When a bond is issued, the corporation or company that issued the bond needs to maintain proper accounting transactions. The proper journal entry for bonds is very important. The journal entry for bond issuance varies depends on the type of issuance; whether it is issued at par, at a premium, or a discount.

In this article, we cover the journal entry for bond issuance. This includes the journal entry for bonds issued and sold at par, journal entry for bonds issued at premium, and journal entry for bonds issued at discount.

What is Bond?

Before jumping to detail, let’s understand the basic concept of the bond. Bond is one type of long-term financing. The bondholders have the right to receive interest as stated on the bond certificate as well as the principal at the maturity date. There are various types of bonds. These include secured bonds, unsecured bonds, term bonds, serial bonds, registered bonds, bearer bonds, convertible bonds, and callable bonds, etc… The detail of each type of bonds is covered in other articles.

Journal Entry for Bonds

As mentioned above, the journal entry for bond issuance varies depends on whether the bond is issued at par, at discount, or a premium. In the below section, we cover the journal entry for each type of issuance.

Journal Entry for Bond Issuance at Par

When the bond is issued at par, the cash receipt from the bond issuance is equal to the par or face value of the bond. That means the market rate is equal to the par value.

The journal entry for bond issued at par is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | XXX | |

| Bonds Payable | XXX | |

| (Sold bonds at par) |

Each semiannually or annually depends on the bond contract, the journal entry for interest payment of bonds issued at par is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bond interest expense | XXX | |

| Cash | XXX | |

| (Paid bond interest expense) |

At the maturity date, the corporation or company that issued the bonds needs to payment both the last interest and principal of the bonds. Below is the journal entry for payment of principal bonds:

| Account Name | Debit | Credit |

|---|---|---|

| Bonds payable | XXX | |

| Cash | XXX | |

| (Paid bond principal at maturity) |

Example

In order to illustrate how the bonds issued and sold at par is recorded, let’s go through the example below.

Let’s suppose, ABC Co has received the authorization to issue $500,000 of 10%, 20-year bonds. This bond issuance will take place on January 01, 2020, and the last maturity date will be on December 31, 2039. The bonds will pay interest semiannually each year; June 30 and December 31.

From the example above, the journal entry for bond issued and sold at par is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $500,000 | |

| Bonds Payable | $500,000 | |

| (Sold bonds at par) |

From the example above, the bond issuer will pay interest semiannually at 10%. The semiannual interest payment is calculated as follow:

Semiannual interest payment = $500,000 × 10% × ½ = $25,000

Therefore, the journal entry for semiannual interest payment is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bond interest expense | $25,000 | |

| Cash | $25,000 | |

| (Paid bond interest expense) |

This interest payment will start from June 30, 2020, until December 31, 2039.

At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders.

The journal entry for repayment of bond principal is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bonds payable | $500,000 | |

| Cash | $500,000 | |

| (Paid bond principal at maturity) |

Thus, at the end of December 31, 2039, ABC Co will fully pay all the principal and interest of the bonds. The bonds payable will be removed from the Balance Sheet of the company.

Journal Entry for Bond Issued at Discount

When a company issues bonds and sells at the price lower than the market rate, it is called discount bonds. This means that the issued price is lower than the par value of the bonds.

In accordance with the GAAP, the discount on bonds is recorded separately from the bonds payable account. This discount on bonds payable account is the contra account of the bonds payable account. The discount on bonds payable is deducted from the par value to arrive at the carrying value of the bonds.

The journal entry for bonds issued at discount is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | XXX | |

| Discount on bonds payable | XXX | |

| Bonds payable | XXX | |

| (Sold bonds at discount) |

When bonds are issued and sold at discount, the interest expense will need to be calculated and recorded based on either the straight-line method or effective interest method. This is called the amortization of bond discount.

In this article, we will illustrate only the straight-line method for amortizing the discount bonds.

Below is the journal entry for the amortization of bond discount to record the interest payment and interest expense:

| Account Name | Debit | Credit |

|---|---|---|

| Bond interest expense | XXX | |

| Discount on bonds payable | XXX | |

| Cash | XXX | |

| (Paid bond interest expense) |

The discount on bonds payable is treated as an additional interest expense on the bonds. Thus, the total interest on discount bonds is equal to the difference between the sum of principal and interest minus the market value of the bond at the date of issuance or the value of discount bonds. Then, this total interest shall need to divide by the total number of periods until the maturity date of the bonds in order to recognize the interest expense equally for each period. This is called the straight-line method of amortization of bond discount.

