Introduction

One of the few recent International Financial Reporting Standards (IFRSs) issued by International Accounting Standards Board (IASB) that happened to supersede the old standard(s) and have caught attention of Accountants in practice and industry across the globe is the standard that discusses the matter of Revenue Recognition in detail – IFRS 15 Revenue from contracts with customers.

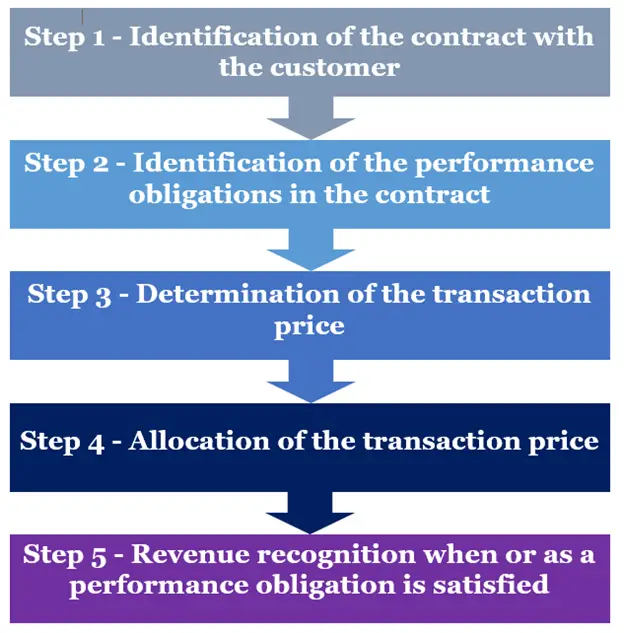

This is about the 5 steps approach of revenue recognition. As this standard superseded two standards namely, ‘IAS 18 – Revenue’ and ‘IAS 11 – Construction Contracts’ along with three IFRICs and an SIC with an application date of January 1, 2018, companies that were preparing IFRS compliant financial statements had an obligation to understand fully and apply this standard in preparing financial statements for the reporting year 2018 and onwards with an option of early adoption.

Many organizations apply accrual basis of accounting for financial statements’ preparation. A key element of accrual basis of accounting is the matching principle which requires recognition of cost in the period in which the relevant revenue is recognized. And for the recognition and measurement of revenue, a comprehensive framework has been provided under IFRS 15 which enables entities to expense out costs of goods and services whose revenue is recognized in the reporting period in accordance with IFRS 15.

The level of complexity associated with revenue recognition varies from industry to industry and company to company. So, this standard caters the revenue recognition matter for various possible business dealings with the customers with some exclusions as mentioned in the standard as: Leases, financial instruments, insurance contracts, guarantees and certain non-monetary exchanges. Before moving forward, it is important to mention here that contracts with parties who are not the customers also fall in the exclusion category of this standard. (This shall be discussed shortly hereinafter)

5 Steps Approach of Revenue Recognition

As this standard primarily superseded IAS-18, it focuses on revenue recognition when the control in respect of goods and services is transferred instead when the risks and rewards are transferred which was the underlying principle of IAS 18 (this point will be discussed later in this article). To make the revenue recognition more methodical, efficient and comprehensive, this standard delineates the 5 steps approach recognition and measurement of revenue as listed below. Importantly, revenue in respect of any goods or services can only be recognized if it passes all these steps.

5 steps approach revenue recognition as as follow:

Step 1 – Identification of the contract with the customer

Commencing the model from the first step, contract must be identifiable and that has to be with the customer (as mentioned earlier) for which standard provides definitions for guidance and clarity during application. It says, a contract is an agreement between two or more parties that creates enforceable rights and obligations. Further, it says, a customer is a party enters into contract with an entity to purchase goods or services being the output of the entity’s ordinary activities, in exchange for a consideration. There is no requirement for a contract to be in written form to be enforceable. It may even be oral or even implied by an entity’s customary business practices.

However, precisely, standard explains that those contracts will fall under the scope of IFRS 15 in respect of which five specific features exist. Otherwise they would be covered under some other relevant standards. Absence of even one of these five features would exclude the contract from this standard’s application: (a) Approval by parties to the contract and performance commitment; (b) Identifiable rights of each party in relation to goods and services; (c) Identifiable payment terms; (d) Commercial Substance of the contract; and (e) probability of collection of the consideration. It means, for instance, if commercial substance does not exist in a transaction between parties due to, for example, absence of arm’s length transaction, IFRS 15 would not apply.

Step 2 – Identification of the performance obligations in the contract

Once it has been established that contract with customer exists, presence of performance obligation has to be checked in the contract. Standard guides by defining performance obligation as a promise with the customer to transfer single good or service or the series of goods and services that are distinct. In simple terms, distinct means separately and uniquely identifiable with separate profit cushion.

