In this article, we will cover how to prepare a cash budget. Typically, cash plays a critical part in every business. Having enough cash enables a business to optimize its operation; especially it helps in the investing activities. In order to help for a business to manage its cash for both investing and financing activities, a proper cash budget is needed. So how to prepare a cash budget?

Before going in detail, let’s go through some basic definition of cash budget.

What is a Cash Budget?

Cash budget is also known as cash forecasting. It is a statement of a business’s planned cash inflows and cash outflows for a particular period. Or simply, a cash budget shows the expected cash receipts and cash expenditures during the budget period of a business entity. Typically, the cash budget is used to estimate the short-term cash requirements for operational uses as well as to fund any investment decisions.

The cash budget is typically prepared to cover a short-period of time; usually within one year period with a breakdown to monthly or quarterly basis. The more frequencies of cash budget internal depends on how seasonal the business is. The more seasonal or uncertain position of a business leads to a more frequent the cash budget is prepared.

For a firm in which the cash flow patterns are so seasonal, the cash budget will be prepared on the monthly basis. This is because it will help such firm to see its cash position frequently and planned ahead for any funding requirements or needs for its operation.

Purpose of Cash Budget

The primary purpose in preparing a cash budget is to know the cash position at the end of each month or quarter. This is because the company can decide on any financing needed if there is shortage of cash and decide on investment opportunities when the company has surplus cash.

When a company has shortage of cash or below a minimum cash balance, the company may consider enter into financing arrangements. This is typically through notes payable or obtain the overdraft facility from bank.

Alternatively, if the company have surplus or plenty of cash, the company can consider investing in any short-term marketable securities; for instance, overnight repurchase agreement or short-term negotiable certificate of deposit (CDs).

How to Prepare a Cash Budget?

Preparing a cash budget is not an easy task. It involves various considerations including incorporating past data and a forward looking approach. There are several steps in order to prepare a good cash budget.

In the later section below, we will illustrate how to prepare a cash budget step by step.

These are as follow:

Step 1 – Prepare the Cash Receipt Projection

Basically, the starting point of preparing the cash budget is to do the cash receipt projections. The cash receipts include all of a business’s cash inflow of a given period.

The most common components of cash receipts are cash sales, collection of credit sales which is from its accounts receivable and other cash receipts.

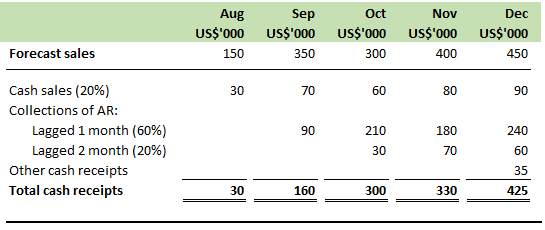

Below is the simple projection of cash receipt:

Example:

ABC Co is preparing its cash budget for the last quarter of the year from October to December 20X9. ABC Co’s actual sales for August and September 20X9 are $150,000 and $350,000 respectively. The company has projected its sales for October, November and December for $300,000, $400,000 and $450,000 respectively.

Historically, ABC Co has 20% of its sales by cash and 60% of its credit sales can be collected after 1 month with the remaining 20% collected after 2 months. For simplicity, ABC Co has ignored the bad debt in its cash budget preparation.

From the example above, we can prepare the projected cash receipts into three main components as follow:

- Forecast sales: This forecasted sales are used to provide an aid in order to calculate the projected cash receipts on the accounts receivable from past experience.

- Cash sales: The cash sales here represents the 20% of cash sales of the company.

- Collection of accounts receivable: These represent the collection of its accounts receivable as result of credit sales for each month based on the past history.

The forecast cash receipts will be presented as below:

Lagged 1 month: This represents the collections of accounts receivable from the sales of previous 1 month. $90,000 collections in September represents the 60% of sales for August. The collections of $210,000 in October represents the sales of $350,000 for September and so on.

Lagged 2 month: This represents the collections of accounts receivable previous 2 months. $30 represents the collections 20% of $150,000 sales of August while the collection of $70,000 represents the collections of $350,000 sales of September and so on.

Other cash receipts are usually the receipts from interest, dividend, proceed from sales of property plant and equipment etc…

Step 2 – Prepare the Cash Disbursement Projection

Cash disbursements are also called cash payments. These include all cash outflows of a business for a given period. Below are the common components of cash disbursements:

- Cash purchases

- Payment of accounts payable

- Rent or lease payments

- Wages and salaries

- Tax payments

- Fixed assets payments

- Interest payments

- Cash dividend payments

- Principal loan repayments

- Payments of repurchases or retirements of stock

Please note that depreciation and other non-cash items are not included in the cash budget. Thus, during the preparation of cash budget, please keep in mind to exclude those items.

