Definition

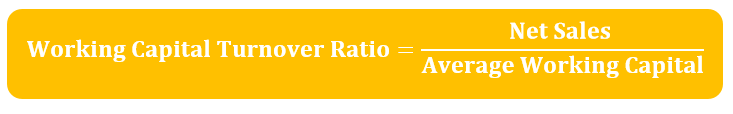

The working capital turnover ratio is a ratio of the turnover of the business to its working capital. It is a measure of the ability of a business to use its working capital to support its turnover, or revenues. The ratio can be used to evaluate the efficiency of a business in using its resources. The turnover of a business is its total revenue or sales it generates from selling products to its customers. The turnover of a business, for profit-making businesses, is one of the major indicators of a business’ performance and profit generation capacity.

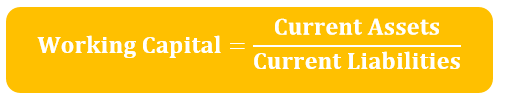

The working capital of a business is the remaining current assets of a business after subtracting all its current liabilities from it. These current assets of a business comprise of inventory, receivables and any cash and cash equivalents. The current liabilities of a business comprise of any short-term obligations, for example, accounts payable, short-term loans, etc. Typically we use working capital to measure the liquidity of the business. It represents the operating capital of a business that is used in its daily operations.

Importance of Working Capital Turnover Ratio Calculation

The working capital turnover ratio is one of the key ratios used to evaluate a business’ financial performance. Since the working capital turnover ratio of a business also takes into account the working capital of a business, it can be a key indicator of the ability of the business to manage its working capital. It can be used to determine whether a business can use its working capital to its maximum capacity. It also helps in determination of the business’ ability to pay off its debts and keep its cash reserves readily available. We also can use it to evaluate the overall performance of a business in its daily operations.

Furthermore, investors look at the working capital turnover ratio of a business to assess the ability and competence of the management of the business. Usually, a business that can generate a higher turnover with limited resources is preferred by investors as it shows the management is capable of generating sales with limited resources. Investors also use it to compare the performance of the business with similar businesses. These similar businesses may include competitors of the business or other businesses in the same industry.

The working capital turnover can also be a critical ratio for small business. This is because the ratio allows small businesses to determine the amount of resources it can dedicate towards the operations of the business after any current liabilities have been paid off. This helps smaller businesses establish an estimate of its resources that are available for use.

Working Capital Management

Working capital management is the strategy set by the management of the business to regulate the working capital of a business. As established above, the working capital turnover ratio can be used as an appraisal tool for the working capital management strategy of a business. The working capital management strategy is used to keep the operations of a business running smoothly. It is one of the fundamental strategies of a business as it dictates the long-term stability of the business. Some businesses cease their operations because of an ineffective working capital management strategy, although they are profitable.

The effectiveness of the working capital management strategy of a business relies on its management of its current assets and current liabilities. If either of these two areas of a business is mismanaged, the strategy can fail. For example, if the inventory turnover period of a business increases, it may affect the sales and receipts of the business and cause a delay in paying the liabilities of the business. This can further force the business into cash flow problems and compel the business to obtain debt. Moreover, the additional debt and interest payments can also affect the profits of the business.

The objectives of a working capital management strategy for a business are to ensure the liquidity and the profitability of the business. The strategy ensures that the business is liquid enough to meet its obligations when they are due. This ensures the business does not lose any customers or suppliers due to the an inept working capital management strategy. Similarly, a proper working capital management strategy ensures that funds are utilized to a maximum to guarantee the profits of the business are maximized.

Formula

The formula to calculate the working capital turnover ratio of a business is as follows:

The Working Capital in the above formula can be calculated using the following formula:

If the working capital of the business is volatile or the working capital of the business needs to be averaged to get better results, the following working capital turnover formula is used instead:

The Average Working Capital in the above formula can be calculated using the following formula:

Example and Analysis

A company ABC Co. had net sales of $20 million in the previous period. Its current assets for the previous period were equal to $9 million while its current liabilities amounted to $5 million. To calculate the working capital turnover ratio of ABC Co., its working capital must first be established. To calculate the working capital of ABC Co., its current liabilities must be subtracted from its current assets using the above formula:

Where Current Assets = $9 million and Current Liabilities = $5 million

Thus Working Capital = $9 million – $5 million = $4 million

Now that the working capital of ABC Co. has been calculated, the working capital turnover ratio can also be calculated by dividing the net sales of the company by the working capital of the company using the above working capital turnover formula:

Where Net Sales = $20 million and Working Capital = $4 million

Hence, Working Capital Turnover Ratio = $20 million / $4 million = 5.0

The working capital turnover ratio of ABC Co. is 5.0 which means the company was able to generate sales of 5 times the size of its working capital. Ideally, the higher the working capital turnover ratio of the business is, the better it is considered. Generally, a working capital turnover ratio of 1.0 means that the company has generated sales of the same value as its working capital. The working capital turnover is preferred to be above 1.0 or at least equal to it.

