What is Depreciation?

In accounting, depreciation is an expense account to record the allocation of the cost of fixed assets or non-current assets over the useful life or life expectancy of the assets.

The depreciation is calculated and recorded as an expense in the profit or loss statement. It is a non-cash transaction; therefore, when we calculate the EBITDA, we typically add back to the EBIT.

When recording this expense, we use another account called accumulated depreciation. The accumulated depreciation is a contra account of fixed assets and the balance is carried forward throughout the life expectancy. The accumulated depreciation is deducted from the cost of the assets to find the net book value of the fixed assets.

This expense is presented in the income statement while the accumulated depreciation is presented in the Balance Sheet as the contra account of the fixed assets.

How to Calculate Depreciation?

To calculate the depreciation, we can use four methods. These are the straight-line method, double declining balance method (DDB), Sum of the Year Digit method (SYD), and Unit of Production method.

As we have covered in detail the four depreciation methods, in this article we just simply illustrate the calculation by using the straight-line method and then jump to the accounting entry which is our key focus in this article.

Let’s assume that ABC Co bought machinery for its manufacturing production of $50,000. The machinery has its useful life or life expectancy of 5 years. At the end of 5 years, the machinery can be sold at $1,000.

To calculate the depreciation by using the straight-line method, we simply divide its cost less scrap value by the total number of year as per the formula below:

Depreciation = (Cost – Scrap Value)/Useful Life

From the example, the total cost of the machinery is $50,000, the scrap value is $1,000 and the useful life is 5 years.

Therefore, we can calculate this expense of the machinery as follow:

Depreciation = ($50,000 – $1,000)/5 = $9,800

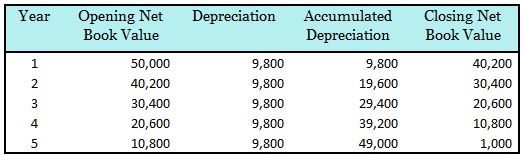

Below is the summary table over the useful life of the machinery:

The net book value of $1,000 at the end of year 5 is the scrap value that can be sold. This scrap value can be disposed and this disposal is covered in another article on disposal of fixed assets.

Journal Entry for Depreciation

The journal entry to record this expense is straightforward. We simply record the depreciation on debit and accumulated depreciation on credit.

Journal Entry for year 1

In year 1, the journal entry is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Depreciation (Income Statement) | $9,800 | |

| Accumulated Depreciation (Balance Sheet) | $9,800 | |

| (To record depreciation for year 1) |

Journal Entry for year 2

In year 2, the depreciation is the same as in year 1. The journal entry for year 2 is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Depreciation (Income Statement) | $9,800 | |

| Accumulated Depreciation (Balance Sheet) | $9,800 | |

| (To record depreciation for year 2) |

In year 2, the total accumulated depreciation is $19,600. This is from the sum of depreciation for both year 1 and year 2.

Journal Entry for year 3

In year 3, the depreciation is the same as in year 1 and year 2. The journal entry for depreciation for year 3 is as follow:

| Account Name | Debit | Credit |

|---|---|---|

| Depreciation (Income Statement) | $9,800 | |

| Accumulated Depreciation (Balance Sheet) | $9,800 | |

| (To record depreciation for year 3) |

In year 3, the total accumulated depreciation is $29,400. This is from the sum of accumulated depreciation in year 2 plus the depreciation in year 3 itself.

By continuing this process, the accumulated depreciation at the end of year 5 is $49,000. Therefore, the net book value at the end of year 5 is $1,000 which is the estimated scrap value.

Conclusion

The journal entry of spreading the cost of fixed assets is very simple and straightforward. We simply record the depreciation on debit and credit to accumulated depreciation. At the end of useful life, the net book value of the asset equal to the cost minus accumulated depreciation.