1,200 |

Thus, in January 202x, the additional utility expense is $200 as a result of under accruals in December 20×9.

Conclusion

The accounting cycle consists of the 10 important steps that are very important in order to manage and present financial information. As accountants and bookkeepers, they shall need to understand clearly about these steps process.