In this article, we cover the degree of total leverage. This includes the key definition, how to calculate the degree of total leverage as well as example and analysis. Before, jumping into detail, let’s understand some key relevant definitions.

Table of contents

Definition

Let’s understand some key definition of total leverage as well as the degree of total leverage (DFL).

What is Total Leverage?

Total Leverage is defined as the potential use of fixed costs both operating and financial to magnify the effect of changes in sales on a firm’s earnings per share (EPS). Basically, the total leverage is concerned with the relationship between the firm’s sales revenue and earnings per share (EPS).

What is Degree of Total Leverage?

Degree of Total Leverage (DTL) is also known as the degree of combined leverage (DCL).

The degree of total leverage (DTL) is the numerical measure of the firm’s total leverage.

Similarly to the degree of operating leverage and the degree of financial leverage, DTL also represents the changes of two variables. These are the percentage change in earnings per share (EPS) and percentage change in sales revenue.

How to Calculate the Degree of Total Leverage (DTL)?

The degree of total leverage can be calculated by dividing the percentage change in earnings per share (EPS) and the percentage change in sales revenue.

Below is the formula that we can use to calculate the DTL:

Degree of Total Leverage (DTL) = Percentage change in EPS/ Percentage change in Sales

Or alternatively, we can calculate the DTL at a given level sales as follow:

DTL at base sales level Q = [Q × (P – VC)]/ [Q × (P – PC) – FC – I – (PD × (1/ (1 – T))]

Where:

Q = Base level of sales

P = Sales price

VC = Variable costs

FC = Fixed costs

I = Interest on debt

PD = Preferred stock dividend

T = Tax rate

We can also calculate the DTL by taking into account for both degree of operating leverage and degree of financial leverage. The formula is as follow:

DTL = DOL × DFL

Example

ABC Co, a computer part manufacturing, expects its sales for the coming year of 20,000 units. The sales price is at $5 per unit. To reach this sales level, ABC Co must meet the following obligations:

- The variable operating costs per unit is at $2

- The fixed operating costs is at $10,000

- Interest expense is $20,000

- The preferred stock dividend for the year is $12,000

ABC Co pays tax at 40% of its profits. Currently, the company has common shares outstanding for 5,000 shares.

Calculate the degree of total leverage of ABC Co assuming that the level of sales would increase 50% on current expected sales.

Solution

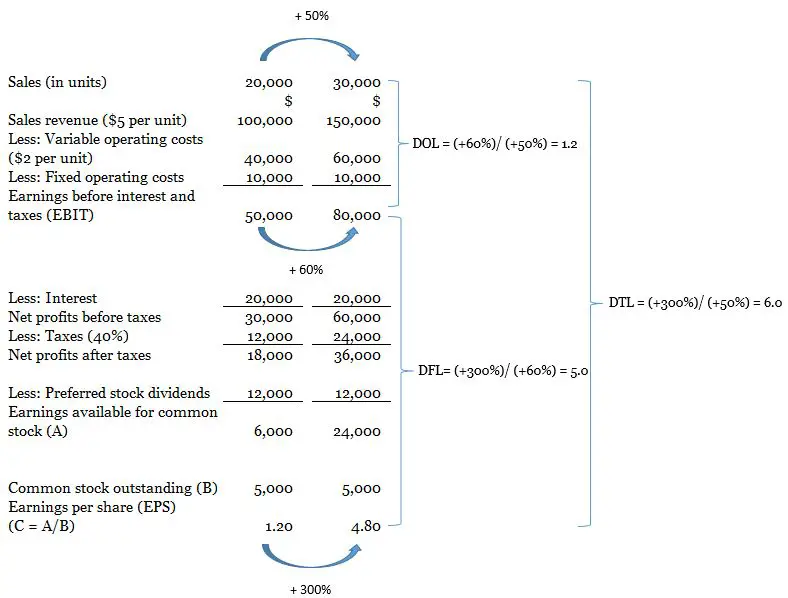

In the calculation below, we will illustrate the calculation of degree operation leverage, degree of financial leverage and the degree of total leverage.

Below are the relevant formula for each degree of leverage:

DOL = Percentage change in EBIT/Percentage change in sales revenue

DFL = Percentage change in EPS/ Percentage change in EBIT

DTL = Percentage change in EPS/ Percentage change in Sales

Based on the information above, we can summary the financial data as per the table below:

As you can see from the illustration above, the degree of total leverage is 6.0.

We can also calculate the degree of total leverage by multiplying the degree of operating leverage and the degree of financial leverage as per the formula below;

DTL = DOL × DFL

From the table above, we have the following:

DOL = 1.20

DFL = 5.0

Therefore, DTL = 1.20 × 5.0 = 6.0

Alternatively, we can calculate the DTL of a given sales level of 20,000 units as per the formula below:

DTL at base sales level Q = [Q × (P – VC)]/ [Q × (P – PC) – FC – I – (PD × (1/ (1 – T))]

Where:

Q = 20,000 units

P = $5 per unit

VC = $2 per unit

FC = $10,000

I = $20,000

PD = $12,000

T = 40%

Thus, we can calculate the DTL as follow:

DTL = [20,000 × ($5 – $2)]/ [20,000 × ($5 – $2) – $10,000 – $20,000 – ($12,000 × (1/ (1 – 0.4))]

DTL = $60,000/$10,000 = 6.0

All the formula above give the same result with is at 6.0.

Interpretation and Analysis

The effect of total leverage results from the changes in the firm’s EPS over the sales revenue.

Typically, the total leverage exists when the percentage change in earnings per share (EPS) as a result of the percentage change in sales revenue is greater than the percentage change in sales revenue or it is greater than 1.

In the cases above, since the DTL is greater than 1, thus total leverage does exist. The higher the value as calculated in both cases above, the greater the degree of total leverage.

The calculation of this second formula is a more direct method of calculating the DTL of a given base level of sales revenue. It is probably is easier formula to calculate with considering the changes in both EPS and sales revenue.

The degree of total leverage (DTL) reflects the combined impact of both the degree of operating leverage and the degree of financial leverage. Therefore, the higher the DOL and DFL will result in a higher of DTL. The combined leverage here does not refers to the addition between DOL and DFL. However, it refers to the multiplication between the two leverages as you can see in the last formula we illustrated above.

Conclusion

The degree of total leverage is an important indicator to measure the relative changes of EPS compare to changes in sales revenue.

The value of the calculation greater than 1 indicates that there is greater degree of total leverage.