Since ABC Co. has a working capital turnover ratio of 5.0, it means that the company is very efficient in generating sales from its working capital. The ratio signifies that the company has either overperformed in generating sales or has managed its working capital exceptionally well. To narrow down which one of the two areas ABC Co. has overperformed in, the ratio must be compared with other ratios.

Therefore, for the analysis to give more information, it is important that the working capital turnover ratio of ABC Co. isn’t only considered on its own but also compared with other companies. This ratio can be compared with historical working capital ratio of ABC Co. itself, the ratio of a competitor, the ratio of another company in the same industry or the ratio of the industry, that ABC Co. is operating in, as a whole.

Another company XYZ Co., made net sales of $25 million. The opening working capital of XYZ Co. was $28 million while its closing working capital amounted to $24 million. The working capital turnover ratio of XYZ Co. can be calculated using the second formula mentioned above. To use the second formula, the average working capital of XYZ Co. must be calculated first, using the above formula as follow:

Where Opening Working Capital = $28 million and Closing Working Capital = $24 million

Thus, Average Working Capital = ($28 million + $24 million) / 2

Average Working Capital = $52 million / 2

Average Working Capital = $26 million

Finally, the working capital turnover ratio of XYZ Co. can be calculated using the above formula:

Thus, Working Capital Turnover Ratio = $25 million / $26 million = 0.96

The working capital turnover ratio of XYZ Co. is below 1.0 and is not considered an ideal ratio because the working capital turnover is preferred above 1.0. This means that company is not using its resources efficiently to generate sales. Furthermore, it may also mean that the company is not managing its working capital properly. Due to the working capital mismanagement, the company may have to face difficulties in paying its current liabilities in the future.

Comparatively, ABC Co. has significantly outperformed XYZ Co. Assuming the companies are both in the same industry, ABC Co. has utilized its resources in the best way possible. Although the sales of ABC Co. are $5 million below the sale of XYZ Co., their working capital management has been exceptional. While XYZ Co. has an average working capital of $26 million, ABC Co. has been able to limit its working capital to $4 million which is a substantial difference.

Although ABC Co. has comparatively performed better, it does not imply that XYZ Co. have underperformed as a whole. To obtain further analysis of whether XYZ Co. has underperformed, the working capital turnover ratio of XYZ Co. must be compared with the industrial average as a whole. If the industrial average is close to 1.0, then it means that XYZ Co. has not underperformed but ABC Co. has significantly overperformed. Sometimes, a significantly higher working capital turnover ratio may also indicate something wrong.

Pros and Cons of Higher and Lower Working Capital Turnover Ratio

As demonstrated in the example above, the working capital turnover ratio is preferred by investors to be above 1.0. However, there are certain pros and cons when it is significantly higher or significantly lower.

A working capital turnover ratio that is significantly high means that the business has used its resources efficiently to generate sales. It may also mean that the business has controlled its working capital within an optimal level. However, if the working capital of the business is significantly above 1, it might also imply that the business may not have enough working capital resources to support its sales or growth. A significantly higher working capital turnover ratio may further imply that the business is overtrading. A constantly high ratio may also be an indicator of an imminent cessation of business.

However, as demonstrated in the example above, it cannot be established if the working capital turnover ratio of a certain business is significantly high unless the ratio is compared with the industrial average. If a business has a working capital turnover ratio of 10.0 but the industrial average is 9.0, then the above points can be ignored.

Generally, a working capital turnover ratio that is significantly lower is always considered bad for a business, however, for startups, the ratio will be initially lower. Startups constantly try to improve the ratio for their business and can use historical data as a comparison tool to see how much they have improved.

Similar to the above point for higher ratios, a lower working capital turnover ratio is also not an indicator of a shortcoming by the business. The ratio must be compared with the industry as a whole to evaluate how much the business is lagging behind. For instance, if the industrial average is 1.0 and the ratio for a particular business within the industry is 0.8, then it may not be considered too bad. However, if the industrial average is 4.0, then the ratio is considered worrisome.

Conclusion

The working capital turnover ratio is an indicator of the performance of a business in managing its working capital to generate sales. The ratio is also an indicator of the working capital management of the business. It can be used for different reasons, for example, it can be used by investors to evaluate the efficiency and competence of the management of a particular business. The ratio, once calculated, must be compared with ratios of other business, within the same industry, to get an accurate idea of the performance of the business the ratio is calculated for. The working capital turnover is preferred to be above 1.0, however, a significantly higher ratio may also be considered bad in some cases.