A 10-column worksheet presents an overview of the account books of a company at the end of an accounting period. It can be prepared for any accounting period like any other financial statement.

A 10-column worksheet serves many purposes for a business. It can also be used to prepare financial statements and extract valuable financial information for business managers.

Let us discuss what is a 10-column worksheet, how it is prepared, and what are its key purposes for a business.

What is a 10-Column Worksheet?

A 10-column worksheet is a columnar file format that displays the summary of key accounting reports together.

It is prepared at the end of an accounting period by accountants and bookkeepers. It is only used for the convenience of the accountants and to summarize key accounts.

It includes five major financial accounts showing debit and credit for each, hence named the 10-column worksheet.

It serves as a link between accounting data and financial statements. Accountants can perform the reconciliation of accounts on this worksheet and remove any errors.

In short, a 10-column worksheet shows an informal summary of accounts of a company for a particular accounting period. It is not mandatory or part of the formal financial statements for any company.

Also, companies that have automated accounting systems often do not require this worksheet. However, it is still in use for companies using worksheets and working offline with their account books.

Structure of a 10 Column Worksheet

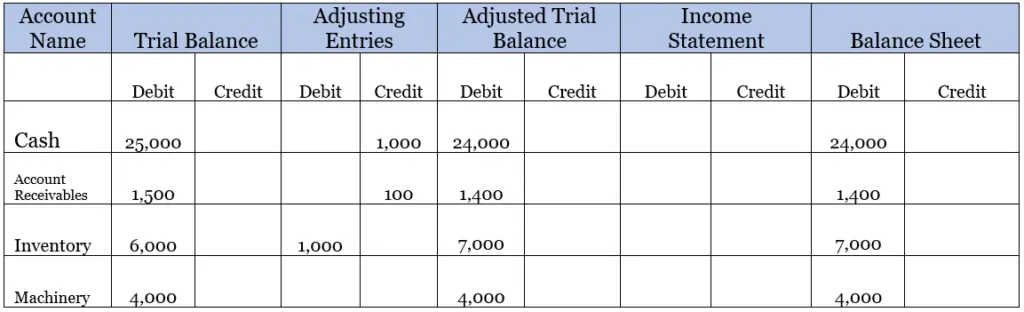

A 10-column worksheet comprises five major accounts with debit and credit entries. Therefore, it would have 10 columns for each worksheet, hence the name 10-column worksheet.

The five components of the 10-column sheet include:

- Trial Balance

- Adjustments for the end of the Accounting Period

- Adjusted Trial Balance

- Income Statement

- Balance Sheet

A formal column of serial number or account name is added before these major account sections. Each account has a debit and a credit column, therefore, 10 columns in total.

Trial Balance

Trial or unadjusted trial balance shows the ending balances of ledger accounts. The trial balance summarizes all ledger accounts at the end of an accounting period.

A business records each account on its general ledger. Each transaction is then recorded on the general ledger. The trial balance then shows the ending balance of debit and credit entries of each ledger account.

Adjustments to Trial Balance

A trial balance may contain discrepancies and errors. Often, general ledger accounts record transactions on or after the ending date of the accounting period.

Either way, a trial balance may need adjusting entries for one or several accounts. For accounting consistency, the 10-column worksheet records these adjusting entries.

Adjusted Trial Balance

As the name suggests, it is the adjusted trial balance of the ledger accounts. Once the adjusting entries are recorded, the updated trial balances are recorded separately.

All ledger accounts may not require adjusting entries. However, any adjustments are visibly shown through the adjusted trial balance in this worksheet.

Income Statement

This section shows the income statement accounts. Mainly the expense and revenue account summaries.

Like the traditional income statement, the debit and credit sides of income statement accounts in the 10-column sheet would not balance. The difference would occur due to a profit or loss of the business.

If the two sides are balanced, then the business would be in the break-even position.

Balance Sheet

This section shows the balance sheet account balances at the end of the accounting period. It will carry the assets, liabilities, and equity balances for the company.

