In the previous articles, we have talked about inventory as well as methods in valuing inventory. In this article, we will talk about the inventory costing. So what are the costing methods of inventory?

Inventory costing is very crucial; especially for merchandising company as we need to present in the financial statements both in statement of financial position or balance sheet and statement of comprehensive income. There are four methods of inventory costing namely specific identification, first in first out (FIFO), last in first out(LIFO), and weighted average. All these method are used in different industries.

Specific Identification

Specific identification is one of the inventory costing where inventories are valued item by item basis. This method is normally used in high value of inventory such as car industry.

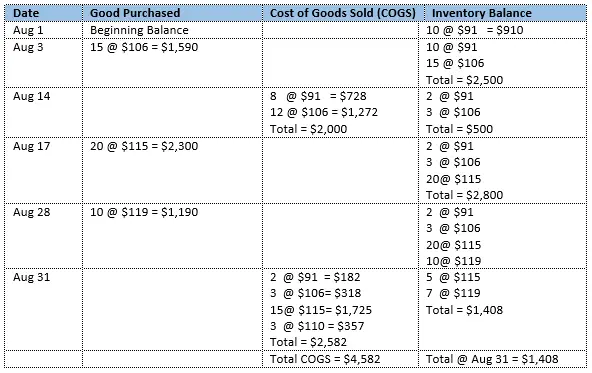

Below is the illustration of the costing under specific identification.

From above illustration, both cost of goods sold and inventory balance are valued at each specific costs at the date of the purchase. Total cost of goods sold is $4,582 while the inventory balance is $1,408. This consists of inventory purchased on Aug 17 of 5 units at $115 and on Aug 28 of 7 units at $119.

First In – First Out (FIFO)

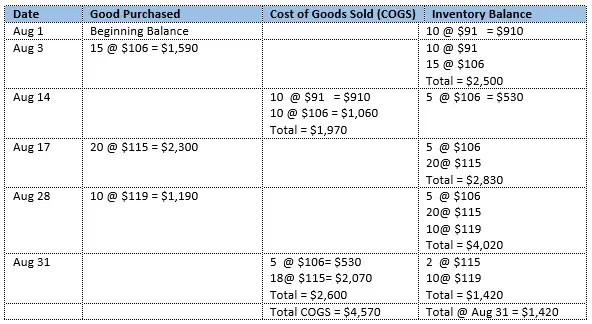

First In – First Out (FIFO) is a method where we value inventory that were bought in first. This method is normally used for any goods that has expiry date. Therefore, any inventory bought in first need to sell out first. Below is the example on how we value inventory based on FIFO method.

From the above illustration, the total costs of goods sold is $4,570 while the inventory balance as at Aug 31 is $1,420 which consists of inventory purchased on Aug 17 of 2 units at $115 per units and on Aug 29 of 10 units at $119 per unit.

Last In – First Out (LIFO)

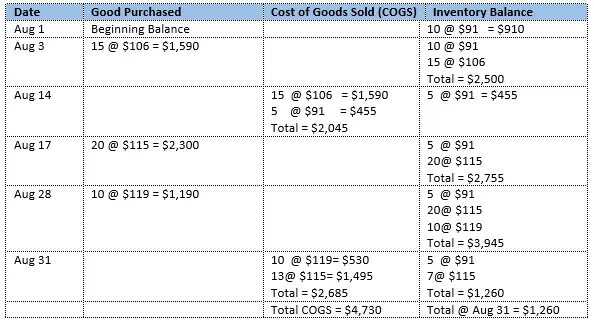

Last In – First Out(LIFO) is another method where we value inventory that were brought in last and sell it out first. That means we sell the most recently purchase first both costs of goods sold and inventory in stock. In practice, this method does not permitted by the accounting standard; however, we will briefly illustrate as per the example below.

From the above illustration, the total costs of goods sold is $4,730 while the inventory balance as at Aug 31 is $1,260 which consists of opening inventory of 5 unit at $91 per units and inventory purchased on Aug 17 of 7 units at $115 per unit.

Weighted Average

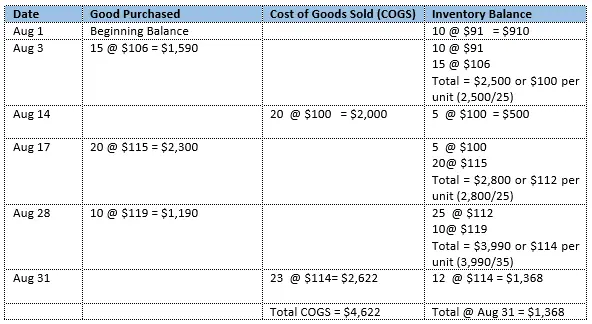

Weighted Average is a method where inventory is valued at average of all inventories purchased at time of each sale. That means the cost per unit at the time of each sale equals the cost of goods available for sale divided by the total units available. Below is the basic illustration of the inventory and costs of goods sold valuation.

From the above illustration, the total costs of goods sold is $4,622. While the inventory balance as at Aug 31 is $1,368 which is at the average costs at each date of transaction incurred.

Conclusion

In conclusion, the costs of goods sold that need to be presented in the income statement and the inventory to be presented in the Balance Sheet are difference from one method to another.

This valuation need to be adopted differently from one industry to another depends on their nature of business activity.