The activity-based depreciation method of assets takes into account the output of assets. It mainly differs from other methods of depreciation on the very nature of the cost spreading method. Other depreciation methods consider time as the main cost spreading factor. The activity-based depreciation method considers the number of units or the output from the asset.

What is Activity Based Depreciation Method?

The activity-based or unit of product depreciation method is the method of calculating depreciation based on the units of output. Simply put, it takes into account the value addition life of the asset rather than just time-lapse.

The unit of production or activity-based method results in varying depreciation amounts over the useful life of the assets. Some seasonal demands for higher productions can also affect the output units, hence affecting the depreciation amount charged.

Analysis and Comparison with Other Depreciation Methods

The activity-based depreciation method takes a contradictory approach from other methods of depreciation. It focuses on the usefulness of the asset rather than spreading the costs of assets over time. Large and tangible assets such as plants and machinery go through cyclic lives with fluctuating usage. These assets incur higher maintenance costs with higher usage. The activity-based depreciation allows businesses to match these higher costs against the usage level of the asset.

The output level from any asset directly relates to the expenses incurred in production. The profitability levels fluctuate with different levels of the activities too. As with activity-based costing, the depreciation method connects the profitability with asset activities. The yearly profits and costs can be really spread out based on the actual performance and utility of the underlying assets.

The formula for Activity Based Depreciation

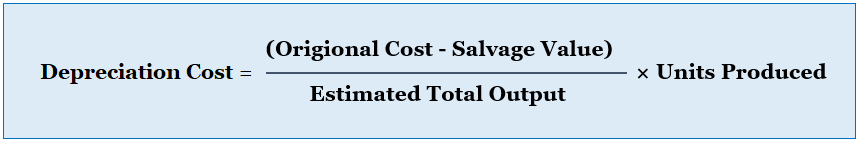

As the name suggests, the main component in calculating depreciation under this method is the units of production. The cost accountants need to estimate the full useful potential of the asset first. They can then allocate the output units on a production basis.

Formula:

The estimated total output from the asset/machinery can be taken from the historical records for the same asset. The units produced will be for the calculation of depreciation cost period, usually on yearly basis.

Working Example

Suppose a company Green Star purchases a small food processing machine for $ 130,000. The Machine comes with an estimated output of 1 million units over the useful life. The company estimates its salvage value to be $15,000 only.

We can calculate the depreciation cost on the actual results of unit production. Suppose the machine produced 150,000 units for the first year.

Depreciation Cost = (130,000 – 15,000)/ (1,000,000) × (150,000)

Depreciation Cost = (0.155) × (150,000) = $ 17,250.

Under the activity-based depreciation method, it is possible to calculate the deprecation cost on a per-unit basis. As in our example, per unit depreciation can be estimated to be 0.155. This per unit or per activity depreciation charge can then be used against the actual volume of units produced.

The depreciation charge under this method will remain the same as it only takes into account the already assumed figures. The varying output units will change the depreciation cost until the full asset value is recovered.

When Should We Use Activity-Based Depreciation Method?

The best use of the activity-based depreciation can be in a situation where the assets are utilized on calculable outputs. Usually, the manufacturing and processing businesses will prefer the unit of production depreciation method.

As in activity-based costing, the Activity depreciation method changes the cost behavior with the fluctuating output. In many production facilities, businesses have to manage additional costs after an increased volume such as additional labor, supervisors, and energy costs, etc. The Activity-Based Depreciation allows businesses to recover higher costs when the production levels increase after a certain limit.

Let us consider our working example above. If the company produces up to 150,000 units per year, it does not hire any other labor and supervisors. However, if the production levels reach 250,000 units in the next year, the company may need to hire additional labor, energy, and supervisor. The additional costs will then be offset against a higher depreciation cost (0.155 × 250,000 = $ 38,750). The depreciation charge under the straight-line depreciation method would have remained the same even with higher production and higher costs.

The Activity-Based Depreciation Method is useful for:

- Businesses with tangible assets over changing levels of activity

- Businesses adopting the matching principles of costs and productions

- Any businesses adapting to the Activity Based Costing

- Any businesses with seasonal demands and varying levels of production

- Assets with easily identifiable useful life and output

- Can also be used for tangible assets with short useful life under one year (partial year depreciation)

Limitation of Activity Based Depreciation Method

As with other depreciation methods, this method also comes with certain limitations.

The activity-based depreciation methods:

- Can only be used where the useful output of assets is possible to estimate

- As with any other depreciation method, it also works on estimations

- It can be hard to allocate the depreciation costs against the intangible assets

- The depreciation method does not offer useful insights for many industries such as in real estate or the service sector

- Companies cannot charge depreciation expenses until the asset is utilized up to a significant level

- The total output levels from an asset can be hard to estimate

- It ignores the time-lapse and diminishing salvage value of assets

For some industries like manufacturing or transportation, the fluctuating levels of output incur different costs. Many industries such as real estate do not incur changing output levels over time. Hence the activity-based depreciation method cannot be uniformly applied across all industries.

Conclusion

The activity-based depreciation method provides useful cost matching for businesses with varying output levels. The method links the costs of assets with their output levels over time. However, in many cases, it can be difficult to estimate the total useful output rather than the useful life of assets over time.