Bond convexity is the analysis of risk that arises with a change in the interest rate. Bond prices move inversely with a change in interest rate. The relationship between a bond price and interest rate is linear. However, the actual effects include several other factors resulting in a curvature.

Convexity is used to assess the risk for investors that comes with a rise or fall in the interest rate in the bond’s price. A bond convexity can be negative or positive with a change in yield for investors. Bond duration is an important link to understand bond convexity.

What is Bond Convexity?

Bond convexity is the measure of the curvature that arises due to changes in the interest rate and market price of a bond.

For bond convexity, the interest rates and bond prices move in the opposite direction. However, investor’s expectations and other factors contribute towards the final market price of the bond as well. Hence, the relationship results in a curvature rather than a straight line. Bond convexity is used to measure the risk for investors that arises due to a change in yield for investors.

Understanding Bond Convexity

Bond prices and yield move inversely. It means if the yield falls, bond prices rise and vice versa. Investors want to calculate the time it takes to recover their investment. It is called the duration of the bond. It shouldn’t be confused with bond maturity, though, which is simply the lifespan of a bond.

Due to the inverse relationship, an increase in the interest rate would mean it would take longer to recover the investment as bond prices would fall. Conversely, a decrease in the interest rate resulting in bond price appreciation would mean it will take a shorter time to recover the bond’s cash flows. Convexity is the concept that attempts to analyze this relationship and hence the risk management for investors.

Generally, a longer duration would mean greater interest rate risk for the investors. A bond with a longer duration will take longer to recover the cash flows and will be prone to more interest rate changes.

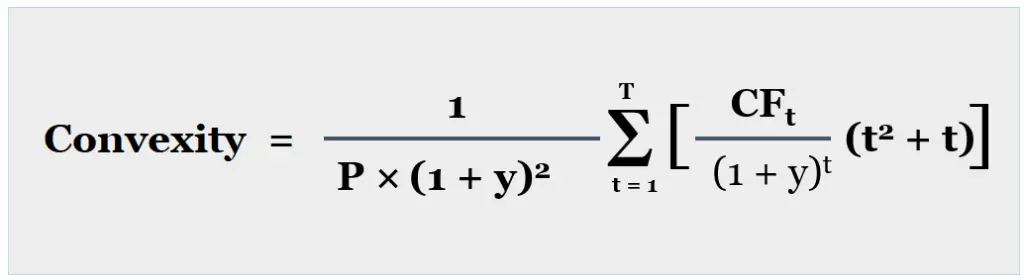

Bond Convexity Formula

We can calculate the bond convexity with the following formula.

Where:

P = Bond Price

y = yield on maturity

T = Maturity in years

CFt = cash flow in time t.

We can calculate the changes in price due to a change in yield as follow:

Change in price = [-modified duration × change in yield] + [½ × convexity × (change in yield)2]

Positive and Negative Bond Convexity

As we know the inverse relationship between the bond price and its yield. Hence, if the duration of the bond increases with an increase in the yield, it will have negative convexity. It means that bond prices would decline more with an increase in yield than they would with a fall in the yield.

Similarly, if the duration of a bond decreases with a fall in the yield, it is said to have positive convexity. A bond with a positive convexity would see a greater price increase with a fall in its yield. Contrarily, a bond with a negative convexity would see a lower price change due to an increase in the yield.

Bond Convexity and Interest Rate

When interest rates rise, newly issued bonds will offer a higher yield to investors. Thus, existing bonds with older interest rate arrangements would lose the faith of investors. As a result, it will cause a decline in their demand, and hence their prices will fall.

Generally, a change of 1% in interest rate annually would mean a change of 1% in bond prices. It means a bond with a maturity period of 20-years will see a significant change in its price if an interest rate increases in the early stages.

For instance, if interest rates of the bond increase by 1% after 5 years into the bond’s life, it will lose approximately 15% of its price. Convexity tries to measure the systematic risk arising due to such changes in the prices of a bond due to any change in the market prices of the bonds.

Bond Convexity and Risk Management

If a bond offers a high coupon rate, it will be less prone to interest rate changes. For example, a bond with an 8% coupon rate with a market interest rate of 5% is less likely to get affected with an interest rate change than a bond with 6%. The market interest rate would need to go above 8% to make that bond less attractive to existing bondholders.

Convexity allows for other risk factors that count towards the final market price of a bond. The Duration of a bond that is used to calculate to recover the cash flows of a bond is one such factor. However, duration only considers a linear relationship between bond prices and interest rates. Whereas convexity allows to absorbs effects of other risk factors as well.

Generally, a bond with a higher yield will be less affected due to a change in interest rate. It means as the convexity decreases, the investors’ risk decreases due to a change in the interest rates.

Final Thoughts

Convexity is the measure of the risk arising from a change in the yield of a bond due to the changes in interest rates. It considers several factors that affect the bond prices as compared to the linear concept of the duration. Investors can use the convexity formula to assess the sensitivity of their bond investments to interest rate changes.