Introduction

Large firms around the world produce millions of products each month. Every product we buy is then the sum of the parts of several by-products. Let’s take an example of a garment business; it manufactures different garment wears like Shirts. That manufactured shirt utilizes raw cotton, stitching threads, sewing machines, colors, and skilled labor hours. What if the manufacturing facility runs out of the raw cotton, or the sewing machines get malware? The whole system would come to haul. We call this as “constraint” in the manufacturing process. Skilled labor in our example is the most precious asset or raw cotton; these are both simple examples of “bottlenecks”…

Definition of Throughput Accounting

“Throughput Accounting is a technique where the primary goal is to maximize throughput while simultaneously maintaining or decreasing inventory and operating costs” CIMA Official

As the definition states throughput accounting is a system that maximizes the inputs, works to decrease the limiting factors, and maximizes the outputs. We calculate throughput as:

Throughput = Sales revenue – Direct Material Costs

What is the Theory of Constraints (TOC)?

In order to understand the throughput accounting, we need to understand the theory of constraints first. This is because in a production process, the maximization of throughput can be done when we reduce the bottlenecks.

Typically, we can increase throughput in 02 ways, either increase the sales or reduce the direct material costs. We will cover this in detail in the later section. In every manufacturing facility, there are some constraints or limitations e.g. maximum available skilled labor, Machine capacity, or availability of raw material. Basically, we call these limiting factors as “bottlenecks” in throughput accounting. The Theory of constraints (TOC) or throughput accounting (TA) is a system that tries to maximize the utility of these scarce resources, which in turn will increase the revenue or throughput.

Or simply, the approach where the aims of each business are to maximize sales revenue less direct material, costs. Commonly, each business focuses on bottlenecks which act as constraints in order to maximize the throughput.

According to Goldratt, the theory of constraints is summarized into five-step approach as follow:

Step 1: Identification of Constraints (Bottleneck Resource)

The bottleneck or constraint can either be an internal issue i.e. available skilled labor hours or an external factor i.e. supply of raw material from the supplier. The first step is to identify the constraints in the system.

Step 2: Decide how to Exploit the Identified Constraints in Order to Maximize Throughput

Or how to Maximizing the bottleneck resources

Once we have identified the bottleneck or constraint, the management must make sure to maximize that scarce resource. For example, if the bottleneck is raw material the machine and labor force will sit idle.

Step 3: Subordinate and Synchronize everything else to the decision made in Step 2

Step 4: Elevate the performance of constraints or Eradicate the bottleneck

Steps must be taken to elevate the bottlenecks, for example, if there is key machinery in the manufacturing facility and it runs out of date then there is no alternative but to purchase a new one.

Step 5: If the constraint has shifted during the above steps, go back to step 1. In this step, we also call continuous improvement.

Once a bottleneck is removed from the system, the new bottleneck must be identified and the process continues.

Please note that each entity shall not allow to have a new constraint.

The Theory of Constraints and throughput accounting both focuses on the continuous process improvements, which is in close conjunction with the theory of JUST IN TIME.

Example of Constraints Theory

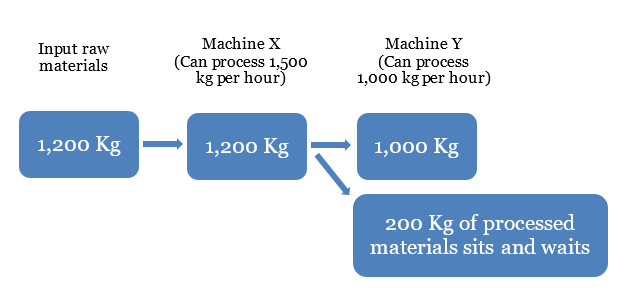

Suppose ABC Co is a manufacturing company and has two types of machine. Machine X and Machine Y. Machine X can process 1,500 kg of raw material per hour. Machine Y has the capacity to process 1,000 kg per hour. After material processed machine X, it need to go through another process in Machine Y.

There are input materials to be processed for 1,200 kg during the production processing.

Thus, the 1,200 kg input materials can be processed 100% by machine X as its capacity is up to 1,500 kg. However, machine Y can only process up to 1,000 kg; thus 200 kg must be wait until machine Y process the 1,000 kg.

In this case, we consider machine Y as a bottleneck resource.

The below graph best describe the bottleneck of the above example:

Let’s see another example focusing on the step 4 – Elevate the performance of constraint.

Suppose XYZ Co has three types of machine; machine type A, B and C and all these types of machine produce only one single product. The current maximum output capacity of each types of machine per week is as follow:

- Machine type A can produce 2,100 units

- Machine type B can produce 1,800 units

- Machine type C can produce 1,700 units

The company is considering the purchase of additional machine type C since the existing one can produce only up to 1,500 units. The cost of this machine is at US$9 million and this machine would increase the level of output of 700 units in addition to the current output level per week. In addition, the company is also able to purchase an additional of machine type B at a cost of US$7 million. This would increase the additional output of 500 units per week.

