Future value (FV) of an annuity due measures the amount of money that you will receive in the future at a given interest rate and timeframe with a certain level of the invested money.

In this article, we cover the definition of the future value of an annuity due as well as how to calculate it using both the future value of an annuity due table and an Excel spreadsheet.

What is Future Value of an Annuity Due?

Before we understand the future value of an annuity due, first, we want to go through the basic definition of an annuity.

Annuity refers to the level of an equal periodic stream of cash flows over a specified period of time both cash inflows and cash outflows. The annuity of cash inflows is the periodic equal return on investment at a given interest rate and timeframe. While the annuity of cash outflows refers to the periodic equal cash outflows of funds invested in order to earn future returns.

Now, you know the basic understanding of annuity. So, next, we will go into detail about the FV of an annuity due with the example calculation.

There are two types of annuities that you should be aware of. These are ordinary annuity and annuity due. An ordinary annuity refers to the annuity with the cash flows occur at the end of each period.

However, for an annuity due, the cash flows occur at the beginning of each period. Thus, the future value of an annuity due refers to the periodic equal future value of cash flows occur at the beginning of each period.

How to Compute the Future Value of An Annuity Due?

In order to calculate the future value of an annuity due, we can simply use the future value interest factors of an ordinary annuity with an annuity due to converting into future value interest factors for an annuity due. Below is the formula to convert this interest factor for an ordinary annuity to future value interest factors of an annuity due:

FVIFA i , n (annuity due) = FVIFA i, n × (1+i)

Then, we can calculate the FV of an annuity due as follows

FVA n = PMT × FVIFA i, n (annuity due)

Where:

FVIFA = Future value interest factors

FVA = Future value of an annuity due

PMT = Periodic or annual cash flows

The basic reason for converting the future value interest factors of an ordinary annuity is that each cash flow of an annuity due earns interest one year more than an ordinary annuity. This is because the annuity due takes into account the interest at the beginning of the period.

Therefore, by multiplying the future value interest factors of an ordinary due by (1+i), that means we add one more year of interest to each annuity cash flow.

Example

Peter is considering two annuities; ordinary annuity and annuity due. Both annuity A and B have five years with yearly cash flows of $1,000 (annuity). The annual interest for these two annuities is 8%. Below table is the summary of the two annuities:

| End of year | Annuity A (Annuity Due US$ | Annuity B (Ordinary Annuity) US$ |

|---|---|---|

| 0 | 0 | 1,000 |

| 1 | 1,000 | 1,000 |

| 2 | 1,000 | 1,000 |

| 3 | 1,000 | 1,000 |

| 4 | 1,000 | 1,000 |

| 5 | 1,000 | 0 |

| Total | 5,000 | 5,000 |

Calculate the FV of an annuity due and ordinary due. Which one provides higher returns at the end of year 5?

Solution:

First, let’s calculate the future value of an annuity due A as follows:

Before we can calculate the FV of an annuity due (A), we need to calculate the future value interest factors of an annuity due by using the below formula:

FVIFA i , n (annuity due) = FVIFA i, n × (1+i)

Where:

FVIFA = 5.867 (From the future value of an ordinary annuity table).

i = 8%

n = 5

Therefore, FVIFA 8%,5 yrs = 5.867 × (1+0.08) = 6.336

So, we can substitute FVIFA of 6.336 into the below formula:

FVA (A) = PMT × FVIFA i, n (annuity due)

Hence, FVA (A) = 1,000 × 6.336 = $6,336.36

Therefore, the FVA (A) = $6,336.36.

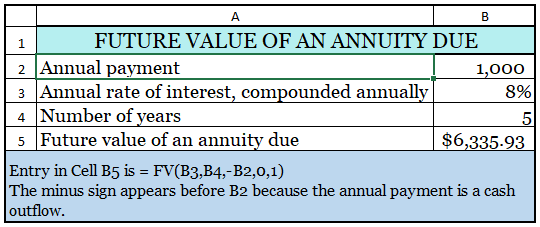

We can also calculate the future value of an annuity due (A) by using the spreadsheet Excel as per the screenshot below:

You can follow the illustration as per the calculation above to develop your own Excel spreadsheet calculation.

The small difference is due to the rounding.

Now, we can calculate the FV of an ordinary annuity B by using the formula below:

FVA (B) = PMT × FVIFA i, n

Where:

FVIFA 8%, 5 yrs = 5.867

Therefore, FVA (B) = 1,000 × 5.867 = $5,867

Hence, the FVA (A) is greater than the ordinary annuity B.

Future Value of an Annuity Due Vs Future Value of an Ordinary Annuity

The FV of an annuity due is always higher than an ordinary annuity. This is because an annuity due gets one year more interest than an ordinary annuity.

As you can see from the calculation above, FVA (A) is $6,336.36 while FVA (B) is only $5,867. FVA (A) is $469 greater than FVA (B).

This is because the cash flow of the annuity due occurs at the start of each period while the ordinary annuity occurs at the end of each period.

How to Get Future Value of an Annuity Due Table?

As you are aware, to get the future value interest factors of an annuity due, we need to multiply the future value interest factors of an ordinary annuity by (1+i). Thus, we need to know the FVIFA of an ordinary first.

Using Future Value of an Ordinary Annuity Table to Convert:

The FVIFA of an ordinary annuity can be taken from the future value of an ordinary annuity table.

