In previous article, we have covered the definition of depreciation expense of property plant and equipment (PPE) as well as other fixed assets and the basic understanding on types of depreciation methods. In this article, we will further explain in detail of each type of depreciation method including the calculation, when to use it as well as the advantages and disadvantages of each methods.

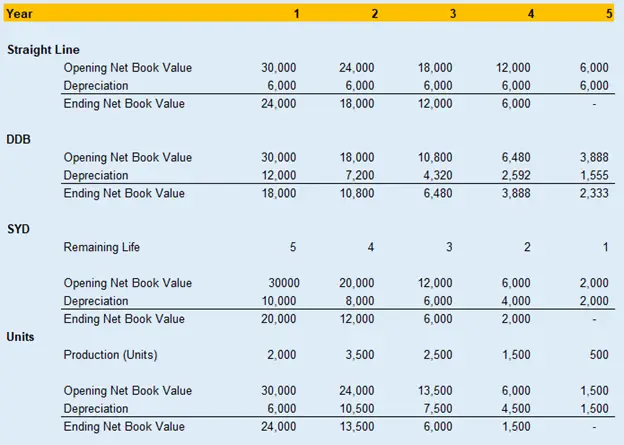

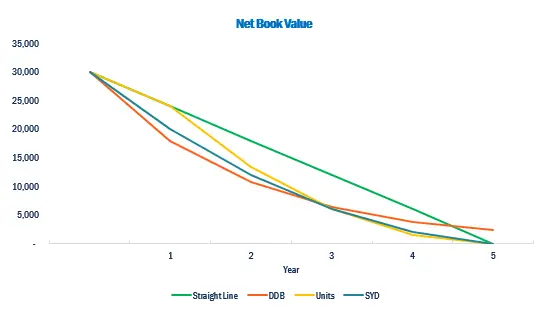

As mentioned in previous article, there are four main types of depreciation methods namely Straight- Line, Double Declining, Sum of the Years digits (SYD) and Units of Production methods and its usage is difference from one asset type to another.

Straight-Line Method (SL)

Straight-Line method is very simple and common method of calculating depreciation by dividing the total assets cost (after deducting any salvage value) by its expected useful life. This method is widely used by most companies given that this method is very simple to calculate.

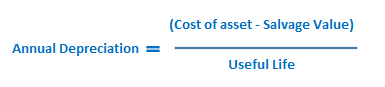

Below is the formula:

Where:

- Cost of asset consists of purchased price of the asset plus any other costs that brought asset into use such as installation cost, transportation costs related to the bringing asset to the company as well as any applicable taxes.

- Salvage value is the remaining value of the asset at the end of useful life that can be disposed.

- Useful life is the life expectancy of the asset that can be used.

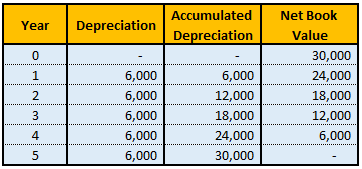

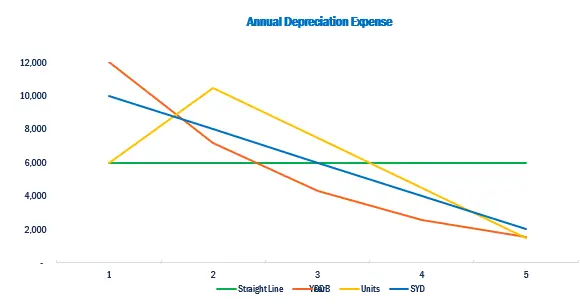

Example, ABC Ltd bought a machinery for 30,000 USD on 01 January 2020. This machinery is expected to have useful life of 5 years with no salvage value.