Example:

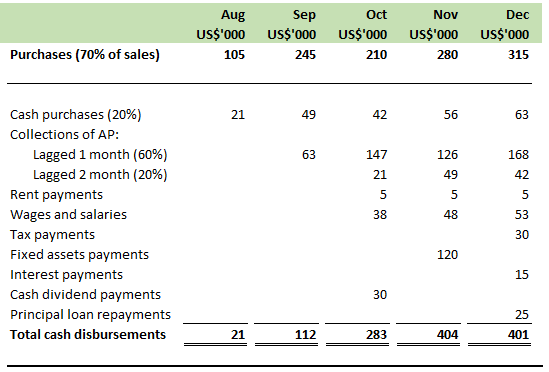

Following the cash receipts projection, let’s continue with the cash disbursements for ABC Co from October to December 20X9. From past history, ABC Co’s purchases represent 70% of sales. Historically, 20% of these is paid by cash, 60% is paid in the following month and the remaining 20% is paid in the second month of the purchases. Below are the other payments projected from October to December 20X9:

- Rent payments are $5,000 per month

- Wages and salaries: The fixed salary cost per year is $96,000 or $8,000 per month. The wages are estimate at 10% of monthly sales.

- Tax payments: The taxes are estimated to be paid in December for $30,000.

- Fixed assets: ABC Co project to purchase new machinery for $120,000 in November.

- Interest payments: The interest payment of $15,000 is due to be paid in December.

- Principal loan repayments: ABC Co has a schedule of $25,000 repayment of principal of a loan from bank in December.

- Cash dividend payments: ABC Co has plan to pay dividend to its shareholders of $30,000 in October.

- Repurchases or retirements of stock: There is no repurchase or retirement of stock expected from October to December 20X9.

From the information above, we can prepare the cash disbursements projection as below:

Below is the summary of data given in the illustration above:

Purchases: The purchases data above came from the 70% of total sales that we illustrated in cash receipts projection above. For instance, $210,000 in October came from 70%*300,000 and so on.

Cash purchases: The cash purchases in the illustration above came from the 20% of total purchases in each month. For instance, $42,000 in October above came from 20%*210,000.

Payments of AP: The payments of accounts payable are summarized into two lags as follow:

- Lagged 1 month: This represents the 60% of payment on the purchase of previous 1 month. $63,000 in September came from 60% of purchases in August (105,000*60%) while $147,000 came from 60% of purchases in September and so on.

- Lagged 2 month: This represents the last 20% of payment on the purchase of previous 2 months. From the illustration above, $21,000 came from 20% of purchases in August (105,000*20%) while $49,000 came from 20% of purchases in September (245,000*20%) and so on.

Wages and salaries: These amount came from the addition of fixed salary of $8,000 per month with the 10% of sales for each month. For instance, $38,000 in October came from (8,000 + 10%*300,000) and so on.

Step 3 – Incorporate the Cash Receipts and Cash Disbursements Projections

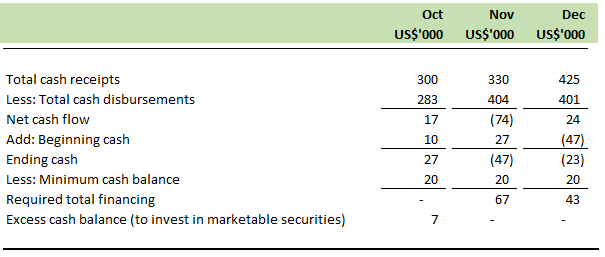

From step 1 and step 2 above, we can summarize the cash budget as follow:

From the illustration above, we can briefly describe as follow:

- Beginning cash: We assume that the beginning cash balance in October is $10,000. Thereafter, the ending balance of October becomes the beginning balance of November and so on.

- Minimum cash balance: We assume that the minimum cash balance for ABC Co is set at $20,000 each month.

- Required total financing: This is commonly from the notes payable. If ABC Co does not have enough ending cash balance at the end of each month above the minimum cash balance, then ABC Co will need to finance through notes payable. In November, the ending cash balance is at negative of $47,000. Thus, in order to maintain minimum balance of $20,000, ABC Co shall need to finance through notes payable of $67,000 ($47,000 negative cash balance plus $20,000 of minimum cash balance).

- Excess cash balance: The excessive cash balance of $22,000 in October after accounting for the minimum cash balance can be invested in the marketable securities.

Limitation of Cash Budget

There are several limitation of cash budget as follow:

- Involve estimations and assumptions

Cash budget involves a lot of estimations and assumptions. These estimations and assumptions might not be correct. For instance, ABC Co estimated that 60% of credit sales could have been collected in the following 1 month and this estimation or assumption has been used throughout the cash budget process. This might not be in the case in actual collection.

- Possibility of manipulation

Cash budget is easy to be manipulated by the manager responsible for cash budgeting process. To have a desired cash budget position, manager may overstate the expected cash receipts through increasing projected sales and underestimate expenses. This is because manager is rewarded by a good performance of cash budget.

- Lack of non-financial Factors

When preparing the cash budget and in case of financing need, manager would estimate cost of financing facility to factor in the cash budget. Typically, lower interest would be considered and accounted for in the cash budget from one bank. However, they fail to account for other non-financial factors such as better customer experience or many other benefit of entering into financing arrangement with other banks.