Overview

In this article, we will cover in detail about cash operating cycle in accounting. It is also know as cash conversion cycle. Before going further, let’s understand the overview of the cash operating cycle as well as the concept of working capital management.

The efficiency of the operations of a business is defined by many factors. One factor that is particularly important among these is working capital management. Working capital management refers to the strategy of a business to monitor the use of its current assets and current liabilities and managing it working capital to run the business operations smoothly. An effective working capital strategy can help the business increase its profitability and earnings through the efficient use of its resources.

The working capital management of a business requires effective monitoring, controlling and planning of its working capital. Working capital is defined as the total current assets of a business after all its current liabilities have been paid off. This basically shows the liquidity position of a business.

To properly manage its working capital, a business must properly manage its accounts receivable, accounts payable, inventories and cash resources. One tool that can be used in this regard is the cash operating cycle. The cash operating cycle can also be called the working capital cycle, the trade cycle, the net operating cycle or the cash conversion cycle. In this article, we will use all these words interchangeably.

Table of contents

Definition

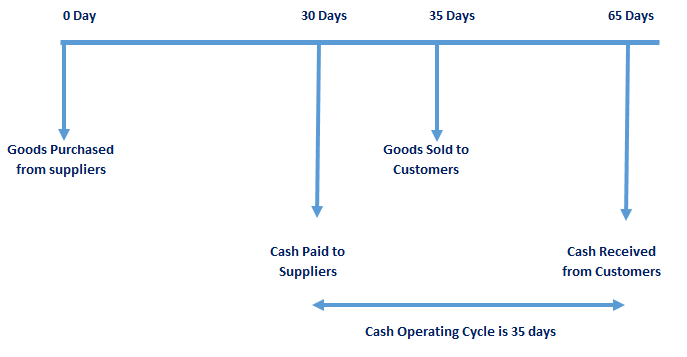

The cash operating cycle of a business is the length of time between payment of purchase of raw materials, paying wages and other expenditures to the inflow it receives from the sale of these goods. In other word, it is the period of time which elapses between the points at which cash begins to be expended on the production of a product and the collection of cash from its customer. Thus, it takes into account the time it takes for the business to pay its payables for the goods purchased and the time it takes for its customers to pay for the goods they have purchased.

The below graphic best describes the cash operating cycle of a business:

Businesses with the lower cash operating cycle interval are considered to have a better working capital management than businesses with longer cash operating cycle intervals. The faster it takes for the cash operating cycle of a business to complete, the lower capital the business would need to invest in its working capital. Businesses that have a high cash operating cycle will need to invest more capital in its working capital due to this reason.

The cash operating cycle of a business is calculated by using different working capital ratios. It is calculated in terms of the time it takes, usually denoted in number of days. Therefore, different working capital ratios, calculated in number of days, such as inventory periods, accounts receivable period and accounts payable period are used to calculate the cash operating cycle of a business.

Operating Cycle vs. Cash Cycle

So what is the difference between cash cycle and operating cycle?

The operating cycle is a concept similar to the net operating cycle or cash cycle concept, however, there is a small difference between the two. The operating cycle of the business refers to the length of time from the initial purchase of raw material to the time cash is received from the sale of the finished goods.

The cash cycle or net operating cycle, on the other hand, does not take into account the initial purchase time of the raw material. It is the time from when the business pays for the raw material purchased to the time cash is received from the eventual sale of the finished goods. Therefore, we normally calculate the net operating cycle by subtracting the payable days from the operating cycle.

Importance of Cash Operating Cycle

The cash operating cycle concept of working capital for a business is the main indicator of whether the working management strategy of a business is effective. An optimal cash conversion cycle can help the business run its operations smoothly and can also positively impact the profit and earnings of a business. Similarly, it ensures that the operations of the business are running in an ordered and efficient manner.

As mentioned above, a short cash conversion cycle can also help the business avoid extra investments in its operations as the cash generated through the operations of the business can easily meet its cash outflow demands. This can help the business avoid any loans that other business, with longer cash conversion cycle, have to take to finance their working capital needs.