Annual depreciation = 30,000/5 = 6,000 per year

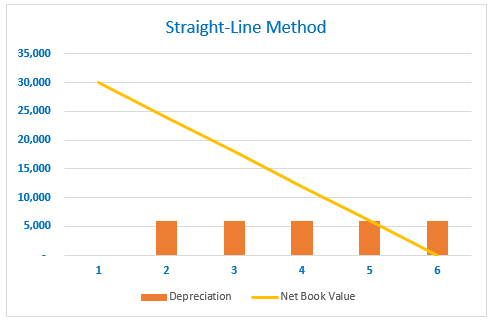

You can also see the graphic below illustrating the yearly depreciation expense and net book value of the asset.

As you can see from the table as well as the graphic above, the depreciation expense is constantly at 6,000 USD per year throughout the useful life of the asset and the net book value also constantly reduce at the same level.

The advantage of using Straight-Line method is that the depreciation expense is easily calculated by just simply dividing the total costs of the asset after deducting any potential salvage value against the expected useful life.

However, it also has the disadvantages. This method cannot apply to all types of assets for example assets that involve with technology. New technology is developed every day; thus the old technology equipment or asset might not be or no longer suitable. Hence, for such technological assets, we shall not use Straight-Line method to calculate and recognize depreciation expense.

Double Declining Balance Method (DDB)

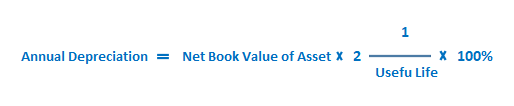

The Double Declining Balance (DDB) method of depreciation depreciates the carrying value of an asset using a percentage. This is different to straight-line method as it considers the carrying value of the asset rather than its cost. This method produces higher depreciation in the early years of the asset’s life and lower depreciation in the later. The word double here refer to the multiplication by 2. This method of deprecation is commonly used for any assets that provide much output or benefit in the early years and less in the later year for instance, the truck or machinery.

Below is the formula to calculate the annual depreciation:

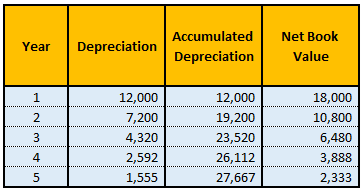

From the example above, below is the table illustrating the annual depreciation expense under Double Declining Balance method:

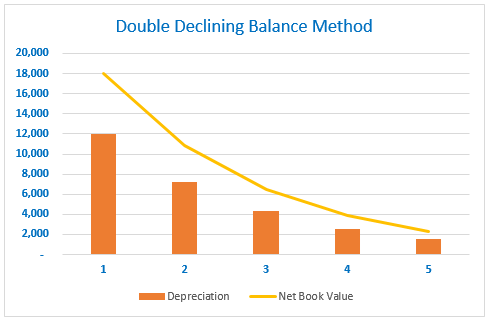

Below is the graphic illustrating the depreciation and net book value of asset over its useful life.

As you can see from both table and graphic above, the annual deprecation amount is big at the beginning of the year and less in the later years. The depreciation at the end of useful life will not be at zero by using this method. Therefore, we can decide to do full depreciation at year five if necessary.

One of the main advantages of using DDB is that it allows us to recognize the depreciation expense much higher in the first few years. It is suitable for types of assets that rapidly deteriorate or quickly loss in value.

However, it also has drawback as this type of depreciation will bring the net profit of the business lower at the beginning of the year as result of much higher depreciation expense while management tend to see more profit.

Sum of the year digit method (SYD)

This method is quite similar to Double Declining Balance method as we recognize annual depreciation at larger amount in the early year and less in the later years. The word sum of the years digits refer to the sum of the useful life of an asset. For example, if the useful life of an asset is 5 years; the sum of the years digits would be 15 (1+2+3+4+5). Each year depreciation is calculated by multiplying the total asset at cost after deducting any salvage value with the depreciation factor which is the remaining year divided by sum of the years digits.

