What is Beta?

Beta is a metric used to measure the systematic risk or volatility of a specific security or investment compared to the market. It is one of the critical parts of the capital asset pricing model (CAPM). In that model, it represents the measure of systematic risk for a given security or stock. Investors and companies use beta to compare a stock or security’s market risk to the market.

Beta helps investors quantify the systematic risk they face for an investment, represented by the beta coefficient. When this coefficient equals 1, the stock in consideration is exactly as volatile as the market. Any number above 1 means that the investment is more volatile than the market. Therefore, it will experience higher fluctuations compared to other options on the market.

Similarly, a beta coefficient of below 1 suggests that a stock or investment is less volatile than the market. Usually, this coefficient stays above 0 and below 2. However, when it reaches 0, it shows that a given stock does not correlate with the market. Similarly, if it becomes negative, the volatility relationship for the stock to the market is negative.

There are two types of beta that investors can consider. These include unlevered beta and levered beta.

What is Unlevered Beta?

Unlevered beta considers a stock’s systematic risk without considering the impact of debt. For that reason, it is also known as asset beta or ungeared beta. Unlevered beta considers the volatility of the returns for a given stock without accounting for its financial leverage. By doing so, it focuses on the risks related to a company’s assets. In short, unlevered beta compares a company’s risk without its financial leverage to the market.

Unlevered beta shows how much a company’s equity contributes to its risk profile. It is the opposite of levered beta, also known as equity beta. Equity beta shows a stock’s volatility against the returns of the equity market. However, ungeared beta removes the impact of financial leverage for that volatility. Since it does so, a stock’s unlevered beta will always be lower than its levered beta.

How to Calculate Unlevered Beta?

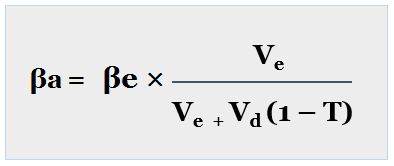

Calculating unlevered beta requires investors to obtain the equity beta (or levered beta) for a stock. Once they do so, they can use the following formula to determine its ungeared beta.

Where:

- βa is unlevered beta or asset beta or ungeared beta

- βe is equity beta or geared beta or levered beta

- Ve is the value of equity

- Vd is the value of debt

- (1-T) is net of tax rate

Using the above formula, investors can remove the effect of debt from levered beta. They can do so by multiplying a company’s debt-to-equity ratio with (1 – T). In the above equation, “T” represents the tax rate. Dividing a stock’s levered beta by this equation will allow investors to calculate its unlevered beta.

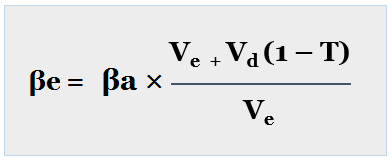

We use this ungeared beta in order to calculate the geared beta as per the formula below:

Example

A company ABC Co. has total debt of $5 million and total equity of $20 million. Therefore, the company’s debt-to-equity ratio is 25%. The company’s tax rate is 30%. The company is unlisted. Thus, it is not possible to determine its levered beta from the market. In this case, investors need to find other companies of similar structure and nature.

Another company, XYZ Co., which is publicly listed, has a similar nature as ABC Co. XYZ Co. has total equity of $100 million and a debt of $20 million. Therefore, its debt-to-equity ratio is 20%. For XYZ Co., the tax rate is also 35% since it has a larger size. XYZ Co.’s levered beta in the market is 1.3. Therefore, XYZ Co.’s unlevered beta will be as follows.

Unlevered Beta βa = 1.3 × $100 million/ [$100 million + $20 million (1 – 35%)]

Unlevered Beta βa = 1.15

Since ABC Co. and XYZ Co. are similar in size, investors can use XYZ Co.’s ungeared beta for ABC Co. Similarly, using the above as a basis, investors can calculate ABC Co.’s levered beta. It will be as follows.

Levered Beta βe = 1.15 x [($20 million + $5 million (1 – 30%)] / $20 million

Levered Beta βe = 1.35

What is the Importance of Unlevered Beta?

Unlevered or asset beta has several use cases for investors. Usually, investors use it to measure a stock’s performance with the market without considering the effect of financial leverage. Since debt has a positive impact on a company, investors can remove it from the calculation to get a better insight into the company. Investors can use it in several financial models or for business valuation.

Overall, investors prefer using unlevered beta when they want to measure a publicly-listed stock’s performance in relation to market fluctuations without the effects of debt. It can also be a great tool for comparing the betas of various companies with varying capital structures.

Conclusion

Beta is the measure of systematic risk for a given security or stock. It has two types, namely unlevered and levered beta. Unlevered beta, also known as asset beta or ungeared, shows a stock’s volatility in relation to the market without the effect of debt. Calculating ungeared beta requires investors to remove the impact of financial leverage from levered beta.