Bonds are one type of debt financing. Basically, bonds are considered as long-term debt of capital that a company raised in order to get more fund for its investment projects. The company raises the bonds need to pay fixed interest to bondholders; usually semi-annually or annually. There are several types of bonds; one of which is called convertible bonds. Basically, an advantage of bond financing is that issuing bonds does not affect owner control. The bondholders have no right to vote like common shareholders. In the later section below, we will discuss in detail about convertible bonds including the calculation of conversion ratio, conversion value, conversion premium, conversion price, the convertible bonds’ value as well as the cost of convertible bond by using the Internal Rate of Return (IRR) method.

What is a Convertible Bond?

There are several definition of convertible bonds. The first definition is that the convertible bonds are one type of bonds that give the right to the bondholder to convert it into other securities (commonly ordinary shares) at a predetermined price (rate) and at a predetermined time.

Another similar definition has defined convertible bonds as bonds that gives right to their holder the right but not the obligation to exercise the right at a specified date in future to convert their bonds into a specific quantity of new equity shares.

These two definitions have the same meaning. Basically, if the holders of these bonds choose to exercise the right then they will become shareholders in the company, but will have to give up their bonds.

If the holders of these bonds decide not to exercise their right to convert, then at maturity the bonds will be redeemed.

Typically, the convertible bonds are fixed-rate bonds that have a coupon rate of interest lower as compared to on similar conventional bonds. In addition, these bonds give the bondholders the right to convert their bonds at a specified future date into new equity shares of the company, at a conversion rate as specified when the bonds are issued.

When convertible bonds are issued initially, the market value of the shares into which the bonds will be convertible is always less than the market value of the convertibles. This is since convertibles are issued in the expectation that the share price will rise before the date for conversion. Investors will hope that the market value of the shares will rise enough to make the market value of the shares into which the bonds will be convertible higher than the value of the convertible.

How to Calculate Conversion Value and Conversion Premium?

Conversion value refers to the current market value of ordinary shares into which a bond is to be converted. The conversion value will be typically less than the value of the bond at the date of issuance. However, this conversion value will be anticipated to increase as the date for conversion nears on the assumption that a company’s shares should increase in market value over time.

The conversion value is calculated by multiplying the conversion ratio with market price per share at the conversion date.

The conversion value formula is as follow:

Conversion Value = Market Price per Share × Conversion Ratio

So where do we get the conversion ratio?

The convertible bond conversion ratio refers to the number of shares that a bond can be converted into. We can calculate the conversion ratio by dividing the number of common shares that can be converted with number of bonds.

The formula is as follow:

Conversion Ratio = Number of Common Shares/Number of Bonds.

Conversion premium is the amount by which the market value of the convertible surpasses the market value of the shares into which the bonds will be converted.

The conversion premium formula is as follow:

Conversion Premium = Current Market Value of Bond – Current Conversion Value

In order to understand clearly about how to calculate the conversion ratio, conversion value as well as conversion premium, let’s go through the example below.

Example

ABC Limited issues 100 million convertible bond at a coupon rate of 3% per annum. The bonds can be converted into common share after five years at the rate of 20 shares for each US$1,000 of bonds. If the shares are not opted to be converted, the company will have the right to redeem the bonds at par at once. In lieu of this, the bonds will be redeemed after ten years.

The company will pay interest on the convertible bonds for the first five years. And after that five years, the bondholders must decide whether or not to convert the bonds into shares.

Basically, the bondholders will exercise their right and convert the bonds into shares if they observe that the market value of 20 shares is higher than the market value of US$1,000 of the convertibles.

Let’s assume that the bonds are quoted at US$1,300 per nominal value of US$1,000. In this case, if the current share price is US$60 per share, then the conversion value would be as follow:

Conversion Value = Market Price per × Share Conversion Ratio

Where:

Conversion ratio = 20 shares/bond

Market price per share = US$60

Hence, the conversion value will be as follow:

Conversion Value = 60 × 20 = US$1,200

So, if the current share price is US$60 per share, then the conversion value is US$1,200 which is higher than US$1,000. Thus, the bondholders would exercise their right and converts those bonds into shares.

The conversion premium would be as follow:

Conversion Premium = US$1,300 – US$1,200 = US$100 or 50/1,200 = 8.33%

So let’s further assume that the current share price is US$45 per share. How much is the conversion value?

