Introduction

Basically, the purpose of setting up a business is to earn a profit, and all stakeholders want to see the business grow for the foreseeable future. They don’t want to see that company encounter any problems or failure that result in liquidation or bankruptcy. Thus, the going concern principle is always a key that stakeholders want to see. So, what is going concern principle?

Definition of Going Concern

The going concern principle is one of the accounting concepts that we normally refer to an entity’s business operation for the foreseeable future. An entity is considered a going concern when such an entity can continue its operation without any indication of failure or bankruptcy. Therefore, in order for a company to continue on a going concern basis, such a company shall have the resources needed in order to continue its operation indefinitely despite such a company being in a loss position.

As the information on going concern principle is very crucial for stakeholders; especially investors and shareholders, a company shall provide information that reflects the real situation of the company.

We normally can do the going concern assessment by analyzing some key ratios such as liquidity ratio, solvency ratio, debt to equity ratio, as well as other ratios where they are necessary to assess the going concern of that company. In practice, a management representation letter is needed to provide evidence of going concern operation. In some cases, each company needs to have a letter of financial support to prove it as a going concern; especially for a group of companies where there are subsidiaries facing the going concern issues.

IAS 1 Presentation of Financial Statements states that “When preparing financial statements, management shall make an assessment of an entity’s ability to continue as a going concern. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so. When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, the entity shall disclose those uncertainties. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern.”

Practically, the standard encourages the management of each entity to be aware of any material deficiencies or uncertainty that involve situations where they may cast significant doubt on the ability of such entity to continue on the going concern basis. In case of significant doubt that the entity will be able to continue for the foreseeable future, such entity shall disclose those uncertainties or deficiencies in preparing its financial statements and describe the reasons why such entity is not considered as a going concern.

Additionally, to be able to assess the going concern of each entity, its management shall need to take into consideration all available future information, at least, but not limited to, the period of twelve months at the end of the reporting period from which the financial statement is issued.

For instance, in occasions where a company has historical profits from its operation, such a company may initially consider that it is on the going concern basis without further detailed analysis.

However, that is not the case. We need to assess further a wide range of factors, including the current and future expected profitability, the ability to pay the debt as per the schedule, and other potential sources of replacing the financing facility before we are able to satisfy that the entity is operating on a going concern.

The following list down some examples of events or conditions that may cast significant doubt on the entity’s ability to continue as going concern:

- Adverse some key financial ratios;

- Negative operating cash flows;

- Loss of key management personnel without replacement;

- Net liabilities or net current liabilities;

- Indication of withdrawal of financial support from creditors;

- Arrears or discontinuation of distribution of dividends; and

- Inability to pay creditors on due dates.

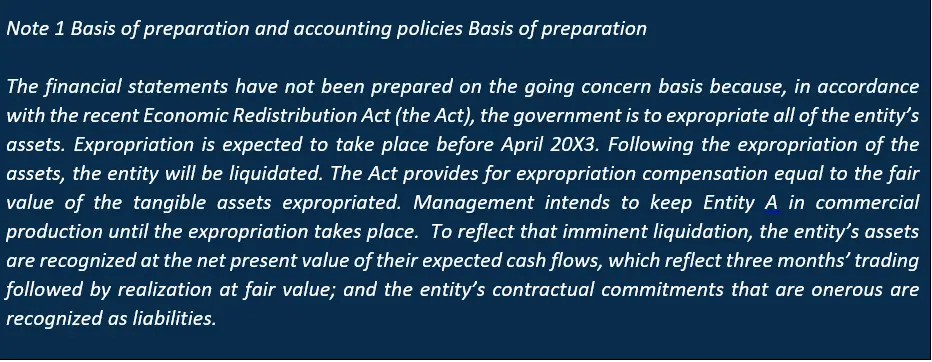

Below is the extract from the note to financial statements when an entity is not on going concern:

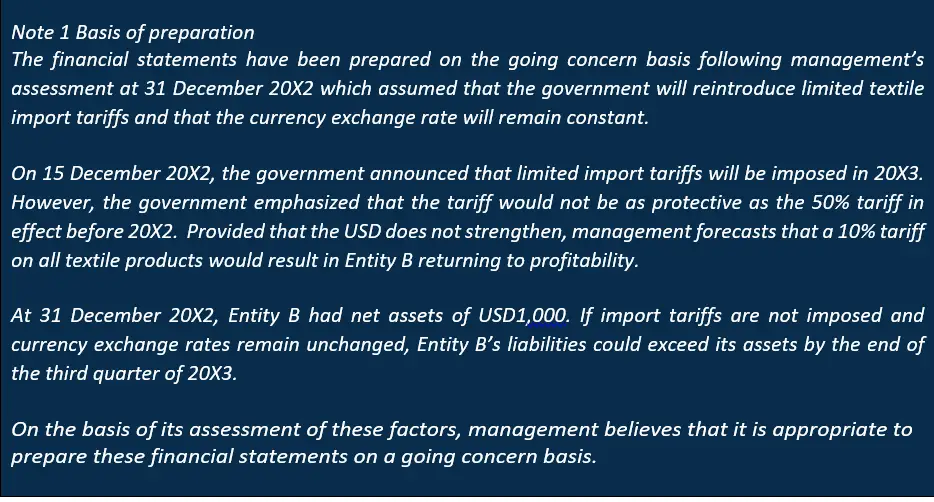

In addition, where there are material uncertainies that cast doubt over the going concern, an entity shall disclose in the note to financial statements as follows:

Conclusion

Going concern basis is very crucial for investors and other stakeholders so that they can make a decision correctly. Thus, each entity should prepare its financial statements on a going concern basis and disclose correctly where there are cast doubt of situation where indicate such company is not on the going concern.