Introduction

In the Statement of Financial Position or Balance Sheet, there are three main elements. These are assets, liabilities and equity. Assets are classified into two types, current assets and non-current assets.

Definition

Before going further to each element of the assets, let’s understand the key definition. Basically, we give definition of assets in many different ways and for many purposes. However, the characteristics of assets remain the same.

Accounting framework has defined the definition of assets as follow:

Asset is a resources controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity.

Similarly, according to the Financial Accounting Standards Board (FASB), the definition of asset is defined as follow:

Asset is the probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events.

From the two definitions above, even though the definitions are difference, however, we can summary the characteristics of asset as follow:

- Future economic benefit. This means that such assets will generate future benefit for the entity or organization.

- Control (refer to ownership). In order to count as asset, an entity need to have control over it. That means, we have the right to use such asset to generate future economic benefits or revenue for the entity.

- The transaction of purchasing or acquiring of such asset has already taken place.

Now we already know the definition of asset. So let’s dive in the elements or types of asset.

Types of Assets

Basically, we divide assets into two types, current assets and non-current assets. We present these two types in the statement of financial position separately.

Current Assets

Practically, we commonly classify current asset as the asset that has its useful life or life expectancy less than or equal to one year. Such asset is owned and controlled by an entity and we use it to generate probable future benefits that flow to the entity or company. Below are the example of current assets:

- Cash and cash equivalents,

- Trade receivable or Account receivable,

- Note receivable (Short term)

- Prepaid rent

- Prepaid insurance

- Inventory,

- Short term investment etc…

Non-Current Assets

We normally classify as non-current assets when such assets have useful life more than one year. We commonly call non-current assets are also known as fixed assets. Furthermore, non-current assets can be tangible or intangible in nature. Tangible assets are assets that we can see and touch. For instance, Land, building, and vehicle etc… In practice, we commonly call such assets as Property Plant and Equipment (PPE).

Intangible assets are those assets that we cannot or touch. For example, copy right, goodwill and trademark etc… Below are the example of non-current assets:

- Land and Building,

- Office equipment

- Computer equipment

- Office furniture

- Plant assets

- Intangible assets

- Biological assets etc…

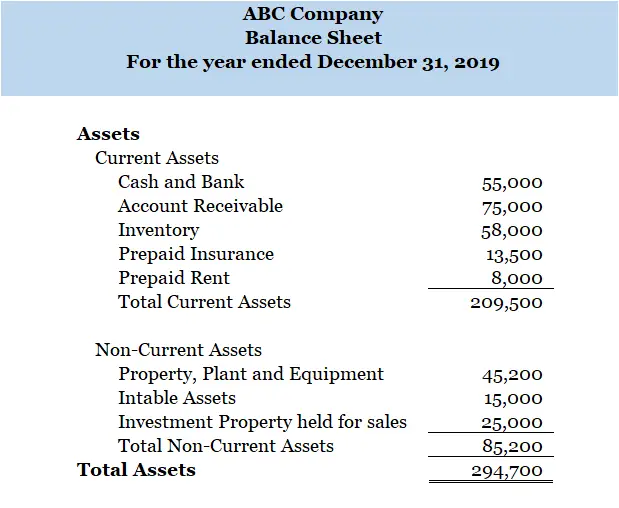

Below is the extract of Balance Sheet of ABC Company for the assets section.

Conclusion

In conclusion, there are two main types of assets namely current assets and non-current assets. We present these assets in the statement of financial position separately.