Introduction

The closing inventory and cost of goods sold of a business are two important values that help a business determine their profits or losses for a period. To calculate the cost of goods sold, a business needs to know the value of its closing inventory. This can be calculated by tracking the inventories of the business. There are two main mechanisms that businesses can use to track their inventories; perpetual inventory system and periodic inventory system.

What is Perpetual Inventory System?

Perpetual inventory system provides an up-to-date closing inventory and cost of goods sold of a business. This is done by continuously updating the inventory account with every purchase, production or sale of inventory. Due to its constant updating inventory account, it gives a business more control over its inventories.

Unlike the periodic inventory system, the perpetual inventory system does not keep a temporary purchases or production account. All inventory received, whether that be through purchase or production, is recorded in the relative account and updated in the inventory account at the same time.

Since the inventory account is updated with every purchase and sale, the closing balance of the inventory account at the end of every period is the closing balance of inventory for that period. Although, the perpetual inventory system does not require a physical count of stock, a business may choose to perform physical count at the end of the period to ensure the accuracy of the closing inventory balance.

The perpetual inventory system also takes all the sales or inventory dispatched into account. Any inventory dispatched is decreased from the inventory account with the value of the inventory sold. If the inventory value is unknown or the inventory is unspecific, different other methods of inventory valuation can be used. These might include different methods such as First-In-First-Out (FIFO), Last-In-First-Out (LIFO), Average Weighted Cost, etc.

Calculating Inventory Using Perpetual Inventory System

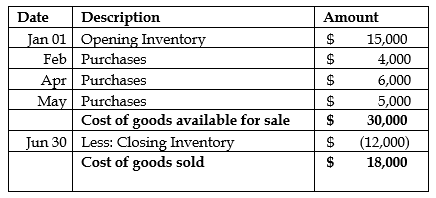

When calculating the inventory using perpetual inventory system, the balance of the inventory account is taken as the closing inventory. This is deducted from the cost of goods available for sale, which is the sum of opening inventory and purchases during the year, to reach the cost of goods sold. The purchases are obtained from the purchases account.

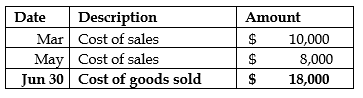

Alternatively, the cost of goods sold can also be calculated by taking the sum of all the deductions (cost of sales) from the inventory account. Either way, the result of the cost of goods will be the same.

Example

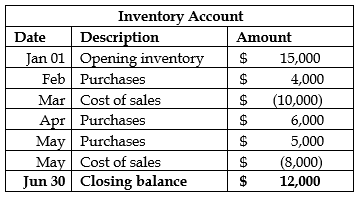

A business had an opening inventory of $15,000 at January 01. It made purchases of $4,000, $6,000 and $5,000 in February, April and May respectively. The business also made sales of inventories costing $10,000 and $8,000 in March and May respectively. The inventory account at June 30 will look like:

The cost of sales can be calculated as follows:

Alternatively, it can also be calculated by taking a sum of all the cost of sales during the year:

Conclusion

The perpetual inventory system keeps a track of a business’ inventory by constantly updating the inventory account. Any purchase of inventory is added to the inventory account and any sale is deducted from it. The balance of the inventory account at the end of the period is the closing balance of inventory. Cost of goods can also be easily calculated using the system using two different methods.