In the previous article, we have covered the future value of an annuity due. In this article, we cover the future value (FV) of an ordinary annuity. This includes the key definition, how to calculate it as well as how to generate the future value of an ordinary annuity table.

So let’s dive in!

What is Future Value of an Ordinary Annuity?

The future value of an ordinary annuity refers to the future returns of periodic equal cash flows that occur at the end of each period. This future return comes from the sum of compound interest of each cash flow of invested funds at the end of the lifetime of such annuity.

How to Calculate Future Value of an Ordinary Annuity?

In order to calculate the future value of an ordinary annuity, we can simply use the FV interest factors of an ordinary annuity multiply with the annuity of cash flow. Below is the FV of an ordinary annuity formula:

FVA= PMT × FVIFA i, n

Where:

PMT = Periodic cash flow of annuity

FVIFA = FV interest factors of an ordinary annuity

i = Annual nterest

n = Number of years

In the above formula, we need to have the future value of an ordinary table to find the FV interest factors of ordinary annuity.

We can break it down into detail formula as below:

FVA = PMT × [((1+i)n -1) /i]

Where:

[((1+i)n -1) /i] is the detail of FV interest factors of an ordinary annuity.

We can also calculate the future value of an ordinary annuity by using the Excel spreadsheets. In the below section, we will give an example of how to calculate the FV of an ordinary annuity by using both the above formula and Excel Spreadsheets.

Example

Suppose Peter is considering investing in an ordinary annuity of 5 years for $1,000 each. This annuity has an annual compound interest of 8% and he wants to know how much he would get at the end of year 5.

Calculate the FV of ordinary annuity above.

We can calculate the FV of ordinary annuity above in three different ways as mentioned above.

The first calculation is by looking at the future value of an ordinary annuity table and then substitute the FV interest factors of an ordinary annuity into the formula.

FVA= PMT × FVIFA i, n

Where:

PMT = $1,000

FVIFA 8%, 5 Yrs = 5.867 (As per the future value of an ordinary annuity table)

Thus, FVA = 1,000 × 5.867 = $5,867

In the second formula, we need to use the financial calculator.

FVA = PMT × [((1+i)n -1) /i]

Where:

PMT = $1,000

i = 8%

n = 5 years

Therefore, FVA = 1,000 × [((1+0.08)5 -1) /0.08] = $5,867

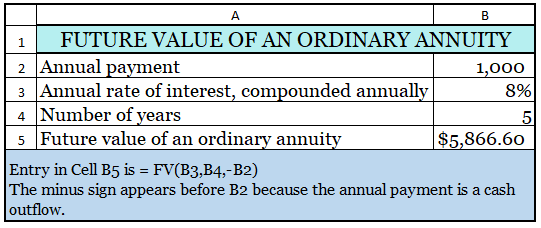

In the third method, we can calculate the FV of an ordinary annuity by using Excel spreadsheet as follows:

The table above provides an illustration of how to can calculate the FV of an ordinary annuity by using Excel spreadsheets. So you can look at the Excel formula at the bottom of the table.

As you can see, the three methods above provide the same amount of the future returns of the ordinary annuity. Thus, you can use any methods of convenience for you.

How to Generate Future Value of an Ordinary Annuity Table?

We can generate the future value of an ordinary annuity table by using the formula below:

FVIFA = ((1+i)n -1)/i

By using the formula above, we can generate the future value of an ordinary due table as below:

| Period | 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| 2 | 2.010 | 2.020 | 2.030 | 2.040 | 2.050 | 2.060 | 2.070 | 2.080 | 2.090 | 2.100 |

| 3 | 3.030 | 3.060 | 3.091 | 3.122 | 3.153 | 3.184 | 3.215 | 3.246 | 3.278 | 3.310 |

| 4 | 4.060 | 4.122 | 4.184 | 4.246 | 4.310 | 4.375 | 4.440 | 4.506 | 4.573 | 4.641 |

| 5 | 5.101 | 5.204 | 5.309 | 5.416 | 5.526 | 5.637 | 5.751 | 5.867 | 5.985 | 6.105 |

| 6 | 6.152 | 6.308 | 6.468 | 6.633 | 6.802 | 6.975 | 7.153 | 7.336 | 7.523 | 7.716 |

| 7 | 7.214 | 7.434 | 7.662 | 7.898 | 8.142 | 8.394 | 8.654 | 8.923 | 9.200 | 9.487 |

| 8 | 8.286 | 8.583 | 8.892 | 9.214 | 9.549 | 9.897 | 10.260 | 10.637 | 11.028 | 11.436 |

| 9 | 9.369 | 9.755 | 10.159 | 10.583 | 11.027 | 11.491 | 11.978 | 12.488 | 13.021 | 13.579 |

| 10 | 10.462 | 10.950 | 11.464 | 12.006 | 12.578 | 13.181 | 13.816 | 14.487 | 15.193 | 15.937 |

| 11 | 11.567 | 12.169 | 12.808 | 13.486 | 14.207 | 14.972 | 15.784 | 16.645 | 17.560 | 18.531 |

| 12 | 12.683 | 13.412 | 14.192 | 15.026 | 15.917 | 16.870 | 17.888 | 18.977 | 20.141 | 21.384 |

| 13 | 13.809 | 14.680 | 15.618 | 16.627 | 17.713 | 18.882 | 20.141 | 21.495 | 22.953 | 24.523 |

| 14 | 14.947 | 15.974 | 17.086 | 18.292 | 19.599 | 21.015 | 22.550 | 24.215 | 26.019 | 27.975 |

| 15 | 16.097 | 17.293 | 18.599 | 20.024 | 21.579 | 23.276 | 25.129 | 27.152 | 29.361 | 31.772 |

Conclusion

To sum up, the future value of an ordinary annuity is the future returns of periodic equal cash flows occur at the end of each period. We can calculate the future returns of such annuity by using the future value of an ordinary table, the detail formula as well as in Excel spreadsheets. All these methods provide the future returns of the ordinary annuity.