Introduction

How to account for amortization of prepaid expenses is the key for accountants not just for a big company but also for a small business entity. Prepaid expenses commonly happen when an entity adopts the accrual basis accounting. When an entity makes an advance payment; for example, for rental for a period of one year, such entity cannot recognize such payment as a one-off expense at the time of payment. Such advance payment shall be recorded as prepaid expenses and do the amortization to recognize the expense when it incurs. Thus, how can we account for such amortization of prepaid expenses?

Definition

Before going in detail, let’s first understand the key definition of prepaid expenses and amortization.

Amortization refers to the recognition or spreading of expense over a period of time when such expense incurred. We commonly see this word when we talk about intangible assets. For intangible assets, the recognition of expense is called amortization, not depreciation. This amortization or spreading the expense at the end of each month is called the adjusting entries which is one step of the accounting cycle.

Prepaid expenses refer to the advance payment or prepayment of something in order to be able to use such things but an entity has not used such things yet. For example, ABC Co has paid an advance rental at the beginning of the year for space usage for one year until the end of the year. In this case, we treat the advance payment as a prepaid expense or specifically as prepaid rent. ABC Co shall not recognize as a full expense at the time of such payment. Instead, ABC Co shall maintain a schedule and do the amortization to recognize as rental expense over the period cover for the rent.

All kinds of prepaid expenses are recorded in the accounting book of an entity and presented in the current assets section in the Balance Sheet. While the amortization of such prepayments is presented in the Income Statement for Profit and Loss Statement.

Now, we already understood the key definitions of prepaid expenses and amortization. Let’s go further about different types of prepaid expenses that we commonly see.

Types of Prepaid Expenses

As an accountant and business owner, they commonly see and experience this kind of payment and wording in their day to day business operation.

In practice, prepaid expenses are divided into different types. These include prepaid rent, prepaid insurance, prepaid advertising, and other types of prepaid expenses, etc…

Prepaid Rent

As mentioned above, prepaid rent refers to the advance payment of rental for the right to use such rent over a period of time. For instance, on 01 January 2019, ABC Co has paid US$50,000 for the office space to D Co, a property management company. This payment is for the use of office space from 01 January 2019 until the end of 31 December 2019.

This advance rental payment is considered as prepaid rent in the accounting book of ABC Co.

Prepaid Insurance

Prepaid Insurance is one type of prepaid expenses that we commonly see in the current assets section in the Balance Sheet. It refers to the advance payment of insurance premiums to the insurance company for insurance coverage. We basically know that there are different types of insurance coverage such as health insurance, property insurance, life insurance, etc…

For instance, ABC Co wants to cover the health insurance of its staff. Thus, ABC has paid US$15,000 for health insurance on 01 January 2019 to cover the health insurance premium until the end of 31 December 2019.

Thus, ABC Co shall record this advance payment as Prepaid Insurance and amortize it over a period of twelve months in order to recognize the expense of the insurance premium.

Prepaid Advertising

This is another type of prepaid expenses records in the current section of the Balance Sheet. This is also commonly seen in practice. When an entity wants to advertise its products or services, that entity would need to pay the advertising agency or TV channel so that they can advertise for that entity.

For example, on 01 January 2019, ABC Co has made an advance payment for the advertising space on one TV channel for US$20,000 per year until 31 December 2019.

Therefore, ABC Co shall record such payment as prepaid advertising and do the amortization to recognize advertising expense over a twelve-month period until 31 December 2019.

Accounting Entries for Prepaid Expenses and Subsequent Amortization

After understanding the key definitions and different types of prepaid expenses, now it is time to know how to account for the prepaid expenses as well as how to record the amortization.

Following the three examples for the types of prepaid expenses above, the accounting entries at the time of making advance payment and recognizing the amortization expenses are as follow:

Prepaid Rent

On 01 January 2019, the accounting entries are as follow:

| Account | Dr US$ | Cr US$ |

|---|---|---|

| Prepaid Rent | 50,000 | |

| Cash or Bank | 50,000 | |

| (To record prepaid rent payment) |

At the end of each month, the amortization expenses are recorded as follow:

| Account | Dr US$ | Cr US$ |

|---|---|---|

| Amortization Expense – Rent or Rent Expense | 4,166.67 | |

| Prepaid Rent | 4,166.67 | |

| (To record and recognize amortization expense of rental) |

Prepaid Insurance

On 01 January 2019, the accounting entries are as follow:

| Account | Dr US$ | Cr US$ |

|---|---|---|

| Prepaid Insurance | 12,000 | |

| Cash or Bank | 12,000 | |

| (To record prepayment health insurance premium) |

At the end of each month, ABC Co shall record the amortization of insurance as follow:

| Account | Dr US$ | Cr US$ |

|---|---|---|

| Amortization Expense – Insurance or Insurance Expense | 1,000 | |

| Prepaid Insurance | 1,000 | |

| (To record and recognize expense of health insurance premium) |

Prepaid Advertising

On 01 January 2019, the accounting entries are as follow:

| Account | Dr US$ | Cr US$ |

|---|---|---|

| Prepaid Advertising | 15,000 | |

| Cash or Bank | 15,000 | |

| (To record the prepayment of advertising) |

At the end of each month, the adjustment entries to recognize the advertising expense are as follows:

| Account | Dr US$ | Cr US$ |

|---|---|---|

| Amortization Expense – Advertising or Advertising Expense | 1,250 | |

| Prepaid Advertising | 1,250 | |

| (To record and recognize advertising expense) |

Practical Guide to Manage Prepaid Expenses

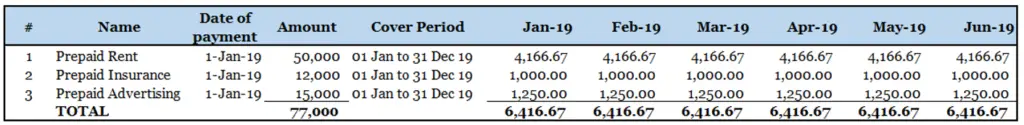

In practice, there are many prepaid items, thus in order to manage those prepayment properly, accountants or bookkeeping staff shall need to maintain a proper prepayment schedule. When they have proper schedule, it will save a lot of time in managing and recording those amortization expenses.

Below are the basic schedule to maintain the prepaid expenses. For illustration purpose, we just show only from Jan to Jun 2019.

You can take the below schedule as the basis and develop your own schedule as per your need.

When we have such schedule, each month we can record the amortization expenses in one transaction together. This way, it will save your time as you will not need to record one by one as per the example above.

Conclusion

In conclusion, accounting for amortization is very important to recognize expenses appropriately when they incur. This is also in line with the matching principle where the expenses should be recognize in period in incur in order to generate revenue.