Future value of a mixed stream cash flow is simple to calculate. It represents the future sum of returns that we will get at the future date.

In this article, we cover the definition of the future value of a mixed stream cash flow, how to calculate it with example calculation as well as how we can generate a future value interest factors table.

So let’s dive in!

What is Future Value of a Mixed Stream Cash Flow?

First, let’s understand some basic definitions of a mixed stream cash flow. A mixed stream cash flow refers to a stream of unequal periodic cash flows over a certain period of time. This type of cash flow has no particular pattern.

In contrast, an annuity refers to the pattern of equal periodic cash flows over a certain period of time.

By now, you understand what a mixed stream cash flow is. So, what is the future value (FV) of a mixed stream cash flows?

The FV of a mixed stream cash flow refers to the sum of the expected future value of a stream of unequal periodic cash flows over a certain period of time at a given interest rate.

How to Calculate the Future Value of a Mixed Stream Cash Flow?

Unlike the future value of an annuity due and the future value of an ordinary annuity, we cannot use the short method to calculate the future value. This is because the cash flow patterns are not equal. Thus, in order to calculate the FV of a mixed stream cash flow, we use a tabular format or an Excel spreadsheet.

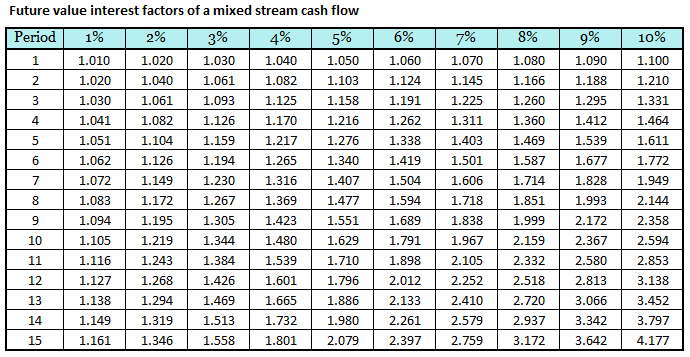

In the tabular format, we need to know the future value interest factors (FVIF). These future value interest factors can be obtained from the future value interest factors table. After we get the future value interest factors of each year at a given interest rate, we just simply multiply each stream of cash flow with the future value interest factors.

Thus, we can summary the formula of the future value of a mixed stream cash flow as follows:

FV of a mixed stream cash flow = C1 × FVIF1 + C2 × FVIF2 + C3 × FVIF3 +……. + Cn × FVIFn

Or we can also rewrite the formula in full as follows:

FV of a mixed stream cash flow = C1 × (1+i)1 + C2 × (1+i)2 + C3 × (1+i)3+ …….. + C1 × (1+i)n

Where:

C = Is each cash flow

i = Interest rate

We can obtain the future value interest factors by looking at the future value interest factors table. Alternatively, we can calculate the future value interest factors for each year at a given interest rate by using the formula below:

FVIFn = (1+i)n

Example

ABC Co expects to receive a mixed stream of cash flow over the next 5 years as follow:

| End of Year | Cash Flow |

|---|---|

| 1 | 10,000 |

| 2 | 11,000 |

| 3 | 15,000 |

| 4 | 12,000 |

| 5 | 16,000 |

ABC Co expects to earn 7% on its investments. So calculate how much would ABC Co receive at the end of 5 years to immediately invest such cash flows?

Solution:

By looking at the future value interest factors table, we can calculate the FV of a mixed stream cash flow as follows:

| Year | Cash flow [1] | Number of years earning interest (n) | FVIF7%, n [2] | Future value [3 = (1) × (2)] |

|---|---|---|---|---|

| 1 | $10,000 | [5 – 1] = 4 | 1.311 | $13,108 |

| 2 | $11,000 | [5 – 2] = 3 | 1.225 | $13,475 |

| 3 | $15,000 | [5 – 3] = 2 | 1.145 | $17,174 |

| 4 | $12,000 | [5 – 4] = 1 | 1.070 | $12,840 |

| 5 | $16,000 | [5 – 5] = 0 | 1.000 | $16,000 |

| FV of mixed stream | – | – | – | $72,597 |

From the tabular calculation above, the FV of mixed stream cash flow is US$72,597. This means that by the end of year 5, ABC Co would have total cash of $72,597 for further investment opportunities.

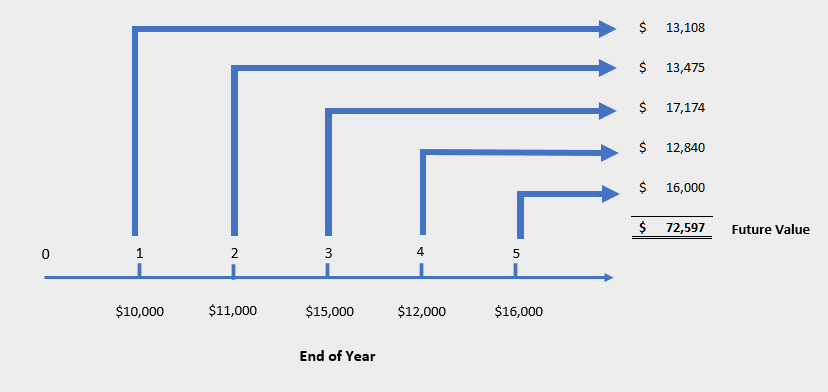

The FV of this mixed stream of cash flow can be depicted as follows:

As you can see, each of the cash flow provides each individual future value at a given interest rate. The sum of these future value of each cash flow is the total future value of mixed stream cash flow that ABC Co can invest.

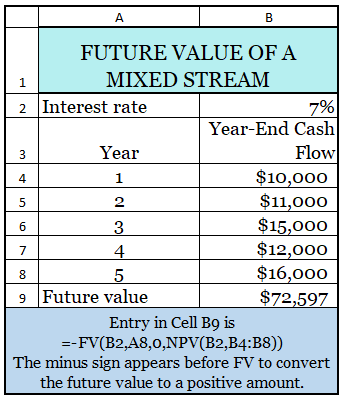

Alternatively, we can also calculate the FV of mix stream cash flow by using Excel Spreadsheets as follows:

From the sample Excel spreadsheet above, the result is the same as the tabular calculation. Thus, whatever methods you use, the FV of the mixed stream is at the same value.

You can use the sample formula above to develop your own calculation.

Future Value Interest Factors Table

The future value interest factors table is commonly used in order to calculate the future value of a mixed stream cash flow. So how to get this table?

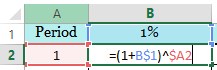

You can generate your own future value interest factors table by using the below formula and then you just need to develop the data table in the Excel Spreadsheets.

FVIFn = (1+i)n

By using the FVIF formula above, you can generate the future value interest factors by simply copy the screenshot formula above and then paste it into each cell so that you will get the future value interest factors the same as above.

Conclusion

The future value of a mixed stream cash flow is simple and easily calculated by using either tabular format or Excel Spreadsheets. In the tabular format, you will need to look at the future value interest factors table.

Additionally, you can also generate your own future value interest factors table by yourself by using the FVIF formula.