Introduction

Overhead costs are categorized into fixed and variable costs. Both these costs can change depending on several factors. Depending on the costing method in use, the contribution or profit margins can significantly change with variance in either fixed or variable overheads. Under the Marginal costing method, overhead costs are charged directly to the income statement. Hence the variance will be only the difference in the actual and standard overhead budgets. Under Absorption costing, however, the variances will occur due to change in the rate or volume as overhead costs are fully absorbed. The total fixed overhead variance can then be divided into fixed overhead expenditure and volume variances.

Definition

Fixed overhead volume variance in Absorption terms can be defined as:

“The difference between the budgeted fixed overheads and actual fixed overheads”

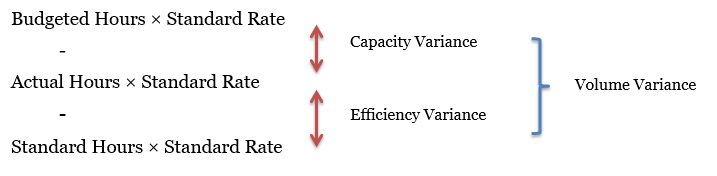

The fixed overhead volume can further be split into:

- Fixed Overhead Volume Capacity Variance and

- Fixed Overhead Volume Efficiency Variance.

We can calculate the fixed overhead volume variance as per the formula below:

Causes for Favorable and Adverse Variance

As the fixed overhead volume variances comprise of capacity and efficiency variances, it’s wise to see through the causes of favorable and adverse variance together as:

| Variances | Favorable | Adverse |

|---|---|---|

| Fixed Overhead Volume | Increased Production Volume. Increased demand for products Increased labor productivity Efficient operations Extended labor hours or extra skilled labor hired | Lower production volume Low demand for products or new competitors Inefficient operations or non-skilled labor Lower actual labor hours worked |

| Capacity Variance | Increased worked hours | Lower worked hours |

| Efficiency Variance | Highly skilled labor Higher staff motivation | Un-skilled labor Lack of staff motivation |

Interpretation and Analysis

Both capacity and efficiency variances can be linked as changes in one often cause a change in the other measure. Because fixed overhead costs do not change with production volumes, hence the total fixed overhead volume variance will only occur if the production is increased or decreased. In the Absorption costing method particularly, the overhead costs are absorbed at the labor hours or machine hours, thus, the labor efficiency to utilize the existing facility will affect the volume variance. Production volumes can also be increased using existing facilities by increasing the total labor hours worked i.e. through capacity variance.

When production capacity exceeds the targeted number of units, we observe favorable capacity variance. Similarly, an under-utilization of available production resources causes an adverse capacity variance.

Working Example

Let’s suppose that a company applies a standard or budgeted absorption rate of $ 15 per unit, and estimates a budgeted production of 1,500 units. Estimated or budgeted fixed overhead costs are $ 15,000. Within an ideal and totally efficient production system, there will be no variances and the company will see an actual output at the same production rate and costs. However, many factors can cause the number of units produced to change and the fixed overheads to increase or decrease. If the company manages to produce 1,300 units and spends $ 18,000 then:

Actual fixed Overhead: $ 18,000

Less budgeted fixed overhead expenditure: $ 15,000 = $ 3,000 ADVERSE

Less Actual units × overhead rate = 1,300 × 15 = $ 19,500 = $ 4,500 ADVERSE

Adverse Fixed overhead volume variance can be due to several factors such as lower staff motivation, idle work hours, decreased production capacity, and so on.

Capacity and Efficiency Variance Example

As the Absorption costing method charges or absorbs full fixed overhead costs at standard factory labor hours, the fixed overhead volume variance should be analyzed separately as capacity and efficiency variances.

Let us suppose Techno blue Co. produces a product P1. It plans to produce 1,500 units of P1 in 6,000 labor hours. Therefore 4 labor hours per unit. It estimates a fixed overhead budget of $ 15,000. Under standard Absorption costing method:

Budget overhead ÷ budgeted labor hours = 15,000 / 6,000 = 2.5 direct labor hours

If the company produced 1,800 units using 6,500 labor hours, then:

Fixed Overhead Volume Capacity Variance = (6,500 – 6,000) × 2.5 = $ 1,250 FAVORABLE.

Because the company exceeded the budgeted capacity and produced more units of products

Standard absorption costing would calculate the standard cost at $ 2.5 and 4 labor hours per unit. Therefore, Techno Blue’s 1,800 units should take 7,200 labor hours (1,800 × 4). The standard cost would then become 7,200 × 2.5 = $ 18,000. Whereas the company produced efficiently 6,500 units at 2.5, therefore Actual Cost is: $16,250. Hence,

Fixed Overhead Volume Efficiency Variance = 18,000 – 16,250 = $ 1,750 FAVORABLE

Advantages of Fixed Overhead Volume Variance

- It gives detailed reasoning for the fixed overhead variances as in absorption costing, full overhead costs are absorbed.

- Breakdown of fixed over volume into capacity and efficiency variance helps identify system production output and efficiency levels

- Fixed overheads do not change in shorter terms, so any variances occur due to change in operating efficiency or labor hours

- It offers greater motivation if operational staff performance is appraised on increased capacity or efficient resource utilization

Disadvantages of Fixed Overhead Volume Variance

- Marginal costing method does not absorb any overhead costs hence the only fixed overhead will be the fixed overhead expenditure variance

- Detailed examination of fixed overheads into capacity and efficiency requires a lot of time and special skills

- Some indirect costs counted as overheads may not be in full control of the operational managers, so adverse variance cannot be managed in that case

Conclusion

Fixed Overhead volume variances provide useful insights to the top-level management for the cost of goods sold analyses. Operating profit for both marginal costing and absorption costing remains the same, however, a detailed study of fixed overhead volume variances can provide valuable information on performance measurement.