What is Long Term Notes Payable?

The long-term note payable is an obligation requiring a series of payments to the lender or issuer. Similar to bonds, the notes are typically issued to obtained cash or assets. However, the notes payable are typically transacted with a single lender; for instance, a bank or financial institution.

In this article, we focus on the accounting for long-term notes payable. This includes the journal entry for the initial recognition as well as subsequent installment payments and accrued interest expense.

How to Account for Long Term Notes Payable

Theoretically, the accounting for long-term notes payable is similar to the accounting for bonds payable. At the initial recognition, the notes are recorded at the face value minus any premium or discount or simply at its selling price. At subsequently, the accrued interest expense shall be carried before the installment is made to the lenders.

Initial Recognition of Long Term Notes Payable

As mentioned above, at the initial recognition, the long-term notes payable are recorded at its selling price or at its face value minus any discount or premium on the notes. For simplicity, we will illustrate only the notes sold at their face value. There are typically two methods of payment pattern on the notes payable. These are accrued interest plus equal principal payment and equal payments.

Let’s assume that ABC Co has obtained a note from a commercial bank to borrow $50,000 in order to buy renovate its building. The note is at an interest of 8% with the installment of six annual payments on both principal and interest.

From the example above, at the initial recognition, below is the journal entry to record the notes payable:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $50,000 | |

| Notes payable | $50,000 | |

| (To record the borrowing of $50,000) |

Subsequent Accrued Interest Expense and Payment

Subsequently, after initial recognition, the accrued interest and principal payment need to take into account. As mentioned above, there are two payment patterns on the notes payable. The first one is with the accrued interest plus equal principal payment and the second one is with the equal payments (The sum of both interest and principal).

Accrued Interest plus Equal Principal Payments

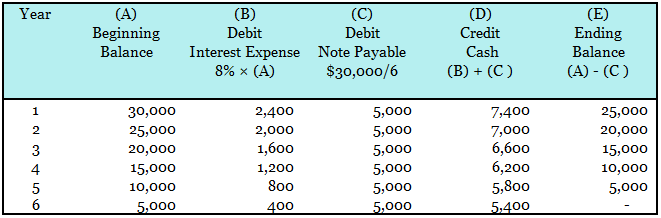

With this option, the principal installment is equal through the term of the notes leaving the interest expense reduce gradually until the end of the term. From the example above, we can produce the schedule of the installment as follow:

As you can see from the table above, the annual principal payment is equal to $5,000 while the interest keeps reducing in proportion to the reduction of principal.

Below is the journal entry for the interest expense and principal payment. This is assumed that the payment is exactly at the month-end.

| Account Name | Debit | Credit |

|---|---|---|

| Interest expense | $2,400 | |

| Notes payable | $5,000 | |

| Cash | $7,400 | |

| (To record the installment of notes payable) |

At the end of year 6, the principal will be zero. Below is the journal entry to record the final payment of notes payable at the end of year 6:

| Account Name | Debit | Credit |

|---|---|---|

| Interest expense | $400 | |

| Notes payable | $5,000 | |

| Cash | $5,400 | |

| (To record the final installment of notes payable) |

Equal Payments

With equal payments, the principal installments vary from year to year. The sum of interest and principal which is the total payment is equal from year 1 to year 6.

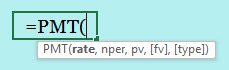

In this method, we need to calculate the total payment by simply using the PMT formula in Excel below:

Where:

PMT is the annual equal payment

Rate is the interest rate of the notes

Npr is the number of periods

PV is the total of the notes at the initial recognition

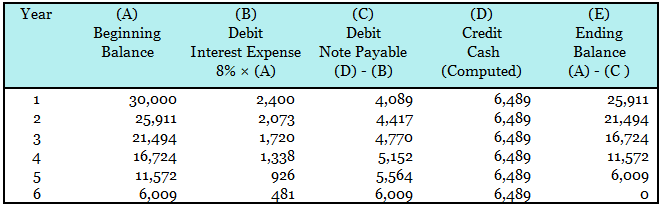

Thus, by inserting the information from the example above, we get the total annual payment of $6,489 equally. Therefore, we can produce the schedule of the notes payable as below:

From the above table, the annual principal payments vary from year to year. In year 1, the principal payment is only $4,089 while the final principal payment at the end of year 6 is $6,009.

We can record the journal entry of the installment of the notes payable for year one as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Interest expense | $2,400 | |

| Notes payable | $4,089 | |

| Cash | $6,489 | |

| (To record the first installment of notes payable) |

At the end of year 2, the journal entry of the notes payable is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Interest expense | $2,073 | |

| Notes payable | $4,417 | |

| Cash | $6,489 | |

| (To record the second installment of notes payable) |

By continuing the journal entry like this, at the end of year 6, the journal entry of the long term notes payable is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Interest expense | $481 | |

| Notes payable | $6,009 | |

| Cash | $6,489 | |

| (To record the final installment of notes payable) |

Summary

The accounting for long-term notes payable is divided into two parts; initial recognition and subsequent payment of interest and principal. At the subsequent payment of interest and principal, there are further two options or patterns; equal annual payment or equal annual principal plus interest expense.