In order to calculate the value of common stock, we first need to know the cost of common stock equity. In this article, we cover how to calculate the cost of common stock equity by using two common models. These are the constant-growth valuation model and the capital asset pricing model.

Now let’s get started!

What is the Cost of Common Stock Equity?

The cost of common stock equity is the return that investors required on common stock in the marketplace. It is the rate at which the expected dividends are discounted in order to determine its share value.

Theoretically, there are two forms of common stock financing; financing from retained earnings and from the new issue of common stock. Each of these sources of financing has its own cost.

How to Calculate the Cost of Common Stock Equity?

In order to calculate the cost of common stock equity, there are two common models or techniques that we can use. These are the constant-growth valuation model or the Gordon Model and capital asset pricing model (CAPM).

Using Constant-Growth Valuation Model (Gordon Model)

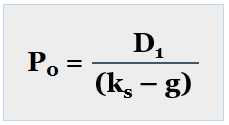

In the constant-growth model, we assume that the growth rate remains constant. Thus, the value of a common stock equals the present value of all future dividends that investors expect over an indefinite time. Therefore, in this model, the value of common stock is derived from the formula as follows:

Where:

P0 = value of common stock

D1 = Dividend which is expected at the end of year 1

ks = required return of common stock

g = the constant growth of dividend

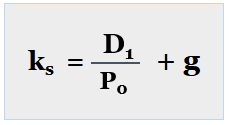

From the above formula, we can calculate the cost of common stock equity by solving the above equation to take ks as follow:

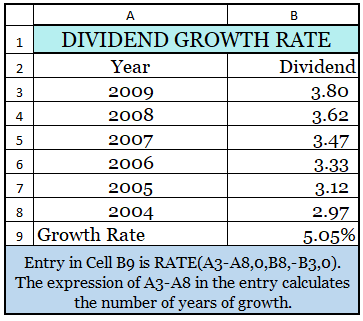

The growth rate can be calculated by using the formula below:

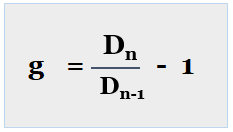

We can also calculate the dividend growth rate in Excel Spreadsheet. We will illustrate how to calculate the growth rate in Excel Spreadsheet in the later section below.

Example

ABC Corporation is determining its cost of common stock equity. Currently, its price of common stock is $50 per share. The company expects to pay a dividend D1 of $4 at the end of the coming year, 2010. Below is the historical dividends from 2004 to 2009:

| Year | Dividend |

|---|---|

| 2009 | 3.80 |

| 2008 | 3.62 |

| 2007 | 3.47 |

| 2006 | 3.33 |

| 2005 | 3.12 |

| 2004 | 2.97 |

Calculate the cost of common stock equity.

By using the above formula, we can calculate the cost of common stock equity as follows:

Ks = (D1/P0) + g

Where:

D1 = $4

P0 = $50

Now let’s calculate the dividend growth rate first.

We can calculate the dividend growth rate by using the above formula year by year and then do the average to get the average growth rate from the year 2004 to 2009. This is illustrated below:

g = (Dn//Dn – 1) – 1

| Year | Dividend | Growth Rate |

|---|---|---|

| 2009 | 3.80 | 4.97% |

| 2008 | 3.62 | 4.32% |

| 2007 | 3.47 | 4.20% |

| 2006 | 3.33 | 6.73% |

| 2005 | 3.12 | 5.05% |

| 2004 | 2.97 | |

| Average Growth Rate | 5.06% |

Alternatively, we can calculate the dividend growth rate in Excel Spreadsheet as follows:

From the dividend growth rate for both methods above, we can round it down to 5% for the cost of common stock equity calculation purposes.

Therefore, by substituting the P0, D1, and g above in the formula, we get the cost of common stock equity as follows:

Ks = (4/50) + 5% = 13%

Therefore, the required return on the common stock equity is 13%. If the actual return is less than that required return, shareholders will likely to sell their shares of common stock.

Using the Capital Asset Pricing Model (CAPM)

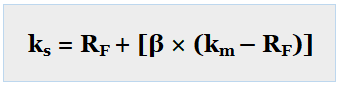

In the capital asset pricing model, it describes the relationship between the required rate of return and the nondiversifiable risk of a firm which is measured by the beta coefficient. Below is the CAPM model formula:

Where:

ks = required return of common stock

RF = risk-free rate

β = beta coefficient

km = market return

In the CAPM model, the cost of common stock equity is the required rate of return that investors expect as compensation for the firm’s nondiversifiable risk which is measured by the beta coefficient.

Example

Let’s assume that ABC Corporation wants to calculate its cost of common stock equity by using the capital asset pricing model. The risk-free rate is 7% while the beta is 1.5. In addition, the market return is 11%. Calculate the cost of common stock equity.

By substituting the relevant data into the formula of the capital asset pricing model above, we can calculate the cost of common stock equity as follows:

ks = RF + [β × (km – RF)]

Where:

RF = 7%

β = 1.5

km = 11%

Hence, ks = 7% + [1.5 × (11% – 7%)]

Ks = 7% + 6% = 13%

Therefore, the cost of common stock equity under the CAPM model is 13%. This represent the required return of investors of ABC Corporation on their common stock.

Constant-Growth vs CAPM Techniques

Even though both models can be used to calculate the cost of common stock equity; however, there are a number of differences.

The CAPM model directly considers the firm’s risk; nondiversifiable risk which is represented by beta, in order to calculate the required rate of return of common stock equity. Unlike the CAPM model, the constant-growth valuation model does not look at the risk. Instead, we use the market price of P0 as a reflection of expected risk.

In the constant-growth valuation model, it is easy to adjust the flotation cost to find the cost of new common stock equity. In contrast, the CAPM does not have any mechanism to make such adjustments. This is because there is no market price of P0 is used in the CAPM.

Last but not least, even though these two models can theoretically be used to calculate the cost of common stock equity, it is difficult to demonstrate the equivalency of cost of common stock equity under each method. This is because there are a number of measurement problems associated with the beta, growth rate, market return, and the risk-free rate.

Given some problems and limitations under the CAPM, the constant-growth model is the preferred method in calculating the cost of common stock equity.

Conclusion

To sum up, the cost of common stock equity can be calculated by using the constant-growth and CAPM models. However, the constant growth valuation model is a preferred method because it allows to have some adjustment on flotation cost, and most information required in order to calculate the cost of common stock equity is easily available.