Overview

In this article, we will cover in detail for the break-even analysis. This involves the calculation of break-even point for a business. Before going in detail, let’s go through the overview and the basic definition.

Typically, the ultimate goal of any business is to make profits. These profits are calculated by subtracting all the expenses of the business from its revenues for a specific period. The profits of the business are reported in the Statement of Profit or Loss of a business. These profits can be reported as either gross profits or net profits, both of which are important indicators of the performance of the business for a specific period in different ways. If the profits of a business are low or when the business makes a loss, the performance of the business is considered unacceptable.

The profits of the business must be carefully monitored and controlled by the management of a business. Therefore, the management of a business use different tools to monitor and control these profits, such as forecasting, budgeting, variance analysis, etc. These tools allow the management of the business to set standards for the business so that actual performance can be measured against it. The management of a business can also use several other methods such as ‘what-if’ analysis to calculate the effects of any changes in the expenses of a business on its profits. This can help the management of the business make better decisions regarding its performance. One specific method used for this purpose is known as break-even analysis.

Definition

Break-even analysis, also known as Cost Volume Profits (CVP) analysis, is the analysis of the effect of changes in fixed costs, variable costs, sales prices and number of units sold of a business on its future profits. This analysis can be used to determine the effects of any possible changes on the budgeted profits of a business based on certain assumptions. The break-even analysis method is used by the management for several reasons such as decision-making, pricing decisions, setting targets, etc.

Break-even, in financial terms, is the point of balance between the revenues and expenses of the business. It is the point at which the revenues of the business are equal to the expenses of the business and no profits or losses are made. Any number above the break-even point is considered as a profit while any number below it is considered a loss. The break-even point is a theoretical point used to determine different factors that contribute to the profits of a business and how changing these factors can affect the profits. It can be determined either in the terms of units or in terms of money.

The break-even point can be calculated for a business as a whole, for a single department within the business or a single product. The calculation for all scenarios remains the same, although, calculating the break-even point for the business as a whole or for multiple products is a more complex process. To calculate the break-even point of a business, the management of the business will have to break costs down for every department or product if the break-even point is not being calculated for the business as a whole.

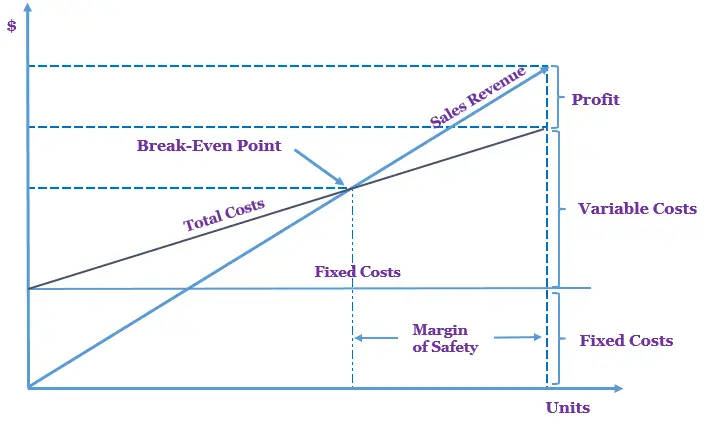

Below is the break-even point chart:

How to Calculate Break-Even Point?

The break-even analysis is the process of calculating the break-even point of a business and analyzing the effects of changes in the key variables used in the calculation. To calculate the break-even point, the business must first classify its costs into different categories based on the behavior of the costs. This means that costs will be classified as either fixed costs, variable costs, semi-fixed or semi variable costs, and stepped-fixed costs. Usually, businesses keep the calculation simple and only classify costs as either fixed or variable costs.

As mentioned above, the break-even analysis is the process of calculating the process of the break-even point of a business, which is the point at which the total revenues of the business equal its total costs. Mathematically, the break-even point of a business can be expressed as:

Total Revenues = Total Costs

The total revenues of a business can be calculated by multiplying the number of units sold with the sale price per unit. This can be mathematically written as:

Total Revenues = Total Units Sold x Sales Price per Unit

The total costs of a business consist of its total fixed costs and total variable costs. Mathematically this can be represented as:

Total Costs = Fixed Costs in Total + Variable Costs in Total

The total variable costs of the business are calculated by multiplying the total level of activity of the business, often in numbers of units sold, with the variable cost per unit of a unit. This can be mathematically written as:

Total Variable Costs = Total Number of Units Sold x Variable Cost per Unit

Substituting the mathematical formulas of total revenues, total costs and variable costs in the original mathematical expression of break-even point, the formula becomes:

Number of Units Sold x Sales Price per Unit = (Total Units Sold x Variable Cost per Unit) + Fixed Costs

Therefore, the break-even point, in terms of units, can be calculated as:

Break-Even Point in Units = Fixed Costs in Total / Contribution per Unit

Where, Contribution per Unit = Sales Price per Unit – Variable Cost per Unit

In terms of management accounting, sales price per unit less variable cost per unit is also known as contribution (margin) per unit.