We can calculate the conversion value as follow:

Conversion Value = 45 × 20 = Us$900

Thus, share price at US$45 would bring the conversion value at US$900 which is lower than US$1,000. Hence, the bondholders would not exercise their right and keep holding the bonds and redeem those bonds at the maturity date which is at the end of year 10.

How to Calculate the Conversion Price of the Convertible Security?

The convertible bond conversion price is a price at par value compare to the conversion ratio. We compute the conversion price by dividing the par value of a bond with the conversion ratio.

The formula of conversion price is as follow:

Conversion Price = Par Value of a Bond/Conversion Ratio

For example, the investor can trade one bond for five shares of common stock which mean that a bond has a conversion ratio of 5.

If the par value of a bond is US$1,000, then the conversion price of such bond is calculated as follow:

Conversion Price = 1,000/5 = US$200

Therefore, the conversion price of that bond is US$200 if the conversion ratio is 5 shares per bond. And let’s say if the conversion ratio is 10 instead of 5, the conversion price will cut down to US$100 (1,000/10).

So it is observed that the market price has to catch up to the conversion price for the security to be converted. In short, we can say that higher conversion ratio results in a lower conversion price and a lower conversion ratio results in a higher conversion price.

The conversion price is important because it determines the number of shares to be received upon conversion. If shares never close to the conversion price, the convertible bond will never be converted to the common shares. It is usually set at a significant amount above the current price of the common stock in order to make conversion suitable only if there is a significant increase in value in company’s common shares. The conversion price has to be decided by the management of a company as part of the conversion ratio before issuance of convertibles to the general public.

How to Calculate the Value of Convertible Bond?

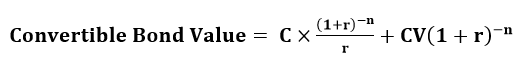

The convertible bond can be calculated by using the below formula:

Where: C is coupon value, r is rate, n is year and CV is conversion value

Example:

ABC Co has issued 100,000 units of convertible bonds with a nominal value of US$100 each. The coupon rate of the bonds is 10% payable annually. Each of the US$100 convertible bonds can be converted into 50 ordinary shares in three years’ time. If any bonds are not converted, such bonds would be redeemed at US$110.

Below are the estimation of expected value of share price on the conversion day of the US$100 nominal value bonds if investors in the bonds now require pre-tax return of 8%:

(1). US$2 per share

(2). US$3 per share

Solution:

To simplify the calculation, we will present in a tabular as follow:

(1). If share price is at US$2 per share

If the share price is at US$3 on the conversion day, then the value of 50 shares will be US$100 (50 shares ×$2 per share). Thus, investor would prefer to redeem the bonds at US$110 rather than convert them into shares.

Hence, the investor would wait to redeem the bond at the maturity date. The value of the bond would be as follow:

| Year | Description | Cash flow | Discount factor at 8% | Present value |

| 1 | Interest | 10 | 0.926 | 9.26 |

| 2 | Interest | 10 | 0.857 | 8.57 |

| 3 | Interest | 10 | 0.794 | 7.94 |

| 3 | Redemption value | 110 | 0.794 | 87.34 |

| Total | 113.11 |

Thus, if the investors do not exercise their right and wait to get the redemption, the estimate market value of such bond is at US$113.11.

(2). If share price is US$3 per share

If the share price is US$3 on the conversion day, then the value of 50 shares will be US$150 (50 shares ×$3 per share). Thus, the investors would prefer to exercise their right to convert those bonds to shares rather than redeem at US$110.

The estimation of market value of such convertible bonds is calculated as follow:

| Year | Description | Cash flow | Discount factor 8% | Present value |

| 1 | Interest | 10 | 0.926 | 9.26 |

| 2 | Interest | 10 | 0.857 | 8.57 |

| 3 | Interest | 10 | 0.794 | 7.94 |

| 3 | Value of 50 shares | 150 | 0.794 | 119.10 |

| Total | 144.87 |

Therefore, the estimated market value of the convertible bond is US$144.87 per US$100 bond.

How to Calculate the Cost of Convertible Bonds?

The cost of capital of convertible to bond is typically most difficult to determine. Basically, the calculation of such cost depends on whether a conversion is likely to happen or not. The conversion will take place if the bondholders satisfy that value of the shares will be greater than the redemption value of such bonds.

Generally, convertible bonds are attractive to investors because those investors has two options whether they want to exercise the right or keep holding such bonds to get redemption at the maturity date . Below are those two possible options at the conversion date:

Option 1: If the conversion is not expected, the calculation of conversion value will be ignore. Thus, the bond will be treated as redeemable bond. In this case, the market value of bond will be calculated by using the internal rate of return (IRR) method.

