It is a common practice to grant rights of return to customers for damaged or faulty products under certain conditions.

Many companies offer a refund, exchange, or free repairs to their customers within a specified period.

The accounting treatment for sales with rights of return requires substantial considerations. Entities need to estimate return goods’ value. They also defer revenue recognition on estimated values of returned goods.

Let us discuss what are the rights of return and the accounting for sales with the rights of return.

Rights of Return

Customers have the right to return damaged goods and claim warranties in most jurisdictions. Customers’ rights to return goods are protected by law.

The refund can be in the form of cash, credit, or repairs for damages to the sold goods. The seller has an obligation to provide the right product with the stated price and quality to the customers.

For some industries, it is common for an entity to offer customers a right to return purchased goods. In some industries, the ratio or frequency of returned goods is higher as compared to others.

In these circumstances, the accounting recognition of revenue where the frequency of returned goods is higher cannot be considered appropriate. An alternative approach is to defer revenue recognition until the return privilege of customers expires.

The rate of return of goods is usually proportional to the privilege period. For some products, this privileged period is shorter while for others it may last longer up to several years in some cases.

Deferred Gross Profit

It refers to the delayed profit that would be realized after the privilege period expires. Simply, it is the profit that would be recognized in the future due to uncertain present circumstances.

Return Privilege

It is the right granted by the seller to a buyer that allows the buyer under certain conditions to return goods and claim refunds or repairs within a specified period.

Customer Acceptance Rights

Among other conditions, customer acceptance rights are important criteria to evaluate the transfer of control in the revenue recognition process. If this condition does not fulfill, the entity should defer the revenue recognition.

Subjective Criteria of Customer Acceptance Rights

The analysis requires careful evaluation to determine the customer acceptance rights.

Subjective criteria are certain provisions or rights that allow customers to evaluate the goods before paying. For instance, some companies allow customers to test products within a certain period and pay only if they are satisfied.

In such cases, the entity should defer revenue recognition until the customer decides to pay and the purchase is confirmed.

Objective Criteria of Customer Acceptance Rights

In most cases, companies allow their customers with acceptance rights objectively. Customers have rights of return with certain conditions such as under warranty claims.

Customer acceptance rights may be evaluated objectively through different criteria points such as specific size, weight, or performance metrics of the goods sold.

When an entity can determine that the control has been effectively passed to the customer, it can recognize the revenue. Otherwise, it can defer the revenue until the objective criteria of customer acceptance are fulfilled.

Accounting for Sales with Rights of Return

ASC 605-15-25 guides on the recognition criteria for sales with rights of return for the customers.

It states that if an entity wants to recognize a sale that can possibly have returned goods, it must fulfill the following conditions.

- The seller’s price of the product is fixed or determinable for the buyer at the time of sale.

- The buyer has paid the seller or has recognized an obligation to pay the seller. The obligation must not be contingent on the resale of the product.

- The buyer’s obligation to pay the seller would not change with any unusual situations such as theft or damage to the sold goods.

- For reselling purposes, the product should have substantial economic substance for the buyer other than that offered by the seller.

- The seller does not have future obligations for product performance that are directly linked with the product resale for the buyer.

- The amount of future return of goods can be reasonably estimated. These estimates should not include product exchanges for similar products with the same features such as price, quantity, and size etc.

New accounting standard such as ASC 606-10-55-23 provides guidelines on revenue recognition on sales with return rights.

An entity should recognize the following to account for the transfer of goods with return rights:

- Revenue for the transferred products. This is at the amount of consideration to which the entity expects to be entitled (therefore, deferred revenue for products expected to be returned);

- The shall also recognize the refund liability as well;

- Last but not least, the entity shall also recognize an asset (and corresponding adjustment to cost of sales) for its right in order to recover products from customers on settling the refund liability.

The liability of refund is the amount an entity would consider not to be entitled to. It is the estimated amount that an entity would set aside that will be returned to the customers. It is usually estimated using historic data.

The asset refers to the returned goods that the entity would receive in a return claim. The asset value will be the net realizable value that includes any additional recovery, repair, or other relevant costs as well.