The increase of the weekly output capacity as result of the additional purchase of the machine is valued at US$60,000 per unit of additional output.

Thus, what should the company decide? Should XYZ Co buy only machine type C or either both type C and B?

Solution:

Among the three types of machine above, machine type C is the bottleneck resource as it has a limited capacity only 1,700 units per week lower than machine type A and machine type B.

In this case, even though XYZ wants to purchase machine type B, it will make no sense as machine type B is not a bottleneck resource. However, XYZ can consider to purchase machine type C first and then follow by machine type B later.

- If XYZ Co purchase only machine type C

If XYX Co decide to purchase machine type C, thus the revised output capacity will be as follow:

- Machine type A: 2,100 units

- Machine type B: 1,800 units

- Machine type C: 2,400 units

Thus, if XYZ decides to elevate the capacity of Machine type C, then machine type C will be no longer a bottleneck resource as it revised capacity jump to 2,400 units per week higher than machine types A and machine type B.

The new bottleneck resource would be machine type B as its capacity is restricted to only 1,800 units per week. Based on current level capacity, machine type B has capacity more than machine type C for 100 units per week.

We can calculate the benefit of purchasing machine type C as result of increasing the level of output capacity as follow:

Total Benefit = (100 units *US$60,000) – US$9 million = -3,000,000 (net loss)

- If XYZ Co purchase machine type C and then machine type B

If XYZ decide to purchase additional of machine type C and machine type B at the same time, then the revised output level would be as follow:

- Machine type A: 2,100 units

- Machine type B:2,300 units

- Machine type C: 2,400 units

Then, machine types A becomes a new bottleneck resource as it has a restricted output capacity of only 2,100 units per week, which 300 units higher than the current output capacity level on machine type B.

Hence, the total profit would be as follow:

Total Profit = (300 units*60,000) – US$9million – US$7 million = +2,000,000 (net profit)

Thus, we can conclude that the combination of the additional purchase of machine type C and machine type B would result in a profit of US$2 million. While the additional purchase of machine type C alone would bring XYZ Co to a loss of US$3 million.

However, the new bottleneck resource now after the additional purchase of machine type C and machine type B is the machine type A. This is because machine type A has an output capacity limited to only 2,100 units per week.

What are Bottlenecks in the Production Process?

A bottleneck can be any limiting factor in a manufacturing facility or in the service industry. Any factor when reached to the maximum capacity can affect the production rate. Following are a few types of bottlenecks:

- Machine hours

- Labor hours

- Availability of raw material

- A particular component or product e.g. software for a digital marketing agency

In addition, there are also bottleneck in other areas such as below:

- The selling resources where there is an insufficient number sale representative

- When there is any uncompetitive selling price is also considered a bottleneck

- There is a lack of quality of the product as well as its reliability

- Where there is a lack of reliable material suppliers

- When there is a lack of resources to deliver on time to any particular customers.

In this article, we will focus more on the bottleneck in the production. Commonly, we can also call the bottleneck resource as binding constraint.

Throughput Accounting and the JUST IN TIME Theory

Just in time theory is a manufacturing practice that stresses the input procurement when and where needed. It reduces inventory holding costs and increases system efficiency. The Throughput Accounting process identifies the scarcest resources; JIT maximizes the use of those resources. The incorporation of both theories implies:

- Improve the system process efficiencies by eliminating wastes

- Timely procurement of the inputs or raw materials

- Minimum inventory holding

- Maximizing the bottleneck resource usage e.g. the bottleneck machine

In practical terms both JIT and TA system aim for similar approaches, these two methods complement each other. As in JIT theory, the TOC also recognizes that there will always be options for waste reductions. For example replacing old machines with new ones, hiring skilled staff with increased capacity, procurement of better quality raw materials, and so on…

Throughput Accounting Performance Measurement

The efficiency of any theory cannot be judged unless measured properly, which also provides means for continuous improvements that are at the core of the throughput accounting.

There four main ratios to measure the throughput effectiveness:

- Total Profit per Day = Total Throughput Contribution – Conversion Costs

- Throughput or Return per Factory Hour = Throughput per Unit/Bottleneck Resource Time for Product

- Cost per Factory Hour = Total Factory Costs /Total Bottleneck Time Available

- Throughput Accounting Ratio or TPAR Ratio = Return per Factory Hour / Cost per Factory Hour

The TPAR is directly proportional to the return per factory hour, which in turn increases when throughput per unit is increased. TPAR ratio is attained by dividing the input resources by the costs incurred to procure those resources. For accounting purposes, if the TPAR > 1, it means that the facility is utilizing its resources efficiently and the Return is in excess of the costs incurred.