Example

Let’s assume that ABC Co issues bonds at a discount of $92,640.50 on January 01, 2020. The total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity of 5 years.

From the example above, the total discount on bonds payable is $7,359.50 ($100,000 – $92,640.50). Thus, at the date of issuance, the journal entry for bond issued at discount is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $92,640.50 | |

| Discount on bonds payable | $7,359.50 | |

| Bonds payable | $100,000 | |

| (Sold bonds at discount) |

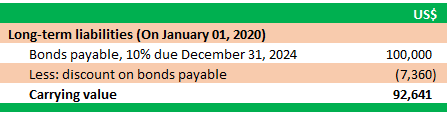

As the discount on bonds payable account is the contra account, the extracted Balance Sheet presentation for the bond issuance is as follow:

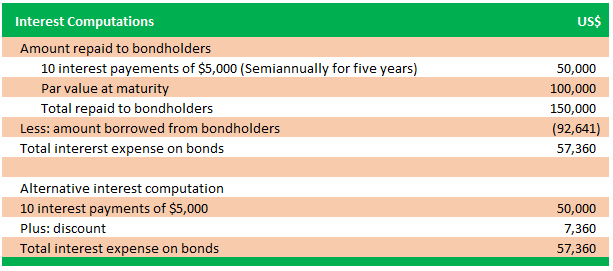

The total interest on the bonds is computed as per the table below:

As mentioned above, as per the straight-line method, the amortization of bond discount is calculated by dividing the total interest on bonds by the total number of periods until the maturity date.

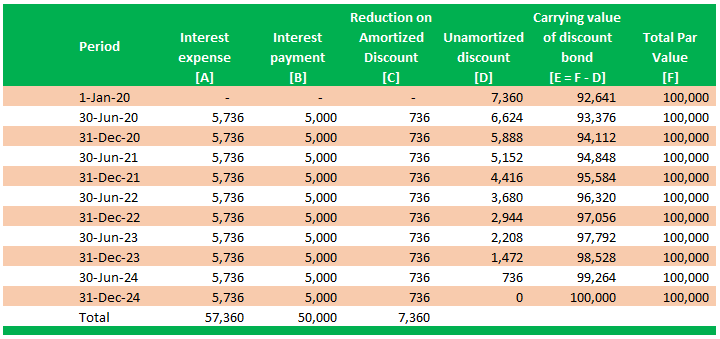

Thus, the amortization of bond discount for each period is $5,736 ($57,360/10). Before we illustrate the journal entry for bonds issued at discount, let’s see the table below illustrates the straight-line amortization of interest expense together with the breakdown of unamortized discount as well as the carrying value of the discount bond at the end of each period.

As you can see, during the bonds’ life, the unamortized discount gradually decreases by $736 ($7,359.50/10). In contrast, the carrying value of the discount bond gradually increases by $736 as well until the maturity date. At the maturity date, the total carrying value equal to the par value of the bonds while the discount on bonds becomes zero.

Therefore, we can record the journal entry for bond issued at discount as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bond interest expense | $5,736 | |

| Discount on bonds payable | $736 | |

| Cash | $5,000 | |

| (Paid bond interest expense) |

This journal entry remains the same for each interest payment. The total discount on bonds payable at the maturity date as a result of the journal entry for each periodic payment above will be zero.

At the maturity date, the journal entry for the repayment of discount bonds is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bonds payable | $100,000 | |

| Cash | $100,000 | |

| (Paid bond principal at maturity) |

Journal Entry for Bond Issued at Premium

When a company issues bonds and sells at the price higher than the market rate, it is called premium bonds. This means that the issued price is higher than the par value of the bonds.

The same as discount bonds, in accordance with the GAAP, the premium on bonds is also recorded separately from the bonds payable account. The premium on bonds payable is added to the par value to arrive at the carrying value of the bonds.

The journal entry for bonds issued at premium is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | XXX | |

| Premium on bonds payable | XXX | |

| Bonds payable | XXX | |

| (Sold bonds at premium) |

When bonds are issued and sold at a premium, the interest expense will need to be calculated and recorded based on either the straight-line method or effective interest method. This is called the amortization of bond premium.

In this article, we will illustrate only the straight-line method for amortizing the premium bonds.