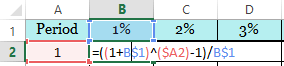

We can generate the future value interest of an ordinary annuity table by using the formula below: FVIFA = ((1+i)n -1)/i

By using the formula above, we can generate the future value of an ordinary due table as below:

You can also see the formula in Excel in order to produce the future value of an ordinary annuity table as follows:

| Period | 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| 2 | 2.010 | 2.020 | 2.030 | 2.040 | 2.050 | 2.060 | 2.070 | 2.080 | 2.090 | 2.100 |

| 3 | 3.030 | 3.060 | 3.091 | 3.122 | 3.153 | 3.184 | 3.215 | 3.246 | 3.278 | 3.310 |

| 4 | 4.060 | 4.122 | 4.184 | 4.246 | 4.310 | 4.375 | 4.440 | 4.506 | 4.573 | 4.641 |

| 5 | 5.101 | 5.204 | 5.309 | 5.416 | 5.526 | 5.637 | 5.751 | 5.867 | 5.985 | 6.105 |

| 6 | 6.152 | 6.308 | 6.468 | 6.633 | 6.802 | 6.975 | 7.153 | 7.336 | 7.523 | 7.716 |

| 7 | 7.214 | 7.434 | 7.662 | 7.898 | 8.142 | 8.394 | 8.654 | 8.923 | 9.200 | 9.487 |

| 8 | 8.286 | 8.583 | 8.892 | 9.214 | 9.549 | 9.897 | 10.260 | 10.637 | 11.028 | 11.436 |

| 9 | 9.369 | 9.755 | 10.159 | 10.583 | 11.027 | 11.491 | 11.978 | 12.488 | 13.021 | 13.579 |

| 10 | 10.462 | 10.950 | 11.464 | 12.006 | 12.578 | 13.181 | 13.816 | 14.487 | 15.193 | 15.937 |

| 11 | 11.567 | 12.169 | 12.808 | 13.486 | 14.207 | 14.972 | 15.784 | 16.645 | 17.560 | 18.531 |

| 12 | 12.683 | 13.412 | 14.192 | 15.026 | 15.917 | 16.870 | 17.888 | 18.977 | 20.141 | 21.384 |

| 13 | 13.809 | 14.680 | 15.618 | 16.627 | 17.713 | 18.882 | 20.141 | 21.495 | 22.953 | 24.523 |

| 14 | 14.947 | 15.974 | 17.086 | 18.292 | 19.599 | 21.015 | 22.550 | 24.215 | 26.019 | 27.975 |

| 15 | 16.097 | 17.293 | 18.599 | 20.024 | 21.579 | 23.276 | 25.129 | 27.152 | 29.361 | 31.772 |

Then, to get the future value interest factors of an annuity due, we just simply convert the data in the table above by multiplying with (1+i).

Generate the Future Value of an Annuity Due Table Directly:

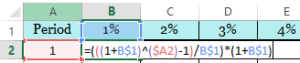

We can also generate the future value of an annuity due table directly as well by using the formula below:

FVIFA of an annuity due = [((1+i)n -1))/i] × (1+i)

Therefore, by using the formula above, we can produce the future value of an annuity due table as below:

| Period | 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.010 | 1.020 | 1.030 | 1.040 | 1.050 | 1.060 | 1.070 | 1.080 | 1.090 | 1.100 |

| 2 | 2.030 | 2.060 | 2.091 | 2.122 | 2.153 | 2.184 | 2.215 | 2.246 | 2.278 | 2.310 |

| 3 | 3.060 | 3.122 | 3.184 | 3.246 | 3.310 | 3.375 | 3.440 | 3.506 | 3.573 | 3.641 |

| 4 | 4.101 | 4.204 | 4.309 | 4.416 | 4.526 | 4.637 | 4.751 | 4.867 | 4.985 | 5.105 |

| 5 | 5.152 | 5.308 | 5.468 | 5.633 | 5.802 | 5.975 | 6.153 | 6.336 | 6.523 | 6.716 |

| 6 | 6.214 | 6.434 | 6.662 | 6.898 | 7.142 | 7.394 | 7.654 | 7.923 | 8.200 | 8.487 |

| 7 | 7.286 | 7.583 | 7.892 | 8.214 | 8.549 | 8.897 | 9.260 | 9.637 | 10.028 | 10.436 |

| 8 | 8.369 | 8.755 | 9.159 | 9.583 | 10.027 | 10.491 | 10.978 | 11.488 | 12.021 | 12.579 |

| 9 | 9.462 | 9.950 | 10.464 | 11.006 | 11.578 | 12.181 | 12.816 | 13.487 | 14.193 | 14.937 |

| 10 | 10.567 | 11.169 | 11.808 | 12.486 | 13.207 | 13.972 | 14.784 | 15.645 | 16.560 | 17.531 |

| 11 | 11.683 | 12.412 | 13.192 | 14.026 | 14.917 | 15.870 | 16.888 | 17.977 | 19.141 | 20.384 |

| 12 | 12.809 | 13.680 | 14.618 | 15.627 | 16.713 | 17.882 | 19.141 | 20.495 | 21.953 | 23.523 |

| 13 | 13.947 | 14.974 | 16.086 | 17.292 | 18.599 | 20.015 | 21.550 | 23.215 | 25.019 | 26.975 |

| 14 | 15.097 | 16.293 | 17.599 | 19.024 | 20.579 | 22.276 | 24.129 | 26.152 | 28.361 | 30.772 |

| 15 | 16.258 | 17.639 | 19.157 | 20.825 | 22.657 | 24.673 | 26.888 | 29.324 | 32.003 | 34.950 |

Conclusion

To sum up, the future value of an annuity due is a future stream of equal periodic cash flows occurs at the beginning of each period. It provides a higher future return as compare to the future value of an ordinary annuity.