Example of Performance Measures of Throughput Accounting

ABC Co is a manufacturing company of computer components. To be in compliance with the health and safety regulations, one of its processes of production can only be operated eight hours per day. ABC Co has an hourly capacity of this process to produce 600 units per hour. ABC Co can sell each computer component at US$120 while the material cost per unit is US$45. The manufacturing costs to produce the computer component on the daily basis are at US$160,000. This cost excludes the direct material costs. ABC Co is able to produce 3,500 units per day for the computer components.

Required:

Calculate the throughput accounting performance measures as follow:

- Total profit per day

- Return per Factory Hour

- Cost per Factory Hour

- Throughput Accounting Ratio

Solution:

Based on the above example, we can calculate as follow:

- Total Profit per Day

The total profit per day can be calculated by using the formula below:

Total Profit per Day = Total Throughput Contribution – Conversion Costs

Where: Throughput Contribution = (Selling Price per Unit – Direct Material Costs) * Unit Produced

= (120 – 45)* 3,500

= US$262,500

Conversion Costs is the factoring costs = $160,000

Hence, Total Profit per Day = US$262,500 – US$160,000

= US$102,500

Therefore, the total profit per day is US$102,500.

- Return per Factory Hour

The return per factory hour is calculated by using the formula below:

Return per Factory Hour = (Sales – Direct Material Costs)/Usage of Bottleneck Resource in Hours (Factory Hours)

Where: Contribution per unit = US$120 – US$45 = US$75

Usage of Bottleneck Resource in Hours = 1/600

Thus, Return per Factory Hour = US$75/(1/600) = US$45,000

Therefore, the return per factory hour for the computer components is US$45,000.

- Cost per Factory Hour

The cost per factory hour is calculated by using the formula below:

Cost per Factory Hour = Total Factory Costs / Total Bottleneck Time Available Hour

Where: Total Factory Costs = Conversion Costs = US$160,000

Total Bottleneck Time Available = 8 hours per day

Hence, Cost per Factory Hour = US$160,000 / 8 = US$20,000 per hour

- Throughput Accounting Ratio or TPAR Ratio

The throughput accounting ratio or TPAR Ratio is calculated by using the formula below:

TPAR Ratio = Return per Factory Hour / Cost per Factory Hour

Where: Return per Factory Hour = US$45,000 as calculated in (b) above

Cost per Factory Hour is the conversion cost per factory hour = US$20,000 per Hour

Hence, Throughput Accounting Ratio or TPAR Ratio = US$45,000 / US$20,000 = 2.25

How to Improve Throughput Accounting Ratio?

A business can improve its throughput accounting ratio by considering to increase the throughput per bottleneck hour or to reduce the operating cost per bottleneck hour. In order to increase the throughput per bottleneck hour or reduce the operating cost per bottleneck hour, the following methods should be considered:

- A business can consider increasing the selling price for its product. This increase in selling price will result in an increase in throughput per unit thus increasing the throughput per unit of bottleneck resource.

- We can also consider reducing the direct material cost per unit. Reducing the material cost per unit will result in increasing the throughput per unit; thus increasing the throughput per unit of bottleneck resource.

- A business shall also consider reducing the expenditures to bring down the operating costs or factory costs in the production. By doing so, a business is able to reduce the operating cost per unit of bottleneck resources.

- Improve efficiency is another way of improving the throughput accounting ratio. When a business is able to improve its efficiency; especially for the production process, it will be able to increase the number of units of the products produced for each bottleneck hour. In this case, we assume that the operating cost per hour remains unaffected. Thus it will lead to an increase in throughput accounting ratio.

- Last but not least, a business can also improve its TPAR ratio by considering elevating the bottleneck. By elevating the bottleneck, a business would be able to have more hours available of the bottleneck resource. Typically, we assume that the throughput per unit of bottleneck remains unaffected. However, because the operating costs are all fixed costs while there are more bottleneck hours available; thus operating costs per bottleneck hour would reduce. Therefore, the TPAR ratio would improve accordingly.

Typically, when a business tries to improve the TA ratio by using the methods as described above, there would be adverse consequences as follow:

| Measures | Consequences |

|---|---|

| Increase the sales price per unit | Results in the demand for the product may fall. |

| Reduce material costs per unit; for example by changing materials and/or suppliers | Results in a lower quality of the material. In addition, bulk discounts may also be lost. |

| Reduce operating expenses | Results in lower quality as well as increasing the errors. |

Conclusion

Throughput only considers direct material costs to be variable while considering all other costs fixed in the short term. This is a difficult concept to apply practically, because other factors may also be variable costs e.g. labor cost per hour. The Throughput Accounting System focuses on increasing the “throughput” which only takes into account the direct material costs, it also stresses the best utilization of the “bottleneck” resources. TA like the Just in Time method considers continuous system improvements more important. This approach can be successfully applied in the short term, but many businesses cannot plan for the short term only. However, the focus on waste reduction, efficient use of scarce resources, and eliminating unnecessary costs are the key benefits of the Throughput accounting system.