Option 2: If the conversion is expected, then we need to calculate the conversion value and then calculate the cost of convertible bond by using IRR method. In this case, the number of years to redemption will be substituted by the number of years to conversion and the redemption value will be substituted by the conversion value i-e the market value of the shares into which the debt is going to be converted.

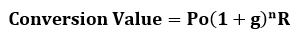

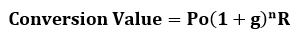

The conversion value can be calculated by using the below formula:

Where

Po = current ex-dividend ordinary share price

g = anticipated annual growth of the ordinary share price

n = number of years to conversion

R = number of shares received on conversion date

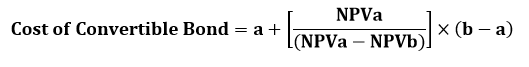

The IRR formula to calculate the cost of convertible bond is as follow:

Where:

a = Cost of debt at lower amount to bring PV greater than zero

b = Cost of debt at higher amount to bring PV less than zero

NPVa = Net present value at cost of debt a

NPVb = Net present value at cost of debt b

Now, let’s jump into the example of calculating the cost of convertible bond.

Example:

ABC Company has issued convertible bonds (8%) which will be redeemed in 5 years’ time. Currently they are quoted at $85 per $100 nominal. The bonds can be converted in five years’ time into 30 shares.

The share price is currently $3 and is expected to grow at a rate of 3% pa. Let’s assume that the tax rate is at 30%.

Calculate the cost of convertible bond.

Solution:

Before we can calculate the convertible bond, let’s first calculate the conversion value of such bond.

The conversion value can be calculated by using the formula below:

Where:

Po = $3 per share

g = 3%

n = 5 years

R = 30

Thus, conversion value = 3 × (1+0.03)^5 ×30 = US$104.33

Since the redemption value is $100 so investors would select to convert the bonds. Thus, in order to calculate the cost of convertible bond, we need to use the IRR method. First we need to calculate the net present value of bond at the discount factor to get the negative net present value and then try another discount factor to get positive net present value. Then, we will need to apply the IRR formula above to calculate the cost of convertible bond.

We will use two discount rate to calculate the net present value as per the table below:

| Year | Description | Cash flow in $ | Discount factor 8% | PV1 ($) | Discount factor 12% | PV2 ($) |

| 0 | Market value | (85.00) | 1.000 | (85.00) | 1.000 | (85.00) |

| 1-5 | Interest [8× (1-0.3)] | 5.60 | 3.993 | 22.36 | 3.605 | 20.19 |

| 5 | Conversion value | 104.33 | 0.681 | 71.05 | 0.567 | 59.16 |

| 8.41 | (5.65) |

Thus, by using the IRR formula above, we can calculate the cost of convertible bond as below:

Cost of Convertible Bond = 8% + [8.41 / (8.41 – (- 5.65))] × (12% – 8%)

Cost of Convertible Bond = 10.39%

Therefore, the cost of convertible bond is at 10.39%

Conclusion

Convertible bondholders get only a fixed, limited income until conversion date irrespective of how profitable the company is which in actual is a vantage for the company because more of the operating income remain available for common stockholders. Generally, bondholders are not authorized to vote for directors since voting control is in the hands of the common stockholders.

If the existing management group is concerned about losing voting control of the business and the company is also looking at alternate means of financing, then selling convertible bonds will be the best option. Another benefit associated with convertible bond is that bond interest is a deductible expense for the issuing company.

Some disadvantages are also linked with convertible bond issuers in a way that financing with convertible securities runs the risk of diluting EPS of the company’s common stock and also the control of the company. Investment banker or insurance company may purchase large part of the company through this conversion security which may transfer the voting control of the company away from its original owners and will be transferred to the bondholders.

Large companies with millions of stockholders do not face this problem due to having a huge number of stockholders, but it is a real consideration for smaller companies.

Other limitations are that it has significantly more risk of bankruptcy than preferred or common stocks. Also, the shorter the maturity, the greater the risk. Further it is also to be noted that the use of fixed-income securities amplifies losses to the common stockholders whenever sales and earnings decline.

The financing of the company by way of issuance convertible bonds must be apprehended in the light of its advantages and disadvantages before making the decision as this would help the company to avoid the occurrence of subsequent difficulties associated with them.