Introduction

Basically, the realization concept derives from the recognition revenue principle. In accounting, we recognize the revenue from sale of goods or provision of services when such goods are delivered or the services are rendered to customers. In this case, upon the delivery of goods or services, the revenues both from the provision of goods or services is said to be realized. So what is realization concept?

Definition

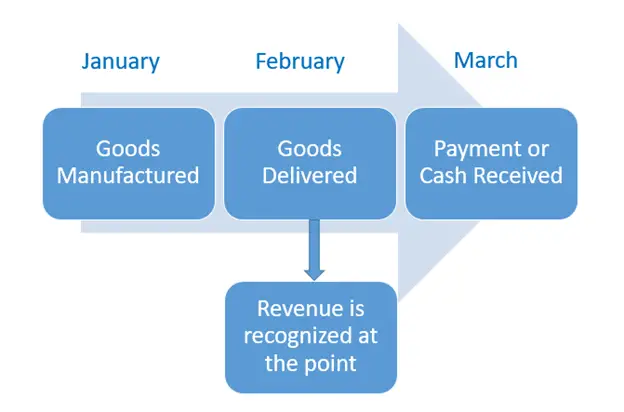

The realization concept is that the revenue is recognized and recorded in the period in which they are realized; similarly to accrual basis accounting. In similar term, we realize as revenues when we deliver the agreed product with customers or the services have been rendered to them.

With the IFRS 15 – Revenue from contract with customers comes to effect, the revenue recognition has been divided into five steps called five steps model.

First, we need to identify the contract with customer. In accordance with IFRS 15, contracts need to have all of the following criteria:

- The contract has been approved;

- The right and payment terms of the providing goods or services to be transferred can be identified;

- The contract need to have commercial substance and;

- The consideration to be receive is highly.

Second, we need to identify the performance obligations in the contract. The performance obligations are the contractual promise to provide goods or services that are distinct either individually, in a bundle, or as a series over time.

Third, we need to determine the transaction price. The transaction price refers to the amount of consideration that an entity is expected to entitle to in exchange of transferring the promised goods or services.

Fourth, the transaction price shall be allocated to each corresponded performance obligation. The allocation is done by based on the stand alone selling price of each performance obligation.

Last but not least, we recognize revenue when the performance obligation is satisfied either over time or at a point in time.

Conclusion

In short, it is very important to recognize the revenue correctly. The revenue shall be recognized when such goods are delivered or the services are rendered to customers.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]