Overview

In this article, we will cover the current cash debt coverage ratio. Before jumping to detail of the current cash debt coverage ratio, let’s see the overview , key definition, purpose as well as other areas of such ratio.

When stakeholders of a business analyze the position or performance of the business, they use different ratios. These ratios can give useful information about the business and help the stakeholders in making key decisions regarding their relationship with the business. These stakeholders may include the owners or shareholders of the business or company, any potential investors of the business, its employees, its customers, its suppliers, the government or the general public.

These ratios used by different stakeholders can be classified into many different categories based on their purpose and usage. For example, profitability ratios are ratios that are calculated to analyze the performance of the business. These ratios are mainly related to the Statement of Profit or Loss, also known as the Income Statement, of a business. Profitability ratios include ratios such as the Net Profit Ratio, Gross Profit Ratio, Net Asset Turnover and the Return On Capital Employed ratios.

Similarly, liquidity ratios are ratios that analyze the liquidity position of a business. These are used to determine whether the business has enough current resources to pay off its current liabilities. These ratios are mainly related to the Statement of Financial Position, also known as the Balance Sheet, of a business but can also take some data from the Statement of Profit or Loss. Liquidity ratios include ratios such as Current Ratio, Quick Ratio, Receivables or Payables Collection Period ratios, etc.

Ratios can also be categorized into investors ratios. Investor ratios include ratios that give useful information to potential investors of the company. These ratios generally apply to companies. Any potential investors can use these ratios to find useful information about the earnings, price of shares or dividends paid by the company. These include ratios such as Price to Earnings (P/E) ratio, Earnings Per Share (EPS), Dividend Yield, etc.

Furthermore, coverage ratios are also a category of ratios. Coverage ratios are used to analyze the ability of a business to meet its debt obligations. Coverage ratios include Interest Coverage Ratio, Asset Coverage Ratio, Debt Coverage Ratio, etc. One of the other main coverage ratios is the Current Cash Debt Coverage Ratio.

What is Current Cash Debt Coverage Ratio?

The current cash debt coverage ratio is the ratio of the operating cashflows of a business to its debts. Only current liabilities are taken as debt to calculate this ratio. The ratio signifies how long it would take the business to pay its current liabilities should the business choose to dedicate all its cash flows to debt repayment. However, it is highly unlikely that the business will pay all its current liabilities at once.

Operating cashflows of a business are all its cashflows that are generated due to its operations. The main cashflows from operations for a business include cash received from customer for sales and cash paid to suppliers for purchases. Operating cashflows also payments against expenses of the business. The operating cash flows of a business can easily be obtained from its Statement of Cash Flows, also known as the Cash Flow Statement.

The current liabilities of a business are all its obligations that must be paid within a 12-month period. These include smaller debts of the business such as short-term loans, account payable or trade creditors, taxes payable, accrued expenses, etc. The current liabilities of the business are considered because operating cashflows of a business cannot cover any long-term liabilities of the business entirely. Current liabilities are also considered because they have to be paid within 12-months and the business must have cash readily available or generate enough cashflows to meet these obligations.

Purpose of Calculating Current Cash Debt Coverage Ratio

The current cash debt coverage ratio is used to determine the capability of a business to pay its short-term debts. The ratio is used to evaluate whether the business generates enough cash to pay its current liabilities. As mentioned above, the business needs to have enough cashflows to pay its current liabilities within the next 12-months. If the business does not have enough cash or does not generate enough cash flows to meet those demands, the business may have to obtain long-term loans.

The current cash debt coverage ratio is also used by stakeholders along with other ratios such as the gearing ratio of a company to determine if the risks associated with their stake in the company is at an acceptable level. Investors use it to evaluate the capital structure of a business. If the business is over-reliant on debt or cannot generate enough cashflow to pay their short-term debt obligations, the business is deemed a risky investment.

Other stakeholders, such as financial institutions, use the current cash debt coverage ratio of a business to establish the business’ creditworthiness before granting loans to the business. This ratio can be used by the financial institutions to determine whether the business generates enough cash flow to not only meet its current liability obligations but also have enough cash left to repay the loans being granted to the business.

The current cash debt coverage ratio can give vital information about the coverage and liquidity position of a business. In addition, it can also be used to compare the business’ performance with its historical performances in the same manner. Furthermore, this ratio can be used as a comparison tool to compare the business with its direct competitors, other businesses in the same industry or the industry as a whole.

Interpretation of Current Cash Debt Coverage Ratio

Optimally, the current cash debt coverage ratio should always be above 1. However, practically, this is not the case. The current cash debt coverage ratio can be either above 1 or below 1. The higher the current cash debt coverage ratio of a business, the better it is considered. When the ratio is equal to or above 1, the business is considered liquid enough to pay for its current liability obligations. A current cash debt coverage ratio below 1 is generally not attractive. When the ratio is below 1, it means that the company cannot generate enough cash from its operations to pay off its current liability obligations.