The cash operating cycle can also be a main indicator of the efficiency of asset-utilization and liquidity position of the business. As previously mentioned, it is calculated using different ratios such as inventory days, accounts receivable days and accounts payable days. Therefore, the cash operating cycle concept can be used as an indicator of the efficiency of the business in managing its inventories, receivables and payables for maximum effectiveness.

The cash operating cycle concept of working capital can also be used to compare the performance of the business with other businesses. However, different industries will have different cash operating cycle standards. Therefore, it is important that the comparison is made within similar business for the comparison to produce useful results.

Cash Operating Cycle Formula

The formula to calculate the cash conversion cycle of a business comprises of different working capital ratios. The formula to calculate cash operating cycle can be written as:

Cash Operating Cycle = Receivable Days + Inventory Days – Payable Days

So now you know how to calculate the cash conversion cycle or cash operating cycle. What about operating cycle? How to calculate the operating cycle?

The formula is similar to cash conversion cycle formula except the omission of payable days. The operating cycle of a business is comprised of only the receivable days and inventory days.

The operating cycle formula is as follow:

Operating Cycle = Inventory Days + Receivable Days

Below are the further breakdown of inventory days; commonly for manufacturing companies.

Inventory days is calculated by the aggregation of raw material inventory holding period, work in progress holding period and finished goods inventory period. Therefore, the formula for inventory days can be written as:

Inventory Days = Raw Material Inventory Holding Period + Work In Progress (WIP) Holding Period + Finished Goods Inventory Period

The raw material inventory holding period of a business in number of days can be calculated as:

Raw Material Inventory Holding Period = (Average Raw Material Inventory / Material Usage) x 365

The WIP holding period of a business in number of days can be calculated as:

WIP Holding Period = (Average WIP Inventory Held / Annual Purchase) x 365

The finished goods inventory period of a business in number of days can be calculated as:

Finished Goods Inventory Period = (Finished Goods Inventory Held / Cost of Sales) x 365

After calculating all the above three inventory related ratios, the inventory days of a business can be calculated.

The receivable days or receivables collection period or days sales outstanding (DSO) of a business signifies the time it takes the business to receive cash from its customers for any credit sales made to them. The receivable days can be calculated using the following formula:

Receivable Days = Average Accounts Receivable / Total Credit Sales x 365

Finally, the payables days of a business is the length of time it takes the business to pay its suppliers for any credit purchases it has made. The payables days can be calculated using the following formula:

Payable Days = Average Accounts Payable / Total Credit Purchases x 365

Example and Analysis

A company ABC Co. has calculated its different working capital ratios, which are as below:

| Raw material inventory holding period | 8 days |

| WIP holding period | 12 days |

| Finished goods inventory period | 10 days |

| Receivable days | 55 days |

| Payable days | 35 days |

To calculate the cash operating cycle of ABC Co., the inventory days should first be calculated using the following formula:

Inventory Days = Raw material inventory holding period + Work In Progress (WIP) holding period + Finished goods inventory period

= 8 days + 12 days + 10 days

Hence, Inventory Days = 30 days

Now, the cash operating cycle of ABC Co. can be calculated using the formula:

Cash Operating Cycle = Receivable Days + Inventory Days – Payable Days

= 55 days + 30 days – 35 days

Hence, Cash Operating Cycle = 50 days

This means that it takes ABC Co. 50 days from its initial purchase of inventory to the time this inventory is sold and cash is received for it. This is a very high cash conversion cycle for a company. However, for some industries this may be considered normal. To obtain more information whether the cash conversion cycle of ABC Co. is normal, below average or above average, its performance must be compared with other companies within the same industry.