Below is the journal entry for the amortization of bond premium to record the interest payment and interest expense:

| Account Name | Debit | Credit |

|---|---|---|

| Bond interest expense | XXX | |

| Premium on bonds payable | XXX | |

| Cash | XXX | |

| (Paid bond interest expense) |

The premium on bonds payable is treated as an adjunct liability account. It is also called accretion of a liability account. Thus, the total interest expense on premium bonds is equal to the difference between the sum of principal and contracted interest minus the market value of the bond at the date of issuance or the value of premium bonds. Alternatively, the total interest expense to be presented in the income statement is calculated by taking the contracted interest minus the premium on bonds.

The same as discount bonds, the total interest shall need to divide by the total number of periods until the maturity date of the bonds in order to recognize the interest expense equally for each period. This is called the straight-line method of amortization of bond premium.

Example

Let’s assume that ABC Co issues bonds at a discount of $116,225.40 on January 01, 2020. The total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity of 5 years.

From the example above, the total premium on bonds payable is $16,225.40 ($116,225.40 – $100,000). Thus, at the date of issuance, the journal entry for bond issued at premium is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $116,225.40 | |

| Premium on bonds payable | $16,225.40 | |

| Bonds payable | $100,000 | |

| (Sold bonds at premium) |

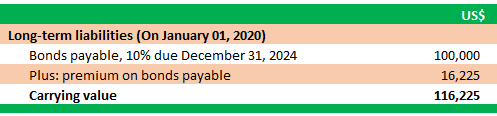

As the premium on bonds payable account is an adjunct liability account, the extracted Balance Sheet presentation for the bond issuance is as follow:

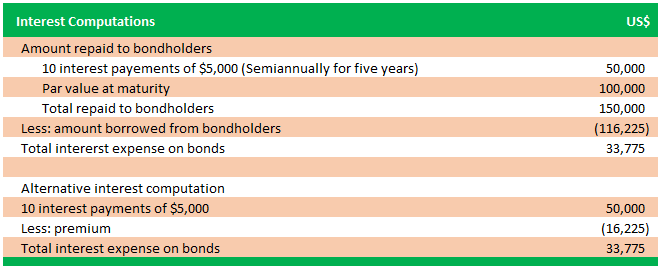

The total interest on the bonds is computed as per the table below:

As mentioned above, as per the straight-line method, the amortization of bond premium is calculated by dividing the total interest on bonds by the total number of periods until the maturity date.

Thus, the amortization of bond premium for each period is $1,623 ($16,225.40/10).

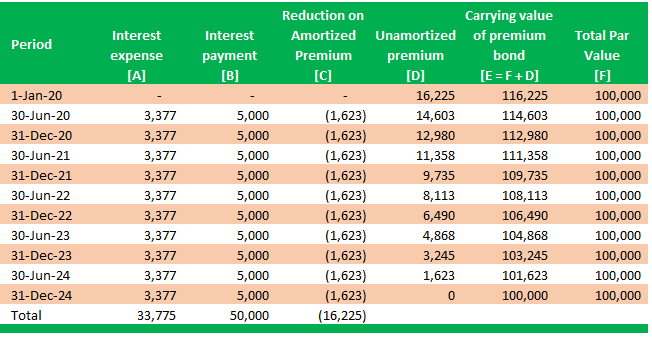

Before we illustrate the journal entry for bonds issued at premium, let’s see the table below illustrates the straight-line amortization of interest expense together with the breakdown of unamortized premium as well as the carrying value of premium bond at the end of each period.

As you can see, during the bonds’ life, the unamortized premium gradually decreases by $1,623 ($16,225.40/10). In contrast, the carrying value of the premium bond gradually decreases by $1,623 as well until the maturity date. At the maturity date, the total carrying value equal to the par value of the bonds while the premium on bonds becomes zero.

Therefore, we can record the journal entry for bond issued at premium as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bond interest expense | $3,377 | |

| Premium on bonds payable | $1,623 | |

| Cash | $5,000 | |

| (Paid bond interest expense) |

This journal entry remains the same for each interest payment. The total premium on bonds payable at the maturity date as a result of the journal entry for each periodic payment above will be zero.

At the maturity date, the journal entry for the repayment of premium bonds is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Bonds payable | $100,000 | |

| Cash | $100,000 | |

| (Paid bond principal at maturity) |

Conclusion

The accounting treatment for issuing bonds is different depending on each type of issue. These include the bonds issued at par, at a premium, and at discount. For journal entries of bonds issued at premium and discount, the amortization of interest expense should be carried out in order to spread the interest expense over the period of the bonds until the end of the maturity date.