Introduction

All organizations work in hierarchical set up, approached differently according to each one’s needs. The top-down and bottom-up approach in budgeting are two approaches of decision making in an organization. These approaches can apply to any planning and decision making process e.g. forecasting, budgeting, and financial decision making. The choice between these two approaches is simply the style of managerial and control issues.

A Top-down budgeting process is in which the top management takes all the decisions without any participation from departments or the middle management.

Bottom-up budgeting is a process where the budgeting input starts from the operational level, moves up to the middle, and top level management with full participation in decision making.

TOP-DOWN BUDGETING APPROACH

In the Top-Down budgeting process, the senior management sets objectives for the company for one year. The direct participation from middle management is a minimum in this process. The top management sets the total budgeting process and passes on to department management. The departmental managers then utilize the budgets for the operational purposes and they assign such budgets to the operational staff.

BOTTOM-UP BUDGETING APPROACH

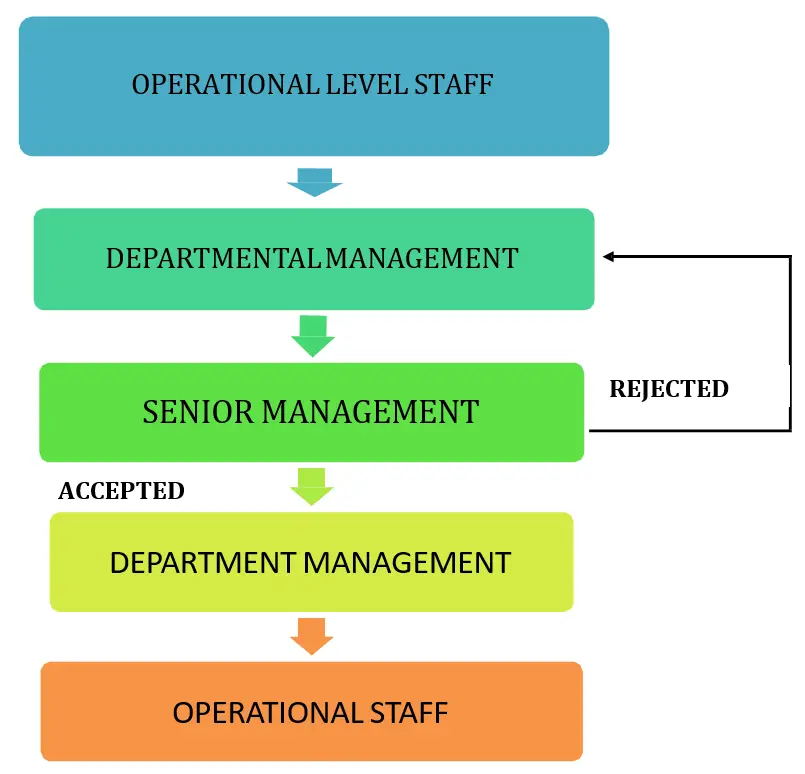

In the bottom-up budgeting process starts with the feedback from the operational staff, the department managers then evaluate the suggestions and pass on to the top management. After evaluation, the top management may decide to reject or accept the budget proposals and in case of rejection, the plans are sent back to the departments for further adjustments.

There are certain benefits and limitations associated with both approaches.

The benefits of the Top-Down Budgeting approach are:

- The senior management takes the strategic goals and objectives on the priority level and they allocate all the budgets accordingly.

- In large organizations budgeting are a difficult process; the top level management is well equipped to prepare large budgets that save time and effort for the departments.

- It sets the sense of command and control for the organization, where top management gives targeted budget to department and operational managers.

Limitations:

- The top level management does not take direct feedback from the operational managers, so may not be aware of the ground realities of the operations.

- This approach creates a sense of autocratic environment which may cause de motivation in departmental and operational staff.

- Top management uses historic data for new budgets, which may be obsolete for the recent budgets.

The benefits of the Bottom-Up Budgeting:

- The operational and department managers are the ones most familiar with the budget requirements, so their participation makes the budgeting process easy and accurate.

- This approach creates a sense of participation and a collective approach to the objectives of the organization.

- The senior management may focus on strategic goals and provide leadership advice to lower management.

- It creates harmony and better communication between the departments and operational managers

Limitations:

- The operational and department managers are more concerned with their short term targets, so the budget feedback may not be in line with the strategic goals of the organization.

- The budgeting process becomes difficult if department managers change often.

- If the top management rejects proposals, the budgeting process may become slow and time consuming.

Conclusion

In conclusion, both top-down and bottom-up approach in budgeting have their benefits and limitations. The correct choice of approach will depend on the functional hierarchy and organizational culture. In large organizations, it is difficult to assume that operational mangers will be able to perform budgeting tasks. However, both the department and operational managers should provide valuable feedback, which then becomes a good starting point for the top management to formulate the budgets.