Introduction

The first and one of the most important elements in an Income Statement is the Sales or revenue of the company. Manufacturing facilities in particular get affected by the volume of production and corresponding sales. Companies always plan a certain volume of product units to sell in period, achieving that target depends on several factors.

Definition

“The difference between the budgeted or planned number of units to sell and actual sales” is called the sales volume variance.

This change in the sales volume directly affects the profit of the company. Depending on the cost method, the change in the sales volume is multiplied by the profit margin or contribution margin to get the variance amount. The sales volume variance occurs due to a change in the Sales Mix and/or in the sales quantity.

A Sales mix variance occurs when the actual profits deviate from the budgeted profits in a sales mix.

A Sales quantity variance occurs when the actual number of units sold deviate from the budgeted or standard sales.

Both the sales mix and sales quantity variance can be calculated with respect to weighted average profit or the standard profit margin per unit.

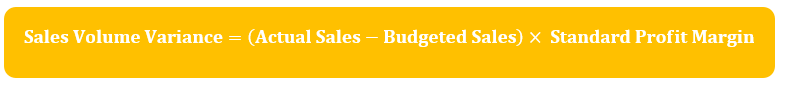

Sales Volume Variance Formula

Sales Volume Variance can be calculated as:

Example

Let’s suppose Techno Blue produces three products with the following details:

| Product | Price | Material | Labor Hours |

| P1 | $ 14 | 3 kg @ 1.80 | 0.5 @ 6.5 |

| P2 | $ 15 | 1.25 @ 3.28 | 0.8 @ 6.5 |

| P3 | $ 18 | 1.94 @ 2.50 | 0.7 @ 6.5 |

The Overheads total $ 85,000 with absorbed at Machine hour rates

Budgeted and Actual Sales and Volumes for the products:

| Product | P1 | P2 | P3 |

| Budgeted Machine Hours | 0.3 | 0.6 | 0.8 |

| Budgeted Sales | 10,000 | 13,000 | 9,000 |

| Budgeted hours: | 3000 | 7800 | 7200 |

| Actual Sale Price | $ 14.50 | $ 15.50 | $ 19.00 |

| Actual Sales | 9,500 | 13,500 | 8,500 |

The Overhead Absorption Rate = 85,000 / 3000 + 7800 + 7200 = $ 4.72

Standard Profit:

| Product | P1 | P2 | P3 |

| Material Cost | 5.4 | 4.1 | 4.85 |

| Labor Cost | 3.25 | 5.2 | 4.55 |

| Overhead cost | 1.42 | 2.83 | 3.78 |

| Total Costs | 10.07 | 12.13 | 13.18 |

| Sale Price | 14.00 | 15.00 | 18.00 |

| Standard Profit | $ 3.93 | $ 2.87 | $ 4.82 |

Weighted average profits:

| Product | P1 | P2 | P3 |

| Standard Profit | $ 3.93 | $ 2.87 | $ 4.82 |

| Budgeted Units | 10,000 | 13,000 | 9,000 |

| 39,300 | 37,310 | 43,380 | |

| Total budget sales | $119,900 |

Weighted Average Profit= 119,900 / 32000 = $3.75

Sales Volume Profit Variance:

| Product | P1 | P2 | P3 |

| Budgeted Units | 10,000 | 13,000 | 9,000 |

| Actual Units | 9500 | 13500 | 8500 |

| Variance in Units | 500 A | 500 F | 500 A |

| Standard Profit | $ 3.93 | $ 2.87 | $ 4.82 |

| Total Variance | $ 1,965 A | $ 1,435 F | $ 2,410 A |

Total Volume Variance = $ 2,940 Adverse

Further Analysis for Sales Mix and Sales Quantity Variances:

| Product | Standard Profit | WA Profit | Difference | Difference in Sale Units | Variance |

| P1 | 3.93 | 3.75 | 0.18 | (500) | $ 90 A |

| P2 | 2.87 | 3.75 | -0.88 | 500 | $ 440 A |

| P3 | 4.82 | 3.75 | 1.07 | (500) | $ 535 A |

Total Sales Mix Variance = $ 1,065 Adverse

Budgeted Total Quantity= 32,000 units

Actual Quantity= 9500 + 13500+8500 = 31500

Difference = (500)

Sales Quantity Variance = 500 × 3.75 = $ 1,875 Adverse

Analysis

As the total sales volume variance is made up of the sales mix and sales quantity variances, it depends on several factors. A favorable variance in one and adverse in the other can offset the numerals but that cannot determine the causes for the variances.