This formula can also be modified to calculate the number of units that a business must sell to generate a target profit. When the business wants to calculate the break-even point with a certain level of target profit, it is called sales volume to achieve target profit. The sales volume to achieve target profit is calculated by using the formula as follow:

Sales Volume to Achieve Target Profit = (Total Fixed costs + Target Profit) / Contribution per Unit

Example and Analysis

A company ABC Co. wants to calculate its break-even point because the company has faced break-even analysis problems in the past. The company sells a single product. The selling price of the product is $30. The variable cost per unit of the product is $20. The fixed costs of the company are $20,000. To calculate the break-even point of the company’s product, the following formula must be used:

Break-even point in units = Fixed costs in Total / (Sales price per unit – Variable cost per unit)

= $20,000 / ($30 – $20)

= $20,000 / $10

Hence, Break-even point in units = 2,000 units

This means that ABC Co. must sell 2,000 units of its product to make a break-even. In other words, it means that if the company sells 2,000 units of its product, it will not make any profit or loss. This can easily be proven by the following calculation:

| Sales (2,000 units x $30 per unit) | $ 60,000 |

| Less: Variable costs (2,000 units x $20 per unit) | $ (40,000) |

| Less: Fixed costs | $ (20,000) |

| Profit/Loss | $ 0 |

Assuming ABC Co. has a target profit of $10,000 for the next period, the number of units that it must sell to achieve this profit can be calculated using the following formula:

Sales Volume to Achieve Target Profit = (Total Fixed costs + Target Profit) / (Sales price per unit – Variable cost per unit)

= ($20,000 + $10,000) / ($30 – $20)

= $30,000 / $10

Hence, Sales Volume to Achieve Target Profit = 3,000 units

This means that if the company wants to make $10,000 profit, it must sell 3,000 units to make this profit. Furthermore, it means that the company must sell an additional 1,000 (3,000 – 20,000) units to make an additional profit of $10,000. Any break-even analysis problems that the company has had in the past can simply be answered by the above calculations

Benefit of Break-Even Analysis

Break-even analysis can have many benefits for businesses. Businesses can use break-even analysis for decision-making purposes. As break-even analysis can help the business determine how many units it needs to sell to not make a loss, businesses can use the information to price their products. With the help of break-even analysis, businesses can determine an optimal price for its products that can boost the profits of the business.

Break-even analysis can also help determine how much contribution should be made or how many units need to be sold by a business for the fixed costs of the business to be covered by it. Variable costs differ with a change in the level of activity of the business. However, fixed costs remain the same. Therefore, businesses can, with the help of break-even analysis, determine whether they make enough sales, in units or in monetary terms, to cover their fixed costs.

As mentioned above, break-even analysis can also be used to determine how many units a business needs to sell to meet a target profit. This can help the business in budgeting or forecasting for the future. Furthermore, by setting targets, the business can have a standard to measure its performance against for future analysis.

Break-even analysis can also be used as an investment appraisal tool. When businesses launch new products in the market, they can use the break-even analysis to determine whether the business can make a profit on the new product based on forecasted sales. This can help businesses mitigate any risks associated with new product launches and avoid potential failures.

Break-even analysis is also required in the preparation of business plans. This means that startups need to do a break-even analysis to present to any potential investors. Businesses need to demonstrate to the investors that their investment in the business is viable. Thus, with the use of break-even analysis, these startups can show the investors how many units it will take for the business to start making profits and how the business plans to achieve that goal.

Break-even analysis can also help businesses with cost-cutting. As the break-even point of a business is calculated by analyzing whether enough contribution is made per unit of a product to cover the fixed costs of the business. This means that if businesses can keep their fixed costs low, the break-even point of the business will also stay low. This can help businesses calculate an optimal mix between the fix costs of the business and its units sold.

Drawback of Break-Even Analysis

While break-even analysis is a great tool when it comes to the above points, it also has a few drawbacks. First of all, while businesses can use break-even analysis to determine how many units need to be made and sold for them to break-even, this tool cannot be used by businesses as a measure for the demand of its products. As the break-even point of a business is determined by using the sale price of a product in the break-even analysis formula, any changes in the sale price can affect the break-even point of a product. However, while changing the price can help businesses determine an optimal sale price, it does not reflect the demand of the product at a particular sale price.

Similarly, as mentioned above, businesses use a simple break-even analysis by classifying costs as either fixed or variable costs. However, there are other types of costs that these businesses do not take into account. These types of costs are stepped-fixed costs and semi-variable or semi-fixed costs. These costs need to be considered separately in order for the break-even analysis to produce accurate information.

Break-even analysis also assumes that the sale price of the product will remain constant. Practically, for some products this may not be possible. In this case the business will have to calculate an average selling price which may not produce accurate results.

Similarly, break-even analysis does not consider the capital requirements of producing the products. While it gives the number of units that must be produced to not make a loss, or profit, it does not consider whether the business has enough capital resources to produce the number of units.

Conclusion

Break-even analysis is a method of calculating the break-even point of a business. Break-even point is the point at which the business does not make any profits or losses. To calculate the break-even point, the fixed costs of a business are divided by the contribution per unit of the product the business sells. The contribution per unit is calculated by subtracting the variable costs per unit of a product from its sales price per unit. There are many benefits of using the break-even analysis, however, it does come with some drawbacks.