Moreover, the standard provides criteria set for assessing whether performance obligation constitutes a single distinct product or service, series of distinct products or services in the same pattern and whether the product or service is distinct or not which has to be assessed. Another important term highlighted in this step is the existence of transfer. Absence of transfer would mean absence of performance obligation and would be excluded from the purview of IFRS 15.

For instance, if you own a construction company and you are constructing a warehouse for your client and for making necessary food arrangements for the construction team at the site, you have built a canteen room for them. This cannot be treated as a distinct performance obligation as it will not be transferred under the contract to the customer.

Step 3 – Determination of the transaction price

After identification of performance obligations in a contract, it is vital to determine the transaction price of the contract for recognizing the revenue. This is where the measurement part of revenue jumps in. The standard defines transaction price as the amount of consideration that an entity expects to be entitled to in exchange for transferring promised goods or services to a customer. Usage of the word “expects to be entitled …” clarifies that expectation has to be developed in respect of transferred goods or services instead of taking the agreed upon contract price straight away as the transaction price.

By taking contract price as the base/starting price, some adjustments have to be made to the same to approach at a reasonable estimated price as transaction price, for instance, adjusting the base price for items like coupons, non-cash consideration, discounts, bonuses, rebates, credits, penalties, etc. The standard uses the term variable consideration for such items and mentions that condition for inclusion of variable consideration as part of transaction price in these words: “variable consideration is only included in the transaction price if, and to the extent that, it is highly probable that its inclusion will not result in a significant revenue reversal in the future when the uncertainty has been subsequently resolved.” Moreover, if consideration is settled upfront or is delayed, incorporation of the effect of time of value of money is also required in the transaction price.

Step 4 – Allocation of the transaction price

Once the performance obligations have been identified and transaction price is determined, the transaction price has to be allocated among performance obligations on the basis of relative standalone selling prices of the performance obligations provided that the contract constitutes multiple performance obligations. The standalone selling price is the price that an entity charges had it sold the promised good or service independently (not as part of the contract). For instance, a laptop manufacturing company giving laptop chargers free of cost with the laptop should identify standalone price of laptop and allocate a portion of transaction price to the laptop.

In case of inability to directly observe stand-alone selling price, standard provides some methods to estimate the same, i.e., adjusted market assessment approach, expected cost plus a margin approach and residual approach (only permissible in limited circumstances). In circumstances where transaction price includes some variable amounts like, discounts, standard mentions that any overall discount is allocated between the performance obligations on a relative stand-alone selling price basis.

Step 5 – Revenue recognition when or as a performance obligation is satisfied

The last step is where IFRS 15 establishes the main distinction with IAS 18, i.e., revenue has to be recognized when a performance obligation is satisfied, and the customer obtains control of the asset (promised goods or services). As mentioned earlier, in IAS – 18, the major focus was on the transfer of risks and rewards for the recognition of revenue. Transfer of control also incorporates transfer of risks and rewards along with four other indicators for revenue recognition which are, but are not limited to: (a) right to payment for the asset is established; (b) legal title is transferred to the customer; (c) physical possession of the asset is with the customer; (d) customer has accepted the assets.

In terms of recognition of revenue, it is the IFRS – 15’s core principle that revenue recognition is dependent on the time when the performance obligation is satisfied and a performance obligation is satisfied when control of goods or service is transferred to the customer. Control can be transferred to the customer either over time or at a point in time and timings for recognition of revenue will be determined accordingly. To determine whether the control will be transferred over time or at a point in time it is essential to analyze the contract. The standard provides certain criteria to be met for concluding that the control is transferred over time.

Even if one of the criteria is met, revenue can be recognized over time. Otherwise, performance obligation is considered to be satisfied at a point in time. (a) customer receives and consumes the performance obligations as and when provided or entity has no need to reperform the performance obligation– usually relates to provision of services such as cleaning services; (b) creation or enhancement of an asset which is under the customer’s control – asset may be tangible or intangible, e.g. in construction of a building at the customer’s site, the asset is under the control of the customer (c) entity performs a performance obligation with no alternative use to the entity and the entity has right to payment for the work done – right to payment also incorporates some element of profit margin in addition to the cost, if only cost is recovered then it is not a right to payment under IFRS – 15. It may be possible that there are various performance obligations in a contract, some of which may be recognized over time while some may be recognized at a point in time.

Once it is identified that the revenue should be measured over time, it is essential for an entity to measure the progress towards completion which will determine the time to recognize revenue. By measuring progress towards satisfaction of a performance obligation an entity recognizes the revenue in the pattern of transfer of control of the promised good or service to the customer. This is where the application of long term contracts gets clarified which were traditionally covered in IAS-11. For example, a construction company undertakes to construct a gigantic parking plaza for a hospital, which will take say, 3 years during which materials, labor and other costs shall incur. Accordingly, it will receive payments (usually termed as progress bills) from the hospital management at predefined stages of completion. Hence, revenue recognition for such long term contracts shall be dependent on stage of completion which shall be agreed upfront.

