Depreciation, amortization, and depletion are all cost allocation methods for different types of long-term assets owned by businesses. All of these are accounting terms with non-cash entries and effects on profits.

These accounting methods help companies follow the accrual accounting principles of matching entries.

Let us discuss what these terms and the key differences between them are.

What is Depreciation?

Depreciation is an accounting term that refers to the process of cost allocation of tangible assets.

The term depreciation is associated with the cost allocation of fixed and tangible assets owned by a business. Instead of allocating the full purchase price of the asset, it spreads the cost of the asset over an estimated period.

Depreciation for tax purposes requires the estimation of the useful life of an asset. Businesses using different classes of assets can estimate different depreciation rates as well.

Depreciation is used for both accounting and tax purposes. The accounting depreciation is used to allocate the cost of the asset over its useful life.

The tax depreciation is an expense for tax reporting purposes for the current period.

Both these terms are similar and work in the same way. The difference largely is between the usage for accounting and tax compliance purposes.

How Does it Work?

Depreciation helps businesses to spread the cost of large investments in fixed assets over several accounting periods.

If a business allocates the full cost of an asset purchase in a single year, it will affect its accounting practices and tax compliance adversely. Doing so would mean huge net losses in one year whereas a business may be profitable otherwise.

Hence, businesses use depreciation methods to spread the costs across several years. It helps them follow the matching principle of accrual accounting as well.

By depreciating tangible assets businesses would match the cost of depreciation against the profits generated from using these assets in the relevant accounting periods.

Depreciation is a non-cash item. It means there is no actual cash outflow for a depreciation expense. It is merely an accounting adjustment. However, it affects the net profit and hence tax payments of a business.

This practice also helps businesses to transfer the depreciation liability from the balance sheet to the income statement as an expense.

How to Calculate Depreciation?

Businesses can choose from one of the different depreciation calculation methods available. However, they must remain consistent throughout an accounting period and any changes should reflect consistently.

Straight Line

The company estimates the total useful life of an asset and salvage value. The salvage value is deducted from the purchase price of the asset and the remaining amount is divided by the number of years.

Declining Balance Method

The declining method calculates the depreciation charge like the straight-line method. However, it deducts the depreciation charge from the remaining value of the asset each year and continuously declines the value until it reaches zero.

Double Declining Method

The double-declining method is an accelerated depreciation method. It works the same way as the declining method but with a double depreciation charge each year.

Sum of the Years’ Digits

This method uses the sum of the years of the useful life of an asset to calculate the depreciation charge.

For instance, if the useful life of an asset is 4 years, the sum of the digit years will be 1 + 2 + 3 +4 = 10.

What is Amortization?

Amortization is an accounting term that refers to the cost allocation of intangible assets over several accounting periods.

It also refers to the process of lowering loan values periodically until maturity. Both terms are widely used by businesses.

Amortization follows the same principles and working methodology as depreciation. However, it is specifically associated with large intangible assets of a business.

Common examples of intangible assets amortized include goodwill, patents, trademarks, and copyrights.

How Does it Work?

Amortization is the same concept as depreciation. When businesses accumulate significant intangible assets, they need to allocate the costs of these assets periodically.

The other use of amortization is for loans used by a business. The process follows a loan repayment schedule over the loan term which is called the amortization schedule.

The amortization payments include a proportion of principal and another for interest payment. In the beginning, the principal amount is smaller as the outstanding loan amount is significant.

Gradually, the principal amount increases and the interest proportion decreases. However, the lenders usually set a fixed monthly installment schedule through this amortization process.

How to Calculate Amortization?

Amortization charge for intangible assets is calculated the same way as depreciation discussed above.

A business will first calculate the total value of intangible assets. Estimating the useful life of an intangible asset is harder than for tangible assets. Businesses can estimate a reasonable useful life and adjust from time to time.

Then, a business can use a similar method of calculating amortization as depreciation from one of the available methods including single line, declining method, double declining method, etc.

For loan amortization, the borrower will multiply the loan amount by the interest rate. Then, the amount will be divided by the number of years (the loan term).

Monthly installments can be calculated easily by dividing the yearly due amount by 12. Each month, the loan installment will reduce the loan balance until the maturity date.

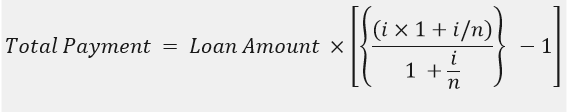

Typically, lenders provide the minimum monthly installment amount. Borrowers can calculate the monthly payment amount by using the following formula.

Here i= monthly interest rate and n = number of periods in months.

What is Depletion?

Depletion is an accounting term that refers to the cost allocation of natural resources owned or leased by a business.

In practice, depletion is also the same concept as depreciation and amortization. However, it is particularly linked with the cost allocation process of natural resources.

The depletion method is used by companies extracting natural resources like oil, gas, minerals, and metals. Businesses spent their resources to extract natural reservoirs.

Thus, authorities allow these companies to charge a tax-deductible expense for extracting these resources (depletion charge).

How Does it Work?

Companies acquiring rights to extract natural resources like oil, minerals, and timber need to estimate the total available resources.

These informed estimates can change over time though. Companies need to spend upfront investment to acquire these resources including lease payments, rights, and equipment expenses.

As companies extract and sell natural resources, they can claim their remaining resources are depleting. Hence, their future profits will deplete as well.

Therefore, they can claim a tax charge to compensate for these depleting resources. Similar to depreciation and amortization, the depletion charge is also a non-cash item on the financial statements.

There are four major types of costs for calculating the depletion charge.

Acquisition Costs

These costs refer to the leases or rights payments to extract natural resources. These are initial costs paid by a company and are usually paid upfront.

Exploration Costs

These costs include any expenses for digging, rigging, and extraction processes to use the acquired natural resources.

Development Costs

These costs may arise to construct additional development projects like building a road, tunnel, or wells to complete the extraction project.

Restoration Costs

These costs occur at the end of the project to restore the natural site. Often these are regulatory costs to avoid any environmental hazards.

How to Calculate Depletion?

There are two methods to calculate the depletion charge for a business.

Percentage Method

Companies can estimate a resource depletion percentage for their natural resources. This percentage is then multiplied by the gross yearly income of the company to calculate the depletion charge for the year.

For instance, if the yearly profit of the company is 1 million and it established a depletion percentage of 2%, then the yearly depletion charge will be $ 20,000.

Cost Method

The cost depletion method will require calculating the total resource endowment. It is the available resources (converted into a dollar amount) before extraction.

Also, the company will need to compute all costs to extract these resources. Then, the number of extracted units is multiplied by the depletion charge to calculate the yearly depletion cost.

Depreciation Vs Amortization Vs Depletion – Key Differences

Let us summarize the key differences and similarities between depreciation, amortization, and depletion methods.

| Description | Depreciation | Amortization | Depletion |

| Definition | A cost allocation method for tangible and physical assets. | A cost allocation method for intangible long-term assets. | A cost allocation process for natural resources. |

| Application | Tangible and physical assets | Long-term and intangible assets | Natural resources – owned or leased |

| Methods | Straight line, declining method Double declining method Sum of the years’ digits | Same as depreciation | Percentage depletion Cost depletion |

| Uses | Accounting and tax compliance. Non-cash entry | Accounting and tax compliance. Non-cash entry | Accounting and tax compliance. Non-cash entry |

Advantages of these Methods

- Spreads costs

- reduces tax liability

- shows accurate profitability

- Helps in long-term planning

Disadvantages of These Methods

- Non-cash entry with no cash outflow

- Requires adjustments for cash flows

- Subject to manipulation

- No standard deduction rates