The entity would evaluate the refund liability and asset for the fair values or adjustments for every accounting period.

Exchange Rights

Some sales contracts allow customers to exchange rights. It means customers are entitled to product exchanges with certain terms and conditions.

ASC 606-10-55-28 states:

“Exchanges by customers of one product for another of the same type, quality, condition and price (for example, one color or size for another) are not considered returns”.

In case of product exchanges, the entity does not need to adjust the transaction price. When a product is exchanged with damages or if the product is not functioning as intended, it is classified as a warranty claim.

Journal entry

The journal entry for a sales transaction with rights of return will be recorded as:

| Account | Debit | Credit |

| Sales Return and allowances | $ XXXX | |

| Cash/Credit Account | $ XXXX |

Different Return conditions

A seller can face different situations for returned goods and customer claims.

Return Of Goods from Customers with Good Conditions

When the customer does not want an exchange or a warranty claim, the return of goods is with good conditions of products. Some sellers allow their customers to return goods within a specified period in good condition.

The entity would then reverse the sales account and related accounts receivable for the returned goods transaction.

Return of Damaged Goods from Customers

This situation occurs when the customers return goods with damages or faults to claim refunds.

No Goods Returned, But Compensation is Made

In some cases, the companies grant rights to their customers for compensation if the goods do not function as intended or claimed at the time of sale.

Examples

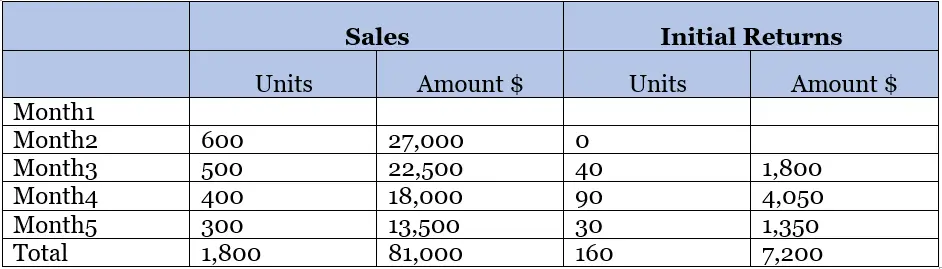

Suppose a company ABC sells computer gadgets. The selling price for each unit is $ 45 and the cost of goods sold is $ 30 per unit.

The company sends 2,000 units to one of its retailers. The retailer has the right to return goods within 4 months. The company estimates using historic data a 15% return of goods.

Other data is:

If the revenue recognition criteria under ASC 605 are met then ABC company record the journal entries as given below.

| Date | Account | Debit | Credit |

| Month1 | Accounts Receivable | 90,000 | |

| Sales | 90,000 | ||

| Cash | 27,000 | ||

| Accounts Receivable | 27,000 | ||

| Cash receipts for the month | |||

| Cost of goods sold | 60,000 | ||

| Inventory | 60,000 | ||

| Estimated Return Costs | |||

| Sales (15% × 2000 units × 45) | 13,500 | ||

| Cost of Sales (for 15%) | 9,000 | ||

| Deferred Gross Profit (for 15%) | 4,500 |

ABC Company will record the subsequent accounting entries for the next 4 months as below:

| Date | Account | Debit | Credit |

| Month2 | Accounts Receivable | 54,000 | |

| Sales | 54,000 | ||

| Actual Returns | |||

| Inventory | 4,800 | ||

| Deferred Gross Profit | 2,400 | ||

| Accounts Receivable | 7,200 | ||

| Expiration of Return Privilege | |||

| Cost of Sales | 4,200 | ||

| Deferred Gross Profit | 2,100 | ||

| Sales | 6,300 |

The revenue and cost of sales recognized in 20X1 are typically based on the number of units expected to be returned which is 300 (15% × 2,000 units). The net revenue recognized is $76,500 (85% × 2,000 units × $45 per unit) and the cost of sales recognized is $51,000 (85% × 2,000 units × $30 per unit). Therefore, the deferred gross profit balance is carried forward until either the textbooks are returned or the return privilege expires.