Large companies work with several divisions and different segments. For publically held companies, the SEC requires them to report profits from each segment or division separately. The profit margins arising from each segment or division are termed as the Segment margin.

What is Segment Margin?

The segment margin is the profit (or loss) arising from one segment or division of a business. The segment can be either a geographical location, subsidiary, a product line, or a particular project.

Once a company can attribute specific costs to a segment, it can then identify revenues generated by that segment. For clarity, the company should only attribute costs and revenues directly linked with the specific segment only. The accuracy of the segment margin will largely depend on the allocation of the costs and revenue stream from each segment.

A company with multiple product lines or geographical presence would need to analyze the profitability of each segment. The overall profitability of the company can be generated from one segment. Without an in-depth analysis, the company may not be able to attribute resources towards the most profit-generating segment.

How to Calculate Segment Margin?

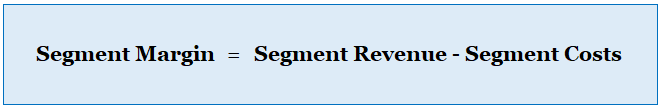

The segment can be calculated as the contribution margin arising from the segment less the fixed costs associated with the segment. Alternatively, it can be calculated directly as the segment revenue less the segment costs. Whereas we should include in the calculation only the variable costs and fixed costs attributable only to the segment.

Formula:

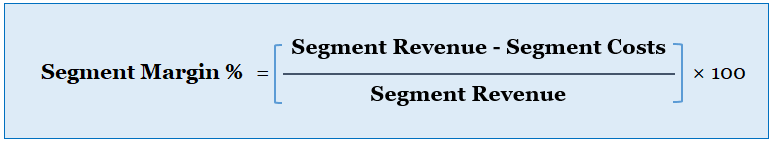

Or we can calculate it in percentage as follows:

Segment Revenues

All sales arising from the particular line of product or the geographical location. For example, sales revenues from a particular branch in one city or item sales in a store.

Sales Costs

This figure will include expenses attributable only to that segment only. The cost of sales for producing the product, or the costs to run the project. The fixed costs that are common with the company or for multiple products should not be included. For example, the machinery cost in a factory producing multiple products should not be included in the calculation. Any other cost directly associated with the segment can be included.

Working Example

Suppose a company ABC co. has several branches in the US. One of its branches produced sales of $ 2.0 million. The costs of sales for products sold in that branch remained $ 1.50 million. The fixed costs for the company’s 5 branches remained at $ 250,000.

We can calculate the segment margin for this branch as follows.

Segment revenue = $ 2.0 million, costs of sales = $ 1.50 million

And segment fixed costs share = (250,000 /5) = $ 50,000

Segment Margin = segment revenue – segment costs

Therefore, Segment Margin = 2,000,000 – 1,550,000 = $ 450,000 or

Hence, Segment Margin % = (450,000/2,000,000) × 100 = 0.225 × 100 = 22.5%

Interpretation and Analysis

Segment margin analysis provides useful information to a company on the profitability of each segment. The company can then allocate resources to profit-generating segments to maximize the total profits. Conversely, it also provides the company with a chance to rectify the inefficiencies in any particular segment with lower profits.

It can be useful in several ways. In multiple product manufacturing, the foremost analysis of this margin will provide each product’s revenue margin separately. The company can also use it for all products but from each branch or franchise. The total revenue for the company may improve due to the high performance of one location or seasonal product demand.

The segment margin analysis is particularly useful for multinational companies. Large firms need to analyze the revenues generated from each international location or region. These companies then formulate policies to improve sales on low-performing locations accordingly.

Segment Margin vs. Contribution Margin

The contribution margin for a company is the total sales revenue less the variable costs. It does not take into account the fixed costs. Whereas the segment margin considers the fixed costs associated with that segment.

The segment margin analysis provides a refined picture for the management as it incorporates a significant portion of fixed costs too. However, for a small project or seasonal products, the fixed costs can be difficult to assign to a particular segment.

Advantages of Segment Margin

Segment margin provides several advantages to the company management when analyzing the overall company profitability. It provides one-step ahead information and builds on traditional methods such as contribution margins.

- The company can analyze the segment margin trends for any division or product line

- Its analysis can be effectively used for product lines, trend analysis, project margins, or multi-location analysis for any company

- It provides useful information to the management of useful segregation of resources to maximize the profits and minimize losses from certain segments

- Segment margin analysis considers relevant fixed costs that provide accurate information on profitability

- The company can utilize the information for benchmarking against the industry standards

- These analyses are useful for internal benchmarking as well

- The listed companies fulfill the compliance regulation from the SEC

In the corporate world, large companies need to report consolidated financial performance to the shareholders. However, with segment margin analyses the shareholders can verify the company performance in each geographical location discretely.

Disadvantages of Segment Margin

The segment margin analysis provides useful information to the company management on segment performance. However, the analysis does also come with some limitations.

- The segregation of fixed costs to each segment can be difficult to allocate accurately

- It will require substantial efforts and time in a large multi-product analysis for margins

- The segment margins in different locations may not be compared on absolute terms as many local economic factors also affect the profitability

- The local management may manipulate the accounting data to maximize the segment sales figures

- Local or segment managers can easily mislead the analysis by dodging the fixed segment costs

Conclusion

The segment margin analysis provides insights on divisional or segment profitability to the management. It can be used for internal or industry benchmarking for performance appraisals. The only limitation with segment analysis is that managers may manipulate figures to increase the short-term profitability. However, the segment margin analyses build on the contribution margin and include the fixed costs to provide even refined information.