Every investment come with risk associated with them. Some of them might be diversifiable and some others might be nondiversifiable. Nondiversifiable risk of an investment or security typically incurs as a result of not being able to diversify through multiple portfolio.

In this article, we cover the nondiversifiable risk associated with investment or security including all components of risk under the Capital Asset Pricing Model (CAPM). We also illustrate how we use the Beta which is a relative measure of nondiversifiable risk to calculate the required rate of return using the CAPM.

So let’s get started!

What is Nondiversifiable Risk?

Nondiversifiable risk is also commonly called systematic risk. It is a risk of not being able to eliminate through diversification. Nondiversifiable risk is a risk that is attributable to market factors such as war, inflation, international incidents, and political events that affect all firms.

Nondiversifiable risk is one component of the total risk of investment or security. Theoretically, total risk equals the sum of diversifiable and nondiversifiable risks. Diversifiable risk is also called unsystematic risk. Unlike nondiversifiable risk, diversifiable risk is the risk that can be eliminated by investing in a diversify portfolio.

Below is the formula of the relationship between nondiversifiable risk and diversifiable risk as well as the total risk of security:

Diversifiable vs Non-Diversifiable Risk

As mentioned above, nondiversifiable risk or systematic risk refers to the risk that is inescapable or cannot be eliminated through diversification of the portfolio. This ranges from economic to political risks. The economic risks here refer to the foreign exchange risk, inflation, interest rate fluctuation, and economic cycle downturn, etc…

Whereas political risks refer to the tax reform, foreign trade policy, trade tariffs, spending, and any other changes in legislation.

In contrast, diversifiable risk or unsystematic risk refers to the risk of investment or security that we can eliminate or escape through diversification. By holding a diversified portfolio, investors can reduce risk or virtually eliminate it. Typically, according to the study so far, investors can eliminate the most diversifiable risk by carefully choosing a portfolio of 8 to 15 securities.

Beta: A Popular Measure of Risk

There are two components that measure the relationship between risk and return. These are Beta (β) and the capital asset pricing model (CAPM). Beta or beta coefficient is a relative measure of nondiversifiable risk or market risk. It indicates how sensitive the price of security is in response to the market forces. The more responsive the price of security in relation to the changes in the market, the higher the beta of such security. Theoretically, we use beta combine with the CAPM to estimate the return of an asset or investment.

CAPM is developed by two finance professors, William F. Sharpe and John Lintner. This model uses beta to link the risk and return of an asset or investment.

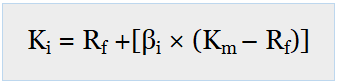

The CAPM model is written into the equation as follows:

Where:

Ki = required rate of return on investment (i)

Rf = risk-free rate of return. This is commonly measured by the return on the U.S Treasury bill

βi = beta coefficient or index of nondiversifiable risk for investment (i)

Km = expected market return of market portfolio assets

In the CAPM model, there are two main components; risk-free rate and risk premium. The risk-free rate is Rf which is measured by the return of the U.S Treasury bill. While risk premium equal (Km – Rf). This risk premium refers to the return that investors demand beyond the risk-free rate in order to compensate for the nondiversifiable risk of an investment.

From the above formula, the higher the beta, the higher the risk premium thereby the required rate of return will be higher.

Now let’s go through 3 different betas to calculate the required rate of return.

How to Use Beta to Calculate the Required Rate of Return

Assume that security (a) has a beta of 1.3 and the risk-free rate is 5% while the market return is 10%. Thus, what is the required rate of return of security (a)?

Following the equation above, we can calculate the required rate of return of security (a) as follows:

Ki = Rf +[βi × (Km – Rf)]

Where:

Rf = 5%

βi = 1.3

Km = 10%

Therefore, K(a) = 5% +[1.3 × (10% – 5%)]

K(a) = 5% + 6.5% = 11.5%

Now let’s assume that beta is 1.4 instead of 1.3. Therefore, we can calculate the required rate of return as follows:

K(a) = 5% +[1.4 × (10% – 5%)]

K(a) = 5% + 7% = 12%

Finally, if the beta is 1.5, what is the new required rate of return of security (a)?

The new required rate of return of security (a) is as follows:

K(a) = 5% +[1.5 × (10% – 5%)]

K(a) = 5% + 7.5% = 12.5%

From the above example, the higher the beta, the higher the required rate of return.

Relationship between Diversification and Portfolio Risk

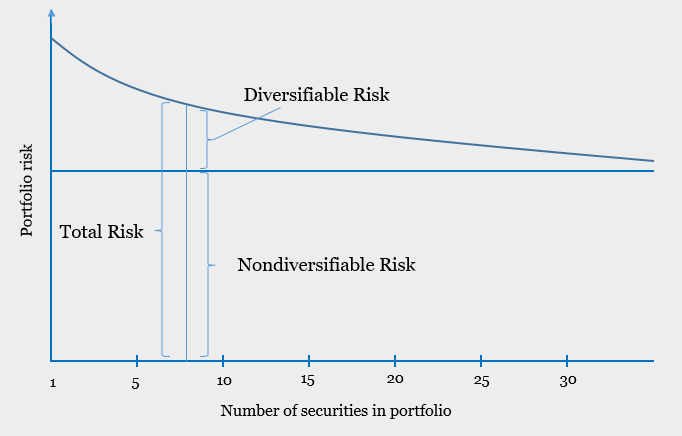

Theoretically, the more securities combined in a portfolio, the total risk of such portfolio will be declined. This total risk here is measured by the standard deviation which is a key measured of risk of an asset. The portion of the risk eliminated is the diverifiable risk; however, the portion of nondiversifiable risk remained unchanged. This means that the nondiversifiable risk cannot be elimination through diversified portfolio.

This represents by the portfolio risk and diversification graph as follows:

As you can see, when there are more securities in the portfolio, the diversifiable risk decline whereas nondiversifiable risk remains the same regardless of diversification.

Conclusion

Nondiversifiable risk is a type of risk that cannot be eliminated by diversification. It is represented by Beta. Beta which is a relative measure of nondiversifiable risk is used with the CAPM model to calculate the required rate of return of a security. The higher the beta (risk), the higher the required rate of return.