An important way analyzing the sales volume variance is to look at the planning and operational side of the equation.

A Planning variance in the sales compares the original sales budget with the revised budget.

An Operational sales variance compares the actual sales achieved with the original sales budget.

Companies need to revise and adjust budget frequently to achieve the long-term goals. The variance in the original and revised budgets and the variance in Actual and original budgets can form the basis of important decision making process. If the company is unable to manufacture budgeted number of product units it will adversely affect the sales quantity variance that in turn need to be related to either planning or operational sales variance. Pricing decisions are often taken at the beginning of the budget plans; a deviation in the sales mix variance would mean an adjustment in the planning process.

Reasons for Favorable Sales Volume Variance

Several factors can cause a favorable sales volume variance:

- A seasonal rise in products demand or a change in marketing strategy can yield higher sales

- A favorable sales mix variance due to higher sales in one or more profitable products in the mix

- Efficient operations resulting in waste and idle time savings and producing more number of product units

- Flexible and revised budgets to match the actual sales volume

Reasons for Adverse Sales Volume Variance

Similarly, several factors can cause ADVERSE Sales volume Variance:

- Lower sales due to higher prices or decrease in product demand

- Adverse sales mix variance due to low sales in high profitable products in the sales mix

- Increased inefficiencies in operations and idle time causing lower production and lower sales

- Unrealistic standard budgets causing a larger than realistic gap in actual and budgeted sales

Preparing flexible budgets and revising them regularly can close the gap between actuals and standard budgeted sales. Thus, we can see a correlation between better planning and favorable sales volume and sales mix variances. Efficiency in operations, minimum waste and idle time can lead to a favorable operational variance i.e. a favorable total sales volume variance.

Sales Volume Variance and Decision Making

Analyzing variance in sales volume numerically alone can yield no results. Categorizing sales volume variance into planning and operational variances can lead towards increased sales revenue. For example, a fair interpretation of sales mix variance can help management with better utilization of scarce resources for the most profitable products. Similarly, higher pricing strategy in comparison with competitors yielding adverse volume variance can help in better future price planning. Sales volume variance can help management in decision making with:

- Planning efficiency by revising budgets flexibly

- Planning in production output and best utilization of scarce resources (Bottleneck)

- Sales mix can help understand higher profit making products in a mix

- Operational efficiency with eliminating waste and idle time

- Increase production for profitable products and adjust prices with competitors

- Staff motivation and efficiency with relative rewards for achieving favorable sales variances

Managers should only be scrutinized for the variables they can control. For example, idle labor hours can adversely affect the volume production and the overall sales variance. The real cause of labor idle hours can be shortage of raw material that cannot be controlled by the operational managers or the skilled labor. Increased sales volume depend on product quality, right pricing strategy, and production volumes in time. A careful interpretation of the sales variance can lead to a better planning and operational strategy. Modern manufacturing facilities are adapting to the total quality management approach and supply chain relations on JIT approach.

Planning and operational variance studies become increasingly important with stress on continuous improvements. Traditional budgeting and variances analyses were performed annually, modern approached need budgets and controls to be more flexible and adaptive. One important factor causing sales volume variance deviation is the approach towards applying standard profit margin. The sales volume variance can change with cost methods using contribution or profit margins per unit. A uniform and preferred way calculating realistic sales volume variance is to use the weighted average profits. The availability of the standard profit margins depends on the historic data (internal) or the industry standard profit margins (external) information.

Limitations of Sales Volume Variance

Sales volume variance analysis has some disadvantages, particularly in modern manufacturing facilities:

- Variance analysis depend on standards, which become outdated quickly if the products have shorter lifecycle

- Modern firms adapting TQM approach set ideal standards and stress on continuous improvements that needs careful interpretation of the changes in variance

- Standard costs and budget are set for bulk production, customized products with low volume production may not find sales volume variance useful

- Operational managers may find it hard to regularly revise the budgets and get demotivated if their performance is appraised based on sales volume variance

- In fast paced markets, variance analysis may become obsolete as they are performed at the end of the budgeting period.

Conclusion

Sales volume variance analysis can provide useful information to the management about operational and planning strategies. The management needs to interpret the result carefully to identify the actual causes of the variance. Flexible budgets revised often and adjusted with standards can yield favorable sales variance. A total quality management approach with continuous improvements leading towards efficient operations and minimum waste can achieve favorable variance. Sales volume variance can also provide information on profitability of products in a product mix to best utilize the resources.