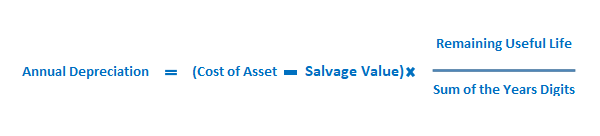

Below is the formula:

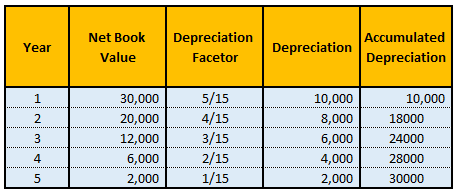

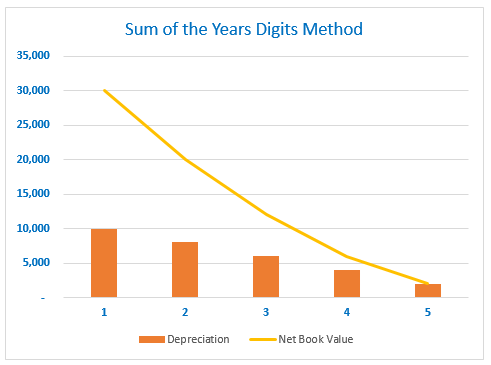

Below are the table as well as the graphic showing the annual depreciation expense and net book value under the sum of the years digits method.

As you can see from the table and graphic above, under the sum of the yeas digits method, the annual depreciation is quite similar to double declining balance method; however the first year depreciation under sum of the years digits method is five times to the last year.

The usage as well as the benefit and drawback of this method is quite similar to Double Declining Balance method.

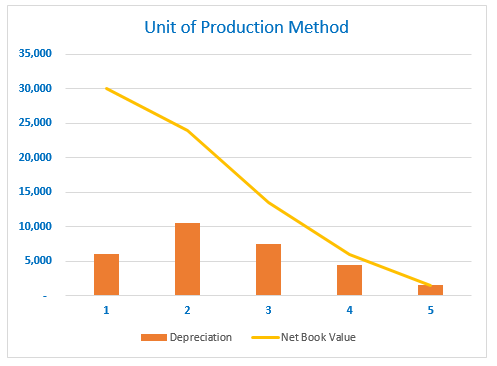

Units of Production Method

Units of Production method is a method of depreciation that recognize depreciation expense based on the level of output the assets can produce during the useful life of the asset. The method is very useful for manufacturing or production companies that use machinery to produce its products. In this method, it requires each company to assess the level of output or units the asset can produce as well as to how much it can produce each year during the useful life.

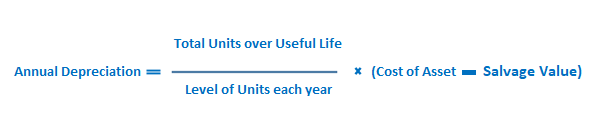

Formula is as follow:

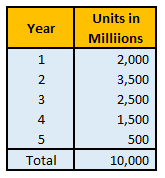

From the example above, assume further that the machinery has the capacity of 10,000 million of production units. The units to be produced are as below:

Thus, the depreciation per units is 30,000/10,000 = $3 per 1 million units.

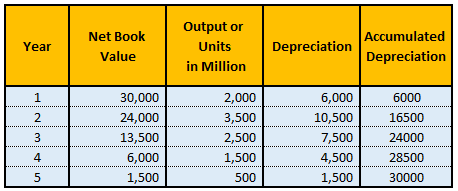

Then the annual depreciation as well as the net book value each year will be as follow:

Based on the level of units produce in year one, the depreciation would be 6,000$ while at the final year, the depreciation is only 1,500$.

This method of deprecation is very useful and transparence in allocating the annual depreciation as it is based on the level of output or units the asset can generate for each year.

Below is the summary of annual depreciation expense and net book value at the end of each year over the useful life of asset.

Conclusion

In conclusion, each types of depreciation methods give difference annual depreciation expenses in each year. Most companies prefer to use straight line method because it is very easy to calculate. While some other companies would prefer to use other types of depreciation such as Double Declining Balance, Sum of the Years Digits and Units of Production methods depending on each types of assets being used.