Another company, XYZ Co., within the same industry has the following working capital ratios:

| Raw material inventory holding period | 5 days |

| WIP holding period | 8 days |

| Finished goods inventory period | 7 days |

| Receivable days | 45 days |

| Payable days | 30 days |

To calculate the cash conversion cycle of XYZ Co., the inventory days should first be calculated using the following formula:

Inventory Days = Raw material inventory holding period + Work In Progress (WIP) holding period + Finished goods inventory period

Inventory Days = 5 days + 8 days + 7 days

Hence, Inventory Days = 20 days

Now, the cash operating cycle of XYZ Co. can be calculated using the formula:

Cash Conversion Cycle = Receivable Days + Inventory Days – Payable Days

= 45 days + 20 days – 30 days

Hence, Cash Conversion Cycle = 35 days

This means that XYZ Co. has a better cash conversion cycle as compared to ABC Co. The main areas of improvement for XYZ Co. are lower inventory days and lower receivables days. However, its payable days are lower than ABC Co. which means it has a negative impact on the cash conversion cycle. Even with the lower payable days, XYZ Co. managed to complete its cash conversion cycle in 35 days which is 15 days lower than ABC Co. This means that XYZ Co. has outperformed ABC Co.

While this comparison can be used between two companies to see which company is doing better, it cannot be inclusive of the results of the industry as a whole. To understand better whether ABC Co. performed worse or XYZ Co. performed better, their operating cycles must be matched with that of the industry.

Reasons for Longer Cash Conversion Cycle

The cash operating cycle concept of working capital suggests that the reason for longer cash operating cycles of a business can be either due to high inventory days, high receivable days or high payable days. If the business cannot convert its raw materials into finished goods on time and cannot convert its finished goods into sales, it will have higher inventory days. This will in term increase the cash operating cycle of the business.

Similarly, if the business does not have a proper credit control policy and an effective credit control department, then it will have a hard time recovering money from its customers to whom credit sales have been made. Likewise, if the business offers its customers a high credit limit or long credit times, then the accounts receivable of the business will be very high and it will take a longer time to recover. All of these factors can affect the receivable days of the business and, therefore, the cash operating cycle of the business will be longer.

Finally, if a business takes a short time to pay its suppliers after they have made credit purchases from those suppliers, then the payable days of the business will be affected. If the suppliers of the business offer the business strict credit terms and a shorter credit repayment period, then the payable days of the business will be affected. Some businesses may also choose to pay their payables before a specified time to avail early settlement discounts offered by suppliers or to ensure a healthy relationship with suppliers is maintained. Either way, shorter payable days can affect the cash operating cycle of a business adversely.

Ultimately, a longer cash operating cycle of a business is mainly caused by an ineffective working capital management. If the business does not properly manage its working capital, then it will be affected negatively.

How to Reduce Cash Conversion Cycle?

The reduction of cash operating cycle of a business can be tough specially if the business is struggling with managing its working capital. To reduce the cash operating cycle of the business, the management of the business have to consider all the factors that affect the cash operating cycle of the business. According to the cash operating cycle concept, these factors include efficiency within the processes of the business, credit terms offered to customers and credit terms negotiated with suppliers.

The first way in which a business can improve its cash operating cycle is to improve the efficiency of its processes. This concept is mainly related to working capital of the business. If there are inefficiencies within the processes of the business, then it is going to take a long time for the business to convert its raw materials into finished goods. The longer it takes for the business to start production on its raw materials and the longer it takes during the production period to covert these raw material into finished goods, the longer will be its inventory days. Therefore, to decrease the inventory days, the business must make its processes efficient.

Similarly, the business should also consider decreasing its credit limits and credit time offered to customers to reduce its cash operating cycles. However, the business may risk losing some customers due to decreased credit terms. The business may also consider offering its customers early settlement discounts to ensure cash is received in a short time. All this can simply be achieved by an efficiency in the credit control department of the business.

Finally, if the business wants to reduce its cash operating cycle, it must negotiate better repayment terms with its suppliers that allows the business more flexibility in making payments. The higher the accounts payable period of a business is, the better it is for the cash operating cycle. In case the business is already bound by a contract with suppliers, this may not be an option. If the business also avails early settlement discounts offered by suppliers, it should reconsider whether the early payment discounts are worth affecting the operating cycle of the business negatively.

Conclusion

The cash operating cycle of a business is the time it takes the business from its payment of purchase of raw material to the time cash is received from their sale. The cash operating cycle concept is of working capital is an indicator of the working capital management of a business. This concept can be used to improve the efficiency of a business or as a cash flow management tool, among other things. There are many reasons why the cash operating cycle of a business can be high for example, high inventory days, high receivable days or low payable days. To reduce its cash operating cycle, the business must target all three of these areas.