IFRS – 15 provides two methods for the measurement of progress towards satisfaction of a performance obligation, output and input based approach. In output based approach, the value transferred to the customer is measured and treated as a basis for revenue recognition. Examples may include surveys of work performed, units produced, units delivered etc. Since, there may be circumstances in which it is difficult to measure the value transferred to the customer; in that scenario, it might be necessary to recognize revenue based on entity’s inputs like, material consumed, labor hours, etc.

The standard also gives guidance about the recognition of contract costs by bifurcating them into those costs which are incremental to the contract and costs required to fulfill the contract. Moreover, the implementation guidance for specific industries and situations have been included in the standard to be complied with for recognizing revenue for specific instances like warranties, sale with right of return, licensing, repurchase agreements, etc. Likewise, the disclosure requirements for this standard.

Practical Example of Revenue Recognition Under IFRS 15

Example:

Suppose Peter has entered into a 12 months internet service fee with one local internet service provider ABC Co. The contractual term of the contract consists of the follow:

- The monthly fixed fee for the internet service is US$30

- Peter will receive a free wifi router for free at upon signing the contract and completing the installation.

ABC Co commonly sells the wifi router at US$100 and the same monthly payment plan without the wifi router for US$25 per month.

Thus, how does ABC Co recognize the revenues from this plan in accordance with IFRS 15?

Solution:

For simplicity, we will illustrate the revenue recognition into separate five steps process as follow:

Step 1: Identification of the contract with the customer

This is the first step under IFRS 15. From the example above, we can conclude that the contract is to provide the internet service. Wifi router is considered as an add-on item to the internet service.

Step 2: Identification of the performance obligations in the contract

In this second step, ABC Co shall need to identify the performance obligation from the service provided to Peter properly. In this case, ABC Co has two obligations as follow:

- Obligation to provide the wifi router to Peter at the inception

- Obligation to provide the internet service over 1 year period from the start of installation.

Step 3: Determine the transaction price of the contract

The contract price in this case is calculated as the monthly fee of US$30 multiply with 12 month to see the yearly fee. The total yearly fee is US$36o.

Step 4: Allocation of the transaction price

In this step, ABC Co shall need to allocate the transaction price properly. Unlike IAS 18 where revenue shall be recognized only on the monthly fee while the wifi router considered as free. Thus, the wifi router would be treated as market cost under IAS 18.

However, in IFRS 15, ABC Co shall need to recognize revenues separately. The wifi is not considered as free.

First, ABC Co shall need to identify the stand-alone price and then calculate the percentage of the fee and wifi router based on the total stand-alone price.

After that, ABC Co shall need to allocate the monthly plan accordingly.

For simplicity, we will illustrate the allocation of transaction price as per the table below:

| Performance Obligation | Stand-alone Price US$ | % on Total | Transaction Price Allocation US$ |

|---|---|---|---|

| Internet Service | 3oo (25*12) | 75% | 270 |

| Wifi Router | 100 | 25% | 90 |

| Total | 400 | 100% | 360 |

Above is the split of transaction price between Internet Service fee and Wifi Router.

Step 5: Revenue recognition when or as a performance obligation is satisfied

This is the last step of revenue recognition under IFRS 15. As you can see from the table in step 4 above, the revenue recognition shall be split between the internet service fee and wifi router. Under IFRS 15, wifi router is not considered as free.

Thus, ABC Co shall need to recognize revenue as follow:

- Internet service fee of US$270 per year and US$22.5 per month

- Revenue from selling Wifi Router is US$90. This is recognized 100% at the inception.

Below are the simple journal entries:

- When Peter entered into contract and made prepayment of the plan

| Account | Debit US$ | Credit US$ |

|---|---|---|

| Cash | 360 | |

| Revenue from selling Wifi Router | 90 | |

| Unearned Revenue | 270 |

- On the monthly basis to recognize revenue over time:

| Account | Debit US$ | Credit US$ |

|---|---|---|

| Unearned Revenue | 22.5 | |

| Service Revenue | 22.5 |

Conclusion

Since, the global economy as a whole, business models and business practices are changing so dynamically that accounting treatments and reporting structures also become more and more complex over time. To address such evolvements, accounting standards have to be constantly updated and revised to make them more and more inclusive and comprehensive in nature so that the accounting treatments and disclosure requirements for maximum possible business models can be covered. IFRS-15, doubtlessly was one of the outcomes of this phenomenon.

Moreover, in an attempt to make them more comprehensive, new standards like IFRS-15 have significantly affected the accounting techniques of many companies since such standards come up with changed underlying principles governing them. Just like any new standard, the extent of impact of this standard on revenue recognition varied in correlation with the level of complexity of revenue structures of different businesses. Some businesses went unaffected with its implementation while some companies like the ones from telecommunication sector experienced a significant hit through implementation of this IFRS.