Introduction

Cash forecasting, also known as cash flow projection, is a key driver for success if an entity prepare it properly. It plays an important role in helping business owner and top management in order to make any financial decision correctly both investment and financing arrangements. So what is cash flow forecasting?

Definition

Before dive in detail, let’s understand the relevant definition and related key words of cash flow forecasting.

Cash Flow Forecasting is a process of collecting and presenting data relating the future cash inflow and cash outflow as well as the potential closing balance at the end of each reporting period.

The interchangeable word of cash flow forecasting is Cash Flow Projection. These two keywords have the same meaning. Some people call cash flow forecasting while some others call cash flow projection.

Purpose of Cash Flow Forecasting

The primary purpose of preparing this kind of forecasting is to enable an entity to manage its liquidity properly. This helps to ensure that such entity has the necessity of cash to meet its obligations and allow such entity to better manage its working capital.

In addition, such entity is also able to manage or make additional investment where necessary when they have build-up of cash. In contrast, in case, there is shortage of fund, the entity can manage to arrange any financing facilities with banks or from other sources.

Important of Cash Flow Forecasting

Similar to the purpose of cash flow forecasting in the above section, the proper and accurate cash flow forecasting is very important. In practice, we do not want to see the actual cash flow is negative at any period. This would be a warning sign if we encounter such negative position. Thus, by having a timely and accurate cash flow forecasting, it would help each entity for a number of reasons as follow:

- It helps to ensure that an entity are able to pay employees and suppliers on time

- If we anticipate a negative cash balance at any certain period, an entity can manage and seek other sources of fund on time. These sources of fund can be obtained from bank (Practically, each entity shall enter into an overdraft facility or OD with bank) or any other external sources.

- Last but not least, please be aware that the key stakeholders such as inventors or bankers want to see the cash flow forecasting before they can make any investment or providing a loan facilities. Hence, an accurate cash flow play a vital role in winning over the decision of those external stakeholders.

Key Assumptions for Cash Flow Forecasting

Before starting the preparation of cash flow forecasting or projection, we shall need to prepare a list of assumptions that are necessary and relevant for the cash flow forecasting. Below are some of the practical assumptions that we should account for before starting working on the cash flow forecasting:

- The estimation of sale growth. This is very key assumption. Business need to see the future prospect. Thus estimating the sale growth and incorporate into the cash flow projection can provide a meaning full and accurate cash flow projection.

- Seasonal Impact. The seasonal consideration is very important in the cash flow forecasting. Thus, each entity shall incorporate this assumption in the preparation of cash flow forecasting.

- Consideration on salary and wage increment as well as staff benefits. This can be done by looking at the current position applying the inflation rate where applicable and necessary.

- Apply Consumer Price Index (CPI) on certain costs element. This enable entity to decide how much costs should be increase or decrease.

How to Prepare Cash Flow Projection

In order to have a good cash flow forecasting, it requires an entity to establish a good model of forecasting or projection. This involves integrating historical data and forward looking approach.

A forward looking approach here refers to the approach of predicting or forecasting the future business of each entity relating to the sale growth, expected future cash receipts as well as the cash payments for all kinds of expenditures or investing on non-current assets such Property Plant and Equipment (PPE) or the company’s core software. All these have been covered in the key assumptions in preparation of cash flow projection in the above section.

In common practice, we normally divide the cash flow forecasting into two parts. These are short-term cash flow projection and long-term cash flow projection. The short term basis usually covers a period of twelve months. This is usually done by spreading the projection on the monthly basis.

Another part is called long term cash flow projection. The long term cash flow projection is commonly prepared for a period of five to ten years. This is also commonly prepared in conjunction with the business plan of each entity.

The long term cash flow projection involves a lot of subjective judgments as well as other key factors both internal and external factors.

The cash flow forecasting requires each entity to work on three main activities of the cash flow. These are operating activities, investing activities and financing activities.

The operating activities involve the forecasting or projecting of the keys business operations. These include expected cash receipts and payment of certain items as follow:

- Cash receipts from sales or other incomes (This would include any VAT or GST and other taxes refund, any receipts from the insurance claim, any receipts from royalty or commission income and any receipts from sale of short-term investments which are held for trading)

- Cash payments of salary and wages

- Cash payments on rental

- Cash payments on VAT and Other Taxes

- Cash payments on Corporate Income Tax

- Cash payments on other operating costs

For investing activities, the forecasting involves the acquisition or disposal of PPE, intangible assets or any other non-current assets. We should also account for any cash receipts from divestment of assets or business line where applicable.

In addition, each entity shall also account for any receipts from government grants in the cash flow projection as well.

While the forecasting for financing activities involve the predicting of principal bank loan payment or interest as well as any another potential new loans. In addition, the future dividend payment as well as the raising of capital are also in this section.

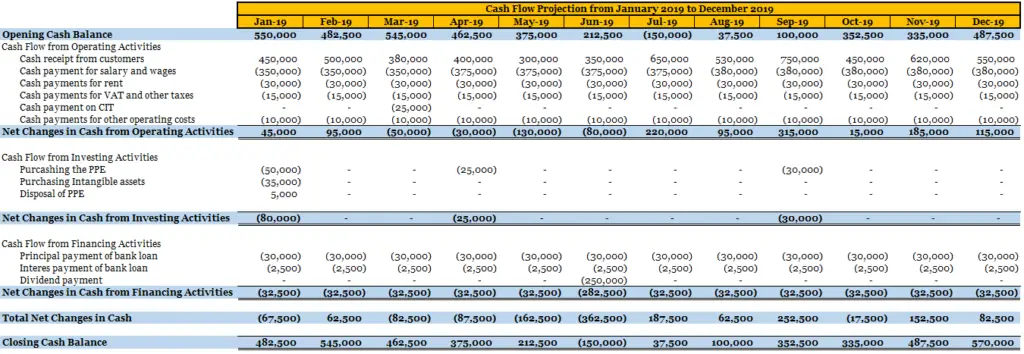

Below is the basic example template for ABC Co:

From the above sample, ABC Co has a projected negative cash balance in June 2019; thus ABC Co shall need to arrange for financing facilities.

In addition, please keep in mind that each entity shall not have only one scenario. In best practice, the cash flow forecast is prepared in several scenarios. This involves using different assumptions for example different revenue growth rate or play around with certain expenses or investment opportunities.

Challenges for the Forecasting

In real practice, it is quite difficult to ensure that the cash flow forecasting preparation is accurate. From past experience, the inaccuracy of cash flow forecasting commonly derives from the lack of communication among relevant departments as well as a poor resources in participating its process. Without competent resources and good communication or coordination from key relevant stakeholders, we would not have an accurate forecasting.

Please note that the market keep changing from day to day. Thus the forecasting sometimes not relevant. Thus, as a top managements and business owners, they shall need to be flexible. They shall not just stick to the plan. When opportunity comes, please take it.

Who is the Goal Owner of the Cash flow Forecasting?

For medium and small business entity, commonly the goal only is the finance manager or director. However, for big corporation or Group Company, usually the goal owners are the group CFO as well as the group treasury and they need to work closely with the top managements and other relevant stakeholders in preparing the cash flow forecasting.

Conclusion

Cash flow forecasting is very important for each entity. It is enable such entity to plan properly for any investing or financing arrangements.