To interpret the current cash debt coverage ratio, it is important to compare it with the current cash debt coverage ratio of either the historical data of the business itself or other companies. While the ratio, on its own, can be interpreted by determining whether it is above, below or equal to 1, for the interpretation to be meaningful, it must be compared with historical ratios of the same business or ratios of other businesses within the same industry. The ratio must not be used to compare businesses from different industries. This is because different industries will have different standards. For example, some industries may not generate the same level of operating cash flows as other industries or some industries may be higher level of current liabilities than others.

Formula

The formula to calculate the current cash debt coverage ratio is as follows:

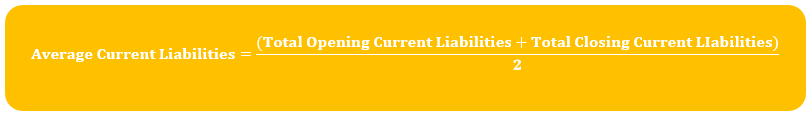

The formula to calculate the average current liabilities of a business is as follows:

Example and Analysis

A company ABC Co. generated a total of $300,000 from its operating activities. Its current liabilities at the beginning of the year amounted to $110,000 while its current liabilities at the end of the year amounted to $130,000. Before calculating the current cash debt coverage ratio of ABC Co., it is important to calculate the average current liabilities of the company using the formula below:

Average Current Liabilities = (Total Opening Current Liabilities + Total Closing Current Liabilities) / 2

= ($110,000 + $130,000) / 2

= $240,000 / 2

= $120,000

Since the average current liabilities of ABC Co. has been established, the current cash debt coverage ratio of the company can be calculated using the following formula:

Current Cash Debt Ratio = Net Cash Generated From Operating Activities / Average Current Liabilities

= $300,000 / $120,000

Hence, Current Cash Debt Ratio = 2.5

This means that the cash ABC Co. generated through its operations can be used to cover its average current liabilities 2.5 times. This result also means that the company is performing exceptionally well in either generating cash flows from its operations or keeping its current liabilities to a minimum. This ratio can also be used to compare ABC Co.’s performance with its historical performances, its competitors, other companies in the same industry or the industrial average as a whole.

Another company, XYZ Co. generated $120,000 from its operations for the year. Its current liabilities at the start of the period amounted to $130,000 while its current liabilities at the end of the year amounted to $150,000. Similar to ABC Co., before calculating the current cash debt coverage ratio of XYZ Co., its average current liabilities should be calculated using the formula:

Average Current Liabilities = (Total Opening Current Liabilities + Total Closing Current Liabilities) / 2

= ($130,000 + $150,000) / 2

= $280,000 / 2

Hence, Average Current Liabilities = $140,000

Once the amount of average current liabilities is established, the current cash debt coverage ratio for the company can be calculated as following:

Current Cash Debt Ratio = Net Cash Generated From Operating Activities / Average Current Liabilities

= $120,000 / $140,000

Hence, Current Cash Debt Ratio = 0.86

From the current cash debt ratio of XYZ Co., it can be established that the company does not have an optimal current cash debt ratio. This means that, theoretically, the company may face problems with paying its current liabilities. This may also mean that XYZ Co. has either not generated enough cash from its operations or it has not controlled its current liabilities properly. However, to narrow down which one of the two options it is, it is necessary to establish which industry XYZ Co. operates in.

Comparatively, it is evident that ABC Co. has outperformed XYZ Co. when it comes to current cash debt coverage ratio. Assuming both the companies operate in the same industry, it can be established that ABC Co. has not only outperformed XYZ Co. in generating cash flows from its operations but also has been able to controll its liabilities better. To analyze even further whether ABC Co. has overperformed or XYZ Co. has underperformed, industrial averages need to be taken and compared with the companies’ results.

Limitation of Current Cash Debt Coverage Ratio

Although the current cash debt coverage ratio is useful, it has some limitations. The biggest limitation of the ratio is that it relies on historical data. Due to its reliance on historical data, the ratio does not reflect the latest liquidity or coverage position of a company. This is mainly due to both the key figures required in calculating the ratio, i.e. operating cash flows and current liabilities, being obtained from the financial statements of a business. This ratio may not, therefore, be appropriate for fast changing business, for instance, startups.

Another limitation of the current cash debt coverage ratio is that it does not cover amortization and lease increments. The ratio assumes that the business will pay its interests and lease payments in the same manner as the past. The terms of interest and lease payments may change in the future and, thus, cost the business more in the future. However, the ratio completely ignores it.

Conclusion

The current cash debt coverage ratio is used to estimate the ability of a business to pay its current liability obligations using its operational cash flows. This ratio is used by different stakeholders of the business to analyze the business’ coverage and liquidity positions. For example, investors can use the ratio to calculate the risks associated with investing in the business. Similarly, financial institutions can use the ratio to establish the creditworthiness of the business before providing a loan to the business. This ratio has some limitations as well, such as relying on historical data and ignoring amortization and lease increments.