Usually, a business would record the net profit or loss in the balance sheet section as well. Otherwise, the debit and credit sides of the balance sheet accounts would not balance.

How to Prepare the 10 Column Worksheet?

Let us first look at the format of the 10-column worksheet. It consists of 10 columns for each account for debit and credit entries plus one column for the account title or serial number.

Now let us consider some key steps in creating the 10-column worksheet.

STEP 01:

Before creating the worksheet, you’ll need to prepare the ledger accounts. Prepare all ledger account balances by the end of the accounting period or month-end.

STEP 02:

The second step is to create the 10-column worksheet in your MS excel or paper book. Create one column for account titles that will enlist all ledger accounts.

Then, create five major worksheet account columns. Divide all account columns into debit and credit columns. So, there will be 10 columns for the five major sections.

STEP 03:

Take the ending debit and credit balances of all ledger accounts and register them against each account column under the trial balance heading.

This step will prepare your unadjusted trial balances for the worksheet.

STEP 04:

Next, you’ll reconcile the ledger accounts as you do normally before the month-end preparations.

All adjusting entries should be recorded separately against the relevant account heading and under the “adjusting entries” section.

STEP 05:

The next simple step is to list the adjusted balances of the ledger accounts under the adjusted trial balance section.

This will prepare the adjusted trial balance for the current accounting period. It is the common reconciliation step that accountants would perform normally as well.

STEP 06:

The next step is to prepare the income statement. It means you’ll list down the income and expense accounts under this section.

The debit and credit sides will only be equal if the company is at the break-even point and makes no profit or loss.

If the credit side is greater than the debit side, it means the company has made profit. If the debit or the expense side is greater, then the company has incurred losses.

You’ll list the difference under the relevant section showing a profit or loss.

STEP 07:

Finally, you’ll prepare the balance sheet of the company. This step will list down all assets and liabilities of the company with the current balances.

Some companies carry over the profit or loss accounts to the balance sheet. It is the retained earnings section that accountants normally prepare in any balance sheet.

Purpose of 10 Column Worksheet in Accounting

A 10-column worksheet works for businesses following the double-entry bookkeeping system.

The primary purpose of this worksheet is to summarize all ledger account balances in one place. If a business does not use an automated accounting system, this worksheet can be very useful.

It eliminates the need of preparing trial balance, adjusting entries, and adjusted trial balance sheets separately. Accountants can prepare and present these working sheets at the same time.

Then, it serves an important purpose of reconciliation of the ledger accounts.

When the accountant prepares an adjusted trial balance, the errors and omissions are reconciled.

Once a 10-column worksheet is prepared and reconciled, it helps an accountant to present the income statement and the balance sheet.

Although it presents these statements in a different format, the purpose is served. Thus, a business can summarize its financial accounts at the same time and present them in a single 10-column worksheet.

A 10-column worksheet is not mandatory for all businesses. However, when prepared, it can serve as a source document for the company.

A source document presenting ledger accounts can be useful in the auditing process as well. Also, it can help the management extract key financial information for planning and monitoring purposes.

Is a 10-Columns Worksheet Mandatory for all Businesses?

A 10-column worksheet is not mandatory for all businesses. It is an optional source document that businesses can prepare for their utility.

Is a 10-column Worksheet Part of the Financial Statements?

It is not a formal part of the financial statements. However, businesses can prepare financial statements by using the data presented in a 10-column worksheet.

How Does a 10-Column Worksheet Classify Accounts?

A 10-column worksheet classifies accounts according to the ledger book. Unlike the income and balance sheet, it does not classify accounts by asset, liabilities, or equity sections.

Why Does Not the Balance Sheet Accounts Balance?

Account balances for the income statement and the balance sheet would show a difference in the 10-column worksheet.

The difference arises due to a profit or loss of the company. It is shown separately after totaling the account balances. When this balance is carried forward to the balance sheet, the account balances would show the same numbers.