In an audit engagement, there are five threats that auditors may face that threaten their independence and objectivity. These threats can significantly limit the auditors’ freedom in forming an opinion and providing an unbiased judgment. Therefore, auditors need to identify these readily and safeguard against them. If they don’t do so, they face the risk of providing a biased opinion, leading to further problems.

All of these five threats to the independence and objectivity of auditors play a role in how auditors perform during an audit engagement. These include self-review, self-interest, advocacy, and intimidation threats. All of these threats will differ according to each audit engagement and its requirements. Therefore, auditors need to evaluate each of these for each audit engagement and consider taking safeguards against them if necessary.

What is the Self-Review Threat?

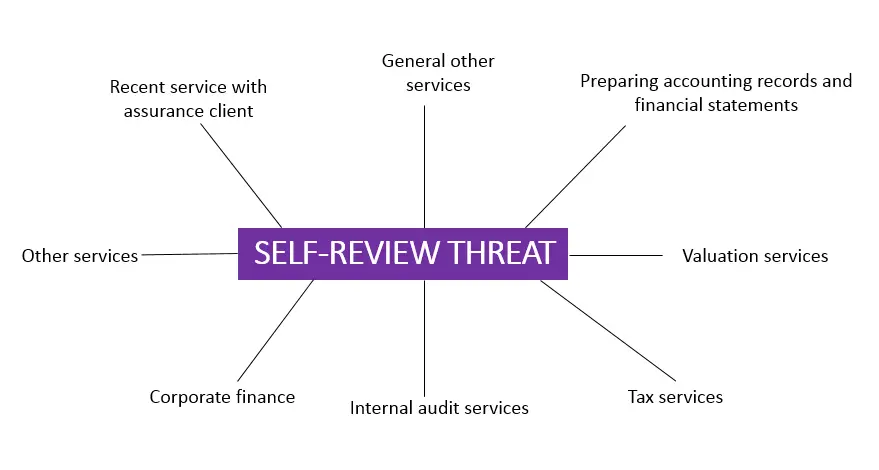

The self-review threat in auditing is when auditors face the risk of reviewing their own work. Usually, audit firms provide other services apart from their primary services. These may include accounting, taxation, valuation, internal audit, etc. The self-review threat arises when auditors also become involved in these services with a client.

Below are the summary chart of the self-review threat:

When auditors provide any of the above services to a client, these affect the financial statements. Usually, audit firms include accountants who are professionals of the trade. However, it is common for them to commit mistakes that can lead to misstatements. The threat arises when the same team that caused these misstatements to occur also are the ones who review it.

How Does the Self-Review Threat Work?

Auditors may provide several other services to clients apart from their primary auditing services. Usually, an audit firm assigns a team for each assignment. Ideally, audit firms will have segregation among each department. For example, they will separate the audit team from those providing accounting or taxation services. In some cases, however, it may not be possible. The best way to explain the self-review threat is through an example.

An audit firm provides accounting services to a client. There are two people in the team that collect information from the client and enter it into their accounting system. These two members are also responsible for preparing the client’s financial statements. However, they only perform these duties for three months during the year.

During the other months, these two members are a part of the audit firm’s audit team. However, one of these members gets assigned to the client for whom they prepared the financial statements. Usually, firms conduct a review to identify these threats. This time, however, the firm ignores it and let the team member join the team.

When this member examines the financial statements, they find some misstatements in the financial statements. However, they were also the ones who prepared it. Therefore, they are the cause of this misstatement. If the team member discloses these misstatements, their work may come under scrutiny and face adverse actions.

However, if they don’t disclose it, it will affect all the stakeholders and users of the financial statements. This example constitutes what the self-review threat is about and how it works. When an auditor becomes responsible for reviewing their previous work for a client, they face the self-review threat. This threat causes them to relinquish their independence and objectivity.

Apart from that, there are some other scenarios in which the self-review threat may exist. For example, someone joins the audit firm and gets assigned to the audit team for their previous employer. However, for a self-review threat to existing, that person must have taken part in influencing the financial statements.

What are Some Safeguards against the Self-Review Threat?

When auditors discover threats to their independence and objectivity, they must take the necessary actions to safeguard against them. However, these safeguards depend on several factors. Firstly, the type of threat they face plays a significant role in the countermeasure they take. On top of that, the intensity of these threats also dictates the safeguards taken against them.

The most effective safeguard against the self-review threat is the segregation of teams. Audit firms that provide non-audit services to clients must use separate members for each assignment. This way, they will never face the threat of having to review their own work. This team includes every member, from the partner to the audit associates involved in an engagement.

According to the International Auditing Standards, audit firms cannot provide most non-audit services to listed clients. It is because the risks are higher for these clients. However, as long as these non-audit services don’t affect the financial statements or the decisions impacting them, it may be allowable. For non-listed clients, audit firms can do so. However, they must ensure their independence and objectivity don’t come under threat.

There are many other safeguards that audit firms can use to protect against the threat of self-review. In cases where auditors cannot ensure objectivity despite the countermeasures, they will have to cancel the engagement. However, these cases are rare. In most audit engagements, auditors can apply the safeguards that prevent them from continuing with their process.

Conclusion

Apart from their auditing services, auditors may also provide non-audit services to clients. However, they face a self-review threat in these circumstances. A self-review threat arises when audit firms use the same team for non-audit and audit services. In most cases, the